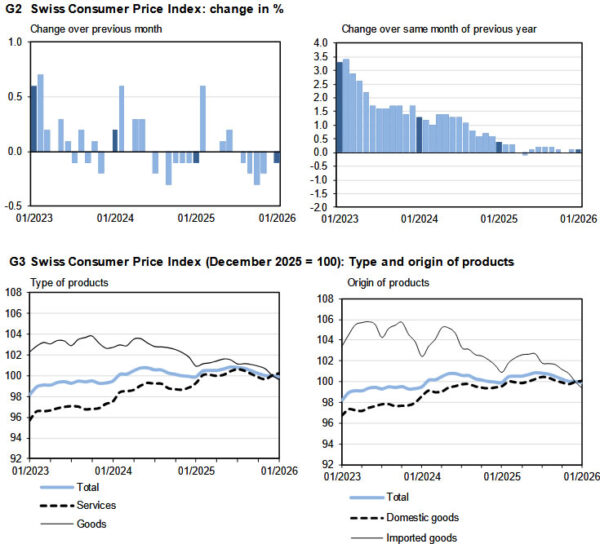

Switzerland’s consumer prices slipped -0.1% mom in January, undershooting expectations for a flat reading. The decline was largely driven by a -0.6% drop in imported product prices, while domestic prices edged up 0.1% on the month. Core CPI, which excludes fresh and seasonal products, energy and fuel, rose 0.1%, suggesting limited underlying pressure.

On an annual basis, headline inflation held steady at 0.1% yoy, in line with expectations. Core inflation was unchanged at 0.5%, with domestic product prices also steady at 0.5% from a year earlier. The data point to a subdued price environment, with limited momentum building in domestic costs.

Imported prices remained a key drag, falling -1.5% year-on-year compared with a -1.6% decline previously. The stronger Swiss Franc and softer external price dynamics continue to suppress imported inflation, keeping overall price growth well below levels seen elsewhere in Europe.