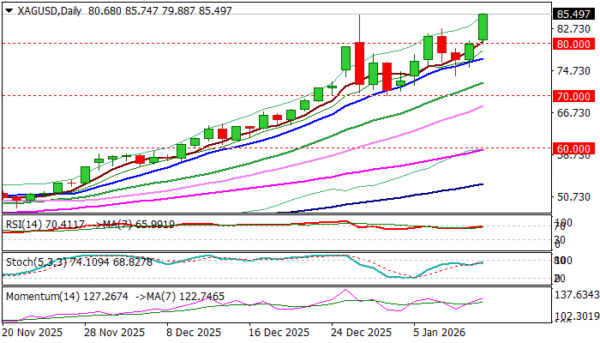

Potential signal:

- I am a buyer right here, right now.

- Stop loss is 6800 and target is 7250.

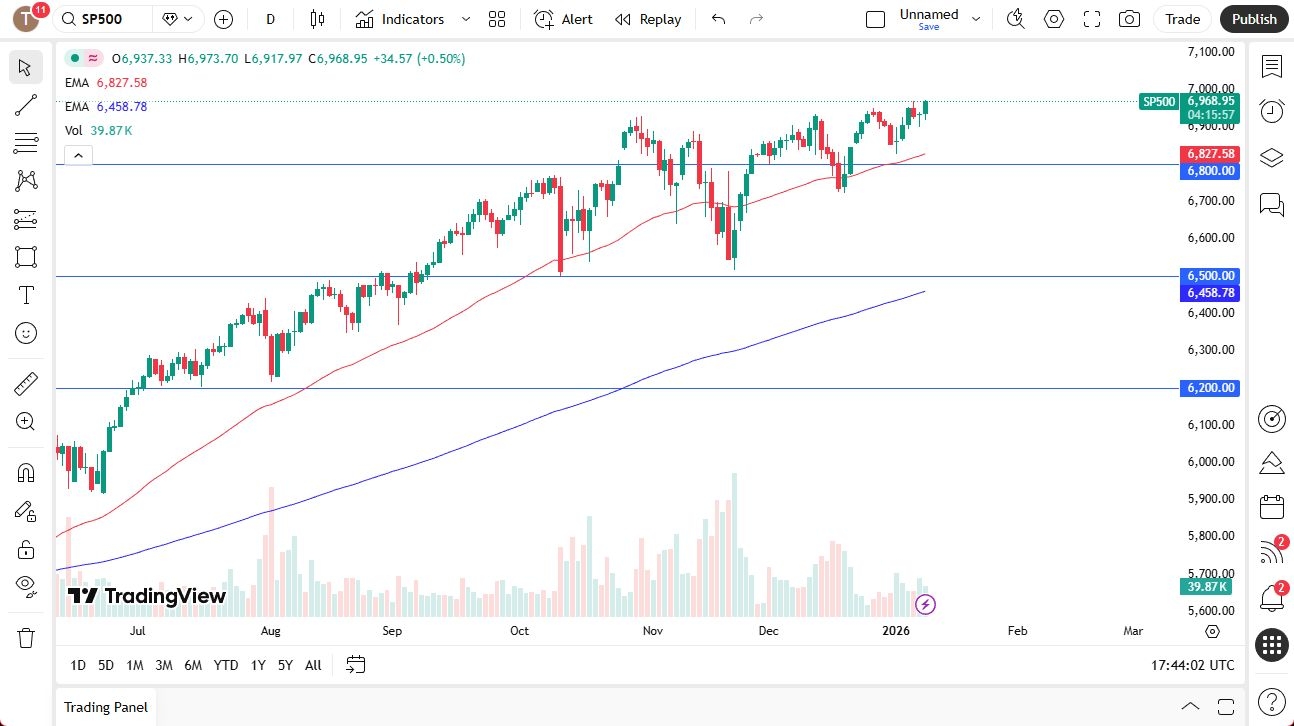

The S&P 500 rose again on Friday, as we are now at all-time highs again. With the Non-Farm Payroll coming in lower than expected, this caused more buying.

The first thing is that liquidity is coming back. We are through the holidays, and I would pretty much bet that everybody’s back at their desk pressing buttons. This means that traders had to deal with the non-farm payroll announcement during the session, and then after that, they can put their positions on. The S&P 500 has looked positive for a while, and it does look like it’s ready to break out, so I’m okay with being long here.

I recognize that there’s probably a lot of noise at 7,000 just waiting to happen, as it is a large round psychologically significant figure, but at the end of the day, it doesn’t really matter anymore than some of the other large round psychologically significant figures in the past.

Buying on the Dips

Buying on the dips continues to be the way forward, as we talk about on the “Pairs of Aces” podcast quite often. This is an extraordinarily stable index. Yes, there is the occasional pullback, but history tells you that for the most part, if you buy a dip, you’ll be happy. That has certainly played out over the last couple of months despite the fact that it’s been painfully slow.

That did make a certain amount of sense because we had such a strong run all year in 2025 and had to take a little bit of a breather. Now that we have a jobs number that came in a little weaker than anticipated, that only throws more fuel on the fire of Federal Reserve rate cuts, and with that, I think you continue to see the stock market rally overall. Keep an eye on 7,000, but at the end of the day, I don’t think it matters. The 6,800 level, for me at least at the moment, is the floor.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.