Beyond The Treasurer’s Desk: Record volatility has moved FX-risk management to the center of corporate strategy.

The building blocks of the global FX market were shifting in 2025.

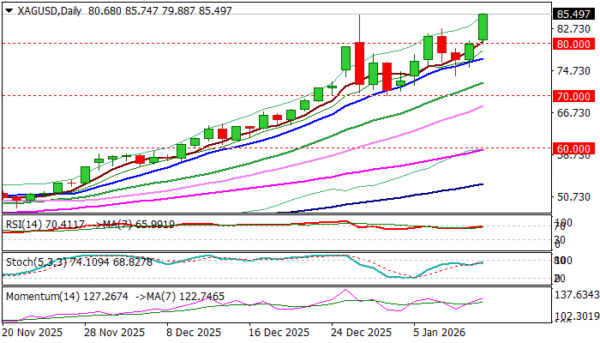

Between President Donald Trump’s erratic trade policies, which weighed on the US dollar; a Bank of Japan rate hike in January that pushed policy rates to a 17-year-high; and extreme uncertainty over rate expectations across both developing and G7 currencies, trading volumes and risks were arguably at their highest in decades. According to data from the Bank for International Settlements (BIS), global FX volumes reached an all-time high of $9.6 trillion per day last April, coinciding with Trump’s “Liberation Day” global tariff announcements.

During that same period, interest rate derivatives surged even more dramatically, rising 59% to $7.9 trillion per day.

For corporates and treasurers, the volatility left no room for argument. Those looking to succeed in today’s macroeconomic environment need tailored solutions and higher technological capabilities that allow quicker, more-precise settlements.

Hedging Takes The Spotlight

More than four out of five companies (81%) now hedge at least part of their FX exposure, and a majority expect to either increase the proportion they hedge or extend their hedge horizons, a 2025 MillTechFX study of 750 senior finance leaders across North America, the UK, and Europe found.

“With currency volatility looking like it’s here to stay, corporate treasurers are under pressure to protect bottom lines from swings and dips in the currency market,” says Eric Huttman, CEO of MillTechFX. FX swaps—still the primary hedging and funding instrument for corporates—reached a record of around $4 trillion in daily turnover in April.

The jump in rate uncertainty also spilled into derivatives. Euro-denominated interest-rate contracts climbed to roughly $3 trillion per day, while sterling and yen contracts increased to $939 billion and $411 billion, respectively.

Those moves underscored how quickly treasurers need to adjust hedge timing and tenor as policy paths in Europe, the UK, and Japan became more volatile.

“Hedging currency risk is no longer seen as a nice-to-have but as essential for protecting companies’ bottom lines,” says Huttman. “Four in five corporates experienced rising hedging costs in the last year.”

FX Volatility Forces A Rethink Of Hedging Strategy

Against this backdrop, many companies are tightening their governance frameworks, emphasizing clearer decision-making around exposure measurement, hedge ratios, and hedge-accounting alignment. A growing number of corporates are also prioritizing cash-flow matching, adjusting hedge maturities to better track the timing of underlying receivables and payables: an approach that is becoming more important as policy surprises trigger abrupt forward-curve shifts.

Uncertainty around global trade is directly shaping hedging behavior, says Stephanie Larivière, managing director and global head of fixed income, currencies, and commodities sales at Scotiabank: “The outlook for exports into the US remains no less murky moving forward. As a result, client demand for structured FX solutions has only increased.”

The new environment is pushing companies to rethink not only how they hedge but also why, she adds. “Clients are focusing on cost management and incorporating flexibility into hedging programs via options-based solutions.”

Currency Demands Shift, But Dollar Remains King

Corporates are also progressively seeking more-comprehensive coverage across emerging-market and commodity-linked currencies. Over the three-year period from April 2022 to April 2025, BIS Triennial Central Bank Survey shows, turnover in South African rand contracts rose 176% to $86 billion per day, Thai baht activity climbed 134% to $114 billion, and Brazilian real contracts increased fivefold to $9.2 billion.

The appetite for emerging-market exposure reflects both shifting supply chains and sharper currency cycles in developing markets, particularly as the US dollar proves more volatile, says Marc Chandler, chief market strategist at Bannockburn Capital Markets.

“When the dollar was in an uptrend, many foreign companies would willingly accept dollars,” he notes. “However, the pronounced downtrend, especially in the first half of 2025, spurred exporters to the US to begin requesting payment in local currencies.”

Is The Dollar’s Role Beginning To Shift?

Rate volatility in advanced economies drove even larger moves in G7-linked derivatives. BIS reports that euro-denominated interest-rate contracts reached $3 trillion per day last April while sterling- and yen-denominated derivatives hit records of $939 billion and $411 billion, respectively.

“Foreigners have been buying long-dated Japanese government bonds at the fastest pace in 20 years and swapping the yen for dollars to earn better than US Treasuries,” Chandler says.

The increasing appetite for nondollar pairs has sparked debate as to whether the US dollar could see continued decline in demand.

Li Zhen, head of Foreign Exchange and Digital Assets, Global Financial Markets, at DBS Bank, anticipates “a more multipolar currency landscape as Asian economies deepen their capital markets and regional trade and investment links.” That does not imply “the end of dollar dominance, but it does point to a larger role for Asian currencies in trade invoicing, funding, and investment.”

Chandler agrees. “The dollar’s role in the world economy may be more a function of its store of value than as a means of exchange,” he suggests. In April, the dollar was on one side of 89% of all global FX transactions, and dollar-linked interest-rate derivatives reached $2.4 trillion per day, even as the share of overall dollar-denominated OTC rate activity declined, according to the BIS report.

Banks Rush to Meet Changing Client Demand

In an environment of relentlessly shifting client needs, banks spent the past year modernizing their FX architectures and technology infrastructure to narrow the gap between corporate expectations and demand. Strengthening automation, improving data accuracy, and removing long-standing operational friction that often slows hedging processes were focal points. Improving real-time digital FX platforms that enable corporates to stream prices, execute trades, and settle payments with greater precision was a significant part of this process.

Banks also stepped up their game in audit-ready reporting; hedge-performance dashboard clarity; and tools that support policy-driven execution, leveraging AI capabilities to deliver solutions via direct integration with treasury and ERP systems through APIs.

The scope of bank coverage also continued to expand, meeting demand for best-in-class offerings beyond the G7 bucket—particularly in nondeliverable forward and swap markets, which saw the highest liquidity demand. “Client demand for structured FX solutions has only increased,” says Larivière. “Clients have focused on cost management and incorporating flexibility into hedging programs via options-based solutions.”

Risks Soar Even Higher

Despite the improvements on the offering side, treasurers still face a more challenging hedging environment. Wider interest-rate differentials and elevated volatility are pushing the cost of protection higher than in recent years. Even so, many companies accept the added expense in exchange for greater budgeting stability.

That being the case, the focus is shifting to prioritization: identifying which exposures carry the highest earnings risk, determining the most efficient tenors, and sequencing hedges to mitigate market-timing risk. Rather than scaling back, corporates are becoming more selective and analytical, concentrating resources on targeted, scenario-based strategies designed to limit unexpected shocks.

As advanced FX risk management becomes essential rather than simply a competitive advantage, 2025 showed that banks are responding quickly, overhauling their operational frameworks to meet the surge in demand.

Methodology

Global Finance selects its award winners based on objective factors such as transaction volume, market share, breadth of offerings, and global coverage, as detailed in public company documents and media reports.

We also include subjective factors such as reputation, thought leadership, customer service, and technological innovation. We use input from industry analysts, surveys, corporate executives, and others. Although entries are not required in order to win, submissions that provide additional insight may inform decision-making.