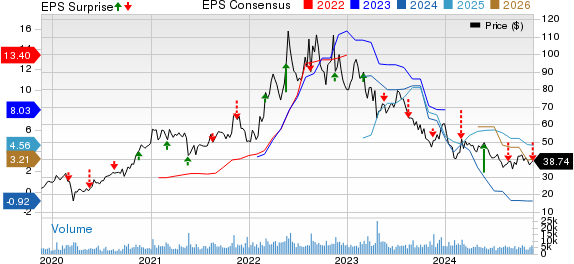

Shares of lidar maker Luminar Technologies (LAZR -4.66%) were trading sharply lower on Thursday, after the company executed a reverse stock split to avoid being delisted from the Nasdaq Stock Market.

As of 11 a.m. ET, adjusted for the split, Luminar’s shares were down about 10% from Wednesday’s closing price.

Image source: Luminar Technologies.

Why companies perform reverse stock splits

The Nasdaq stock exchange requires listed companies to maintain a share price of at least $1 per share. If a company’s stock price slips below $1 for a period of 30 consecutive trading days, the exchange notifies the company that it’s out of compliance — and that it has 180 days to get back into compliance.

Companies that receive such notices, and that don’t anticipate a big bullish development within the 180-day period, will often use a reverse stock split to get back into compliance. In a reverse stock split, several of the under-$1 shares are exchanged for a single new share that will (hopefully) stay well above the $1 limit.

Luminar’s reverse split took effect Wednesday evening

Luminar received one of those notices on Oct. 15. On Oct. 30, the company’s shareholders approved a reverse stock split. That reverse split — in which 15 old shares were automatically exchanged for one new share — happened after the markets closed on Wednesday.

So why is the stock down today? Because reverse stock splits in response to delisting notices aren’t generally bullish. Think about it: If Luminar had good reason to believe that its stock price would jump sometime in the next few months, it might not have bothered with the split.

Year to date, Luminar’s shares are down about 80%.

John Rosevear has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.