Don’t expect the same share price returns of the past three years, but more good times could still be ahead for Nvidia.

The past three years have been phenomenal for Nvidia (NVDA 2.21%) shareholders. The company’s stock gained 791% as tech giants invested hundreds of billions of dollars in building data centers for artificial intelligence (AI) computing, driving surging processor sales for the company.

But how will Nvidia fare over the next three years? Let’s just say there’s probably little for Nvidia shareholders to worry about.

Image source: Getty Images.

1. Data center investments will fuel Nvidia’s growth

Spending on processors and data centers will eventually slow down, but the latest announcements from leading tech companies show we haven’t reached that point yet. Alphabet‘s management said recently that the company will double capital expenditure (capex) spending this year, reaching up to $185 billion, to keep pace in AI.

And Alphabet isn’t the only one. Meta Platforms said it will nearly double its capex spending this year to $135 billion, mostly to build AI data centers, and Amazon has said it will spend $200 billion this year.

These are just three of the largest U.S. tech companies, and combined, they could spend nearly half a trillion dollars this year on capital expenditures, mostly on AI. Nvidia, of course, has been one of the biggest recipients of AI spending because it holds a dominant 81% market share in data center processors.

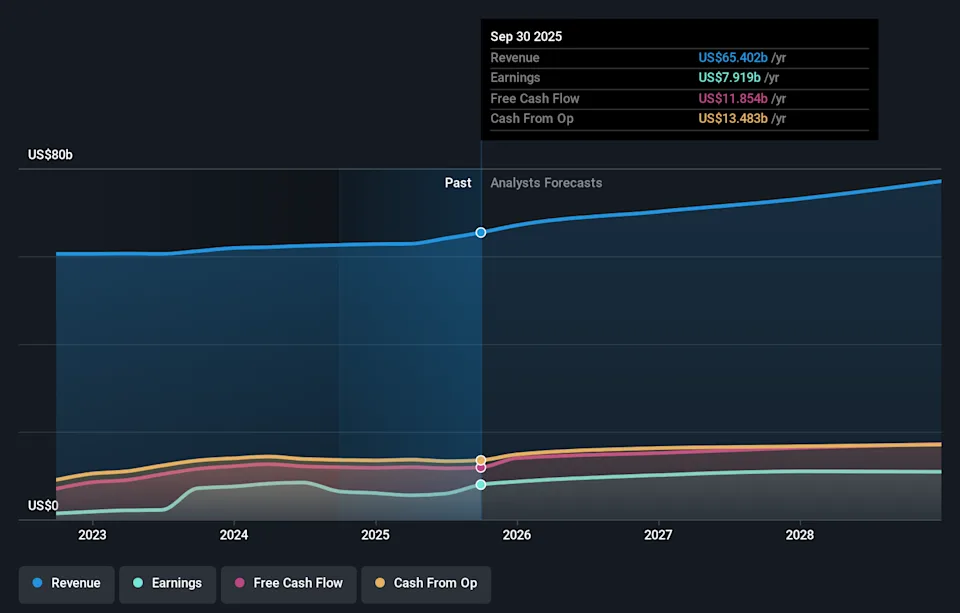

This spending spree could fuel sales and earnings for Nvidia over the next year and beyond as the company works to fill processor orders. And analysts have taken notice. The consensus estimate for Nvidia’s annual revenue in 2029 is $468 billion, and its earnings $246 billion — an increase for both of more than 3 times from fiscal year 2025.

Today’s Change

(-2.21%) $-4.13

Current Price

$182.81

Key Data Points

Market Cap

$4.4T

Day’s Range

$181.59 – $187.55

52wk Range

$86.62 – $212.19

Volume

5.4M

Avg Vol

180M

Gross Margin

70.05%

Dividend Yield

0.02%

2. The stock could be a little volatile, but more gains are likely

I don’t think Nvidia’s stock will repeat the phenomenal gains it’s made over the past three years, and there could be volatility, as some investors are getting jittery about a potential AI bubble and shifting away from tech stocks and toward safer havens.

This means Nvidia shareholders should probably temper their expectations, especially since tech and AI stocks have pulled back lately.

But in general, with spending on AI data center infrastructure still increasing and Nvidia still holding a commanding lead in AI processors, there’s a good chance the share price can outpace the S&P 500 over the next three years.

Chris Neiger has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, and Nvidia. The Motley Fool has a disclosure policy.