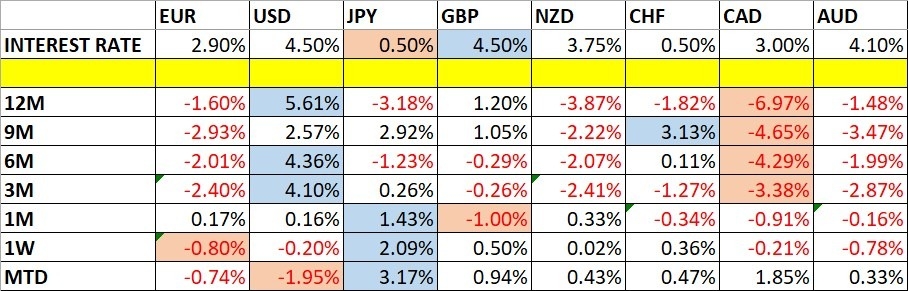

The euro has fallen a bit during the trading week, as the 1.05 level has offered a bit of a ceiling. However, we have been all over the place, so it shows that we have a lot of volatility in general. When you look at the chart, the area above 1.05 is resistance, extending all the way to the 1.06 level. It’s not until the market breaks above the 1.06 level that you get the “all clear” for a trend change. In general, this is a market that looks as if it is still trying to sort things out.

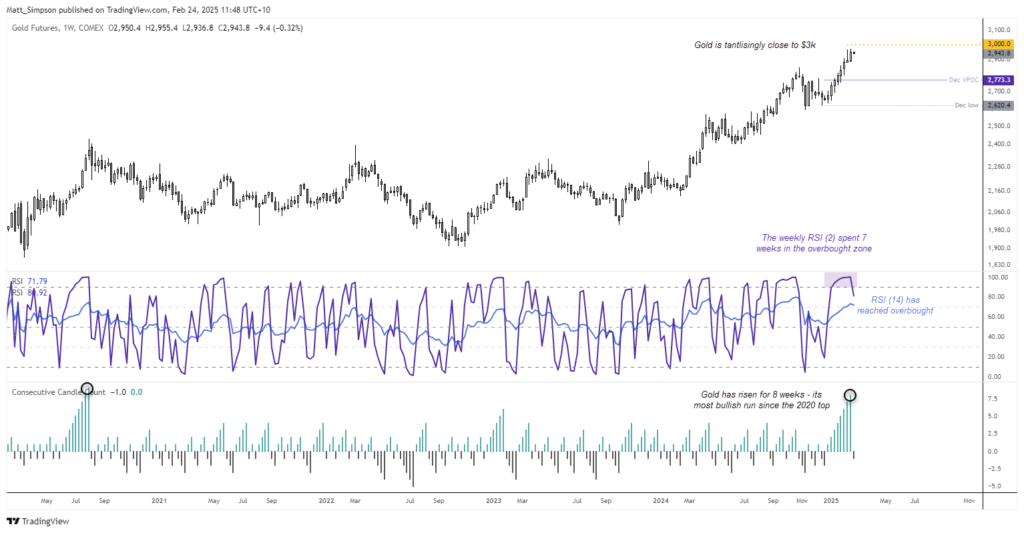

Gold markets have rallied again for the week, as we continue to see a lot of upward pressure. At this point, it looks like it’s very likely that the gold market could go looking to the $3000 level. At this point, any short-term pullback is going to end up being a buying opportunity from what I can tell, with the $2900 level being a potential support level. Underneath there, we have the $2800 level offering support, as it had previously been major resistance. That being said, I think that’s the bottom of the overall trend at the moment.

Silver initially rallied for most of the week, but you can see that there is a lot of noise above, and it looks like this is a market that is going to continue to struggle. The area above the $32.50 level is massively resistant, and I believe at this point in time silver probably needs gold to rally as well in order to continue going higher. Quite frankly, this is a market that looks tired, and we could very well pull back from here. If the market were to break down below the $31 level, then we could see this market reaching toward the 50 Week EMA below.

The US dollar has fallen hard against the Japanese yen during the trading week, as we have broken well below the ¥150 level, and are closing the week out at the ¥149 level. If we break down much further from here, the market is likely to drop down to the ¥145 level, followed by the 140 and level underneath. The ¥140 level below of course will be important as it has been multiple times in the past, as well as the could see a little bit of support due to the 200 Week EMA there as well.

The US dollar has rallied a bit during the course of the trading week as the level of 1.42 continues to attract a lot of attention. If we can break above the highs of the week, I think the next target could be the 1.43 level, an area that previously had been support. If we were to break above there, then it opens up the door to the 1.45 level after that. All things being equal, this is a market that looks like it is trying to stabilize, and therefore I think we’ve got a situation where we could see a little bit of a bounce back.

The US dollar initially tried to rally against the Swiss franc, breaking well above the 0.90 level. That being said, the market has given up those gains and now it looks as if the US dollar could be in serious trouble. If we were to break down below the 0.89 level, then we could see another plunge. On the other hand, if we turn around a break above the top of the candlestick for the week, then you could see the US dollar attacked the 200 Week EMA, followed by the 0.92 level above.

The Australian dollar has rallied a bit during the week, but gave back almost all of the gains, as it looks like we are going to end up forming a shooting star for the week. This of course is a very negative turn of events, and if we break down below the bottom of the candlestick for the week, it could open up a drop to the 0.62 level. On the other hand, if we break above the candlestick for the week, then we could go looking at the 0.65 level where the 50 Week EMA currently resides.

The US dollar has rallied a bit against the Mexican peso during the trading week as we continue to go back and forth in a consolidation area. Despite the fact that the Mexicans are starting to arrest cartel members, the reality is that we still have a long way to go before the Mexican economy turns around. This might not even be a situation where people are so worried about Terrence, rather they are worried about a slowing Mexican economy. I think we stay in the range between 20 MXN and 21 MXN going forward.

Ready to trade our Forex weekly forecast? We’ve made a list of some of the best regulated forex brokers to choose from.