Gold

Gold market participants have been through a lot over the last couple of days, as we go back and forth quite rapidly. That being said, the reality is that we are heading into the holiday season, and therefore I think you’ve got a situation where liquidity will be thin, and therefore the market is likely to continue to see more back-and-forth than anything else. This will be especially true for the next 2 weeks, but in the longer term, it’ll be interesting to see whether or not buyers can push the market above the $2730 level.

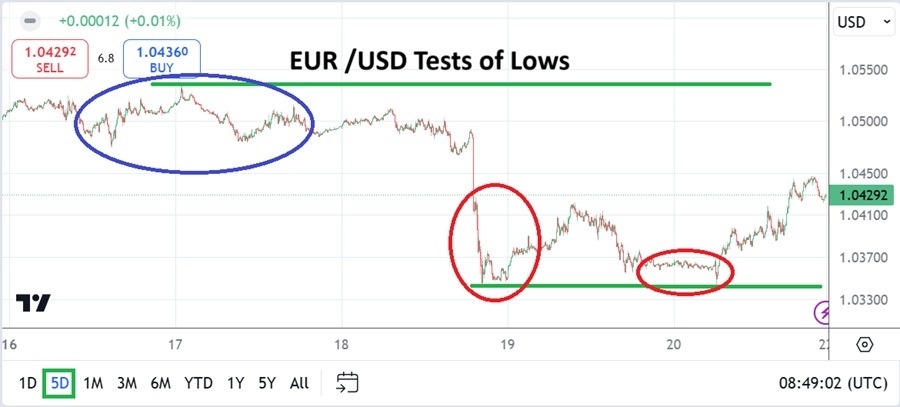

EUR/USD

The euro plunged during a large portion of the week, but then turned around to show signs of life. The 1.03 level seems to be offering a bit of support, and the snapback rally late in the week was coordinated with the idea that interest rates were dropping in America. However, the dye has been cast, and I do believe that the euro continues to suffer due to the US dollar strength. Rallies will more likely than not offer selling opportunities that people can take advantage of on signs of exhaustion.

AUD/USD

The Australian dollar has plunged for the week, reaching the 0.62 level. The 0.62 level has been important in the past, so it’s not a huge surprise to see that we have bounced a little bit from there. However, I also recognize that we are more likely than not going to continue to see a lot of questions asked of the Australian dollar, as Australia is so highly levered to the Chinese economy. Furthermore, interest rates in America will stay higher longer than most people thought, so I think rallies are probably going to offer selling opportunities on signs of exhaustion.

NZD/USD

The New Zealand dollar plummeted for the week, as much everything fell against the US dollar. However, the New Zealand dollar seems to be much weaker than its cousin the Australian dollar, and this tells me just how bad things are with the kiwi dollar overall. Short-term rallies will more likely than not continue to offer selling opportunities in a market that is clearly leaning in favor of the greenback. The 0.55 level is an area that a lot of people will be paying close attention to, because if we were to break down below there, the bottom could fall out.

NASDAQ 100

The NASDAQ 100 has been all over the place during the week, as Jerome Powell made a huge mess of the press conference after the FOMC rate decision. All things being equal, this is a market that I think continues to see uptrend potential, but I also think it is likely that we will continue to see a lot of noise along the way. The 22,000 level above continues to be a significant barrier, so if we were to break above there, it would obviously be a very bullish sign. I have no interest whatsoever in shorting this market anytime soon.

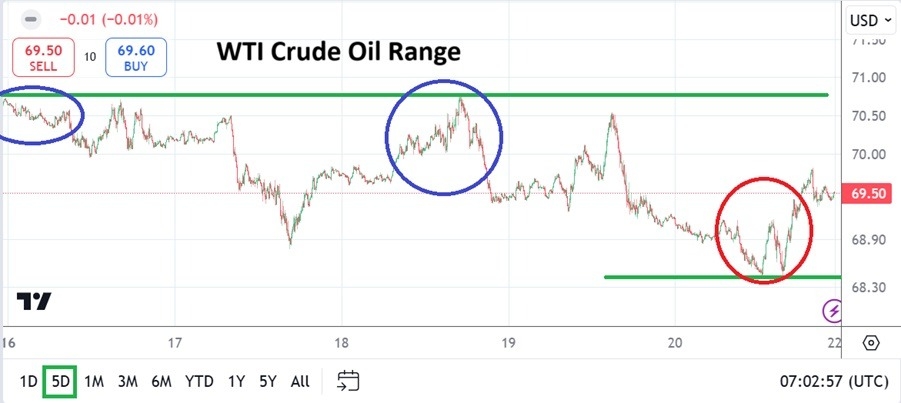

WTI Crude Oil (US Oil)

The West Texas Intermediate Crude Oil market has pulled back just a bit during the week, but we have been going sideways for a couple of months now, and I think that will continue to be the way forward. After all, the market is likely to continue to see traders waiting for some type of clarity, and I do think that with inflation picking up, and central banks around the world adding fuel to the fire by cutting rates, it’s likely that we will eventually see this market break out. However, I expect more sideways action between now and the beginning of next year.

DAX

The German index had a horrible week, but it is worth noting that we did bounce a bit from the crucial €19,750 level, during the Friday trading session. This could give us a little bit of hope for a bounce, but I think that would be asking a lot as we head into the holiday season. This doesn’t mean that I’d be looking to short the DAX, just that I’m not expecting much out of it over the next several sessions. With this, the uptrend continues, but we obviously have hit a little bit of a hiccup.

USD/MXN

The US dollar initially shot higher against the Mexican peso during the trading week, but it appears that we have run out of momentum. The 20 MXN level will continue to be important, but the candlestick for the week does suggest that we are getting close to some type of pullback. We are seeing the US dollar give back some of its strength that it had enjoyed previously, so this should not be a huge surprise that perhaps the market needs to pullback in order to find longer term buyers again.

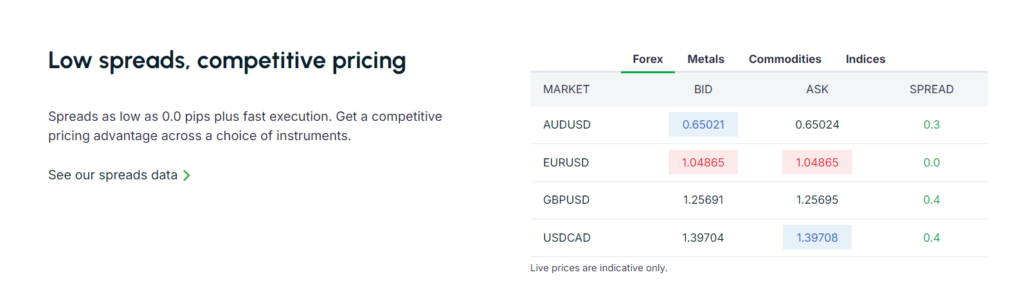

Ready to trade our weekly Forex forecast? We’ve made a list of some of the best regulated forex brokers to to choose from.