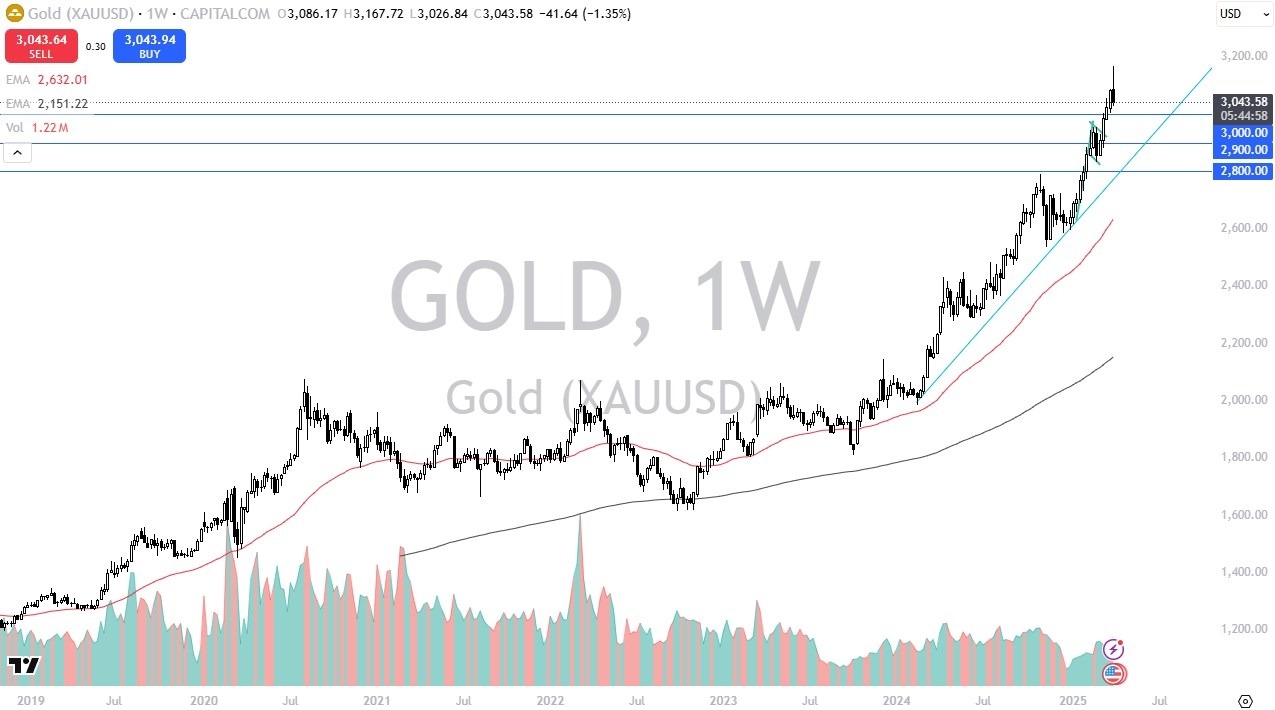

Gold markets have been sold off rather viciously during the trading week, but quite frankly at this point in time I think you got a situation where gold will eventually find buyers, especially if we get too close to the $3000 level. The $3000 level of course is a large, round, psychologically significant figure that traders will be paying close attention to. Ultimately, it remains very bullish, and I do think that it is probably only a matter of time before the buyers come back in and pick this market up. Remember, we formed a bullish flag that suggests a move to the $3300 level.

Basically, the S&P 500 continues to get slapped around by the idea of tariffs, just as most indices do. However, on Friday we are starting to see some people step in and try to pick up the market. If they do in fact do that, we may have seen the worst of the selling. This isn’t to say that you should be a buyer of this market, just that the selling is a little bit overdone at this point. The 5000 level underneath should continue to be a significant support level as well, so you should pay close attention to it.

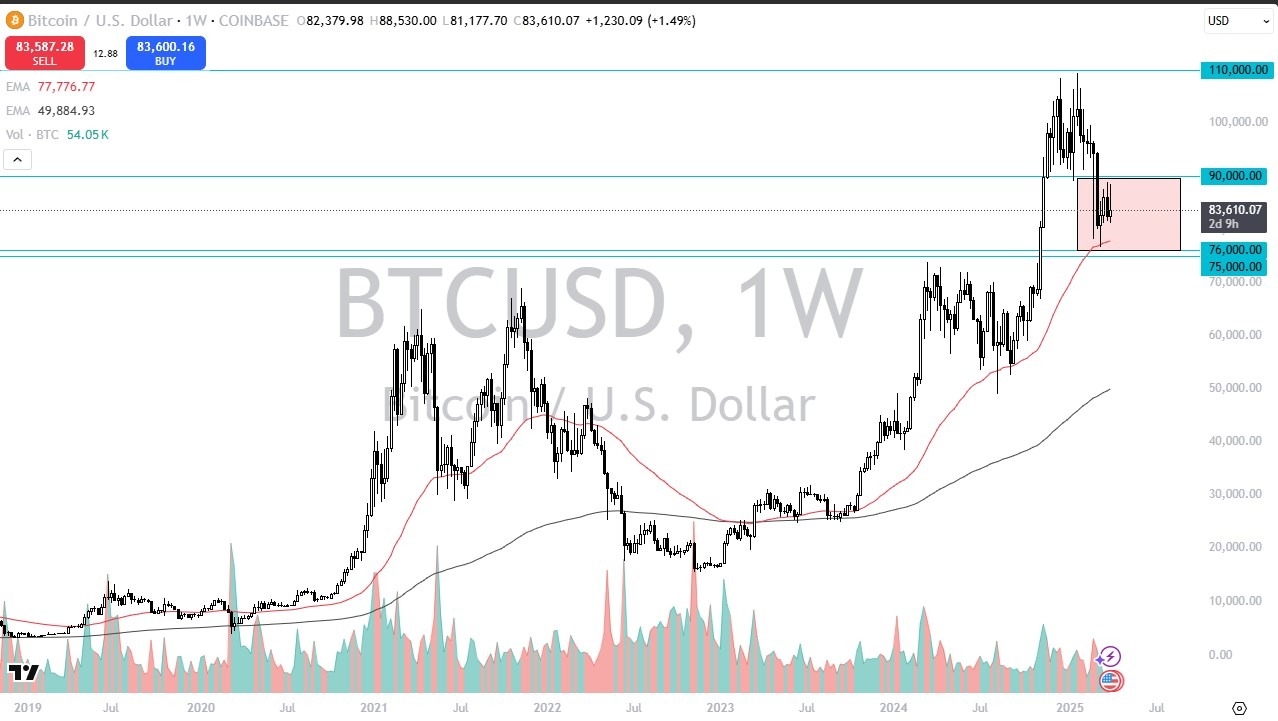

Bitcoin has been relatively strong in relation to the way Wall Street has been behaving all week, which might be the beginning of something in this market. We have been in the consolidation area for a while, and although we gave up quite a bit of the gains for the week, the reality is that Bitcoin is basically where it started for the week, something that you cannot say for most assets. Granted, Bitcoin sold off previously, so perhaps all of the “weak hands” have been flushed out? Regardless, I think the $75,000 level continues to be the “floor in the market.”

Bitcoin has been relatively strong in relation to the way Wall Street has been behaving all week, which might be the beginning of something in this market. We have been in the consolidation area for a while, and although we gave up quite a bit of the gains for the week, the reality is that Bitcoin is basically where it started for the week, something that you cannot say for most assets. Granted, Bitcoin sold off previously, so perhaps all of the “weak hands” have been flushed out? Regardless, I think the $75,000 level continues to be the “floor in the market.”

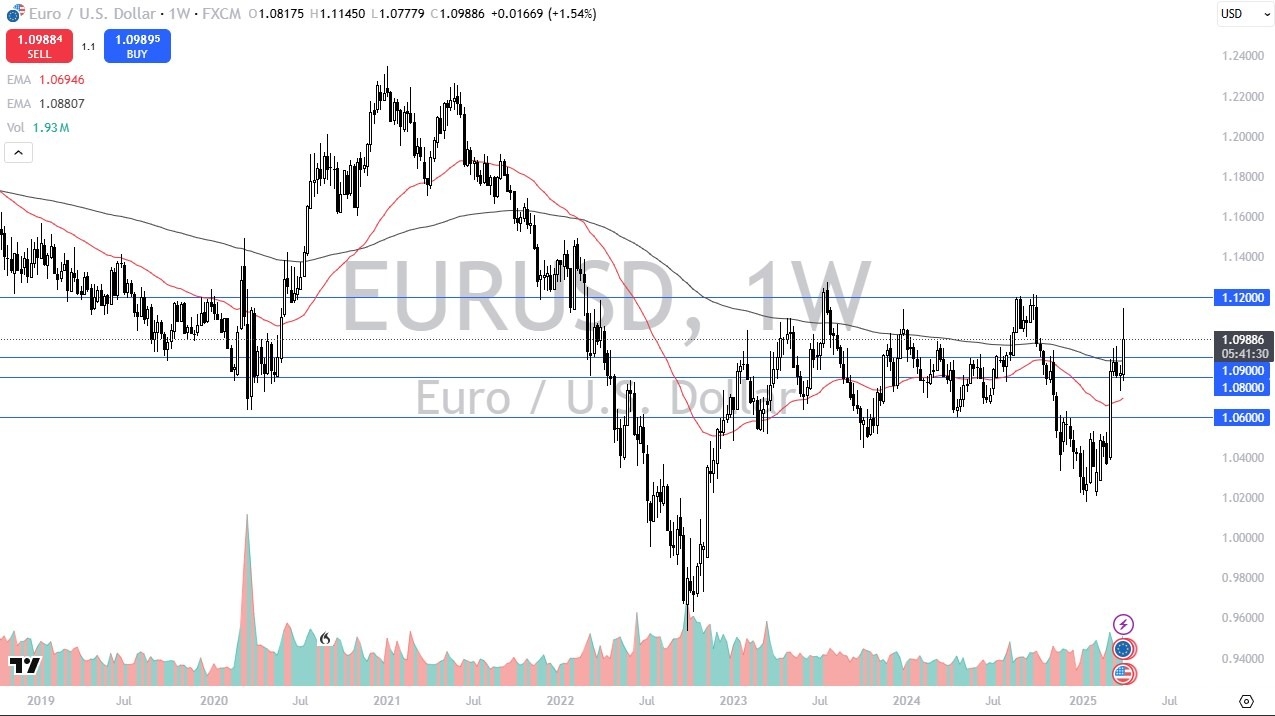

I believe this next week could be crucial for the Euro, as we had seen the market exploded to the upside, mainly in reaction to the new tariffs in the United States. However, sooner or later people run back to the dollar for safety, and we may already be starting to see a little bit of this. As things stand right now, I see this as a market that could remain range bound in a 300 pip range between the 1.09 level and the 1.12 level, which has acted as a ceiling more than once. Ultimately, choppy sideways erratic behavior is probably going to be the norm here for a while.

The German index has been absolutely crushed during the previous week, and while it had been one of my favorite indices previously, I think at this point in time it needs to prove itself, and proving itself might even involve dropping down to the €20,000 level. If the market were to give up the €20,000 level, it could be a very negative turn of events for the DAX. While it has outperformed the lot of the New York indices, right now it looks like it’s getting ready to play “catch up” to those very same markets. After all, the tariff war will hurt European and outsized way, as Europe blocks or tariffs most US products already. Simply put, the Americans just don’t sell much to the Europeans on a day-to-day basis.

To begin the week, the US dollar fell against the Mexican peso, but it looks like the area around the 19.90 MXN level continues to offer massive support. At the close of the week, we found this pair right dead in the middle of the previous consolidation area, between the 20 MXN level in the bottom, and the 21 MXN level on the top. It’s very likely that we will stay in this range, as long as there is going to be economic uncertainty. The US dollar of course will be used as a safety currency in this scenario, and if global economic conditions start to deteriorate, a major exporter like Mexico will suffer. For what it is worth, no new tariffs were placed on Mexico, as the Mexicans and the Americans have been working together quite well over the last month or so.

This pair is going to be interesting to watch due to the fact that it is essentially going to be the “epicenter of trade war nonsense” going forward. At this point, the Americans hold all the cards, but the Canadians are still fighting on every front. Good on them, but sooner or later the Canadian dollar pays the price, just as it has for several months. While I do expect a lot of volatility, the fact that the US dollar bounced so hard this past week suggest there is still more upward bias. Furthermore, the Canadians showed a loss for their employment numbers on Friday, while the Americans still see plenty of new hires. You should also keep in mind that there is a major election in Canada in a couple of weeks, so a lot of the rhetoric may die down after April 28.

The WTI Crude Oil contract initially tried to rally a bit during the trading week but got slammed that the $72,50 level. In fact, we have broken significantly below the $65 level, showing quite a bit of negativity. This is a mixture of concerns about the global growth situation going forward, and the fact that OPEC+ has stated that they are going to increase production by 400.000 barrels per day, despite the fact that global growth could be slowing.

Ready to trade our Forex weekly forecast? We’ve made a list of some of the best regulated forex brokers to choose from.