(Bloomberg) — Wall Street’s macro traders are headed for their best year since 2009 as clients rushed to place bets on changing interest rate policies by central banks around the world.

Firms including Goldman Sachs Group Inc., JPMorgan Chase & Co. and Citigroup Inc. are expected to generate $165 billion in revenue from trading in fixed-income, credit and commodities this year, up 10% on 2024, according to data from Crisil Coalition Greenwich.

Most Read from Bloomberg

Interest-rate adjustments by global central banks, uncertainty around tariffs, concerns over ballooning fiscal deficits and a steepening yield curve have all bolstered the fee pool for rates traders, in particular. In the Group-of-10 rates business, revenue is expected to reach a five-year high of $40 billion.

Coalition Greenwich is anticipating a similar windfall in 2026, when the industry’s revenue is expected to be just 2% less at $162 billion.

“Central bank rates are normalizing policy rates and their balance sheets but what hasn’t normalized is the sheer amount of issuance,” Nikhil Choraria, head of European interest rate products trading at Goldman Sachs, said in an interview. “Most of these conditions are here to stay. There is no reason why the type of activity levels we’ve seen can’t be repeated in 2026.”

Emerging-market macro traders are expected to rake in their biggest haul in at least two decades with $35 billion. Credit traders are tipped to make $27 billion and commodities, $11 billion.

Yet some traders hoping for outsized bonuses risk disappointment, according to Michael Karp, chief executive officer of recruitment firm Options Group.

“Expectations versus reality will be a mismatch” for rates traders, Karp said. The compensation pool for FICC this year is likely to be up about 3% on average, his company said in a report, predicting an increase of 7% for rates, 5% for emerging markets and 4% for foreign exchange.

“There obviously will be superstars that they have to pay, but it’s not going to be 10 superstars,” Karp said. “There will be one or two guys in each of swaps, bonds and volatility, that’s about it.”

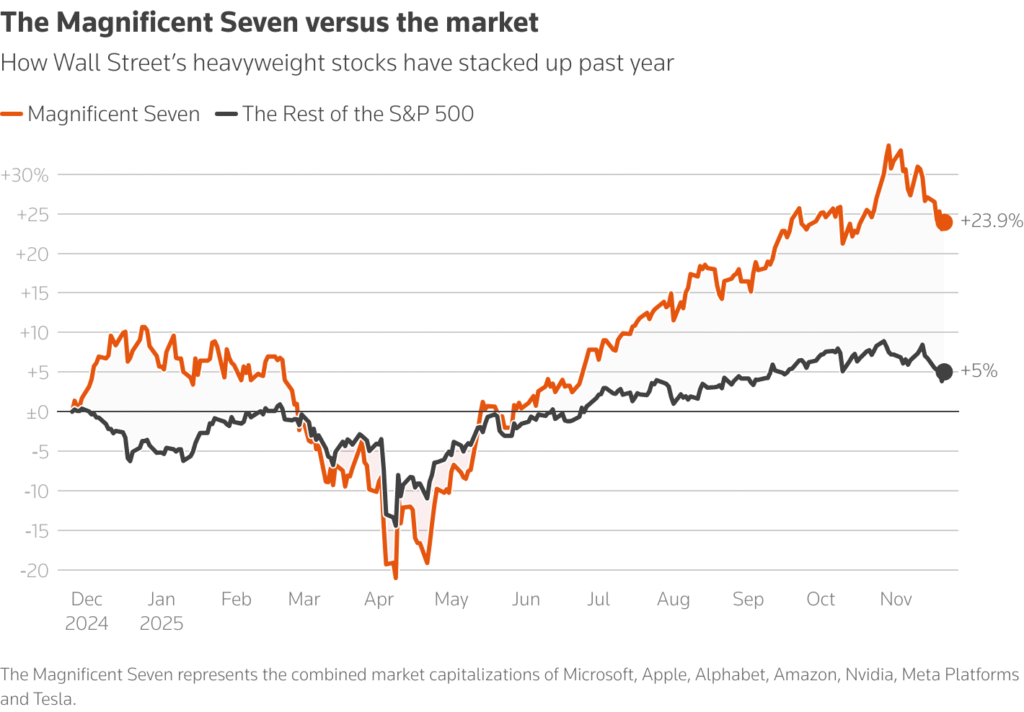

Payouts for stock traders, meanwhile, are set be 14% higher than they were last year, Karp’s firm found. That’s because equities desks are expected to turn in their best year for revenue in at least two decades after clients piled into booming AI stocks in recent months.