Good morning. Spring is often a good time to sell a house. But amid DOGE’s sweeping budget cuts, this year could be completely different — if buyers realize how much leverage they have.

In today’s big story, the markets finally have a glimmer of hope.

What’s on deck

Markets: Want to work at Balyasny? Get ready to pitch some stocks.

Tech: The streaming wars are over. The rich won.

Business: Harvard has a high-stakes strategy to fend off Trump.

But first, hope at last!

If this was forwarded to you, sign up here.

The big story

Another wild day on Wall Street

Getty; Chelsea Jia Feng/BI

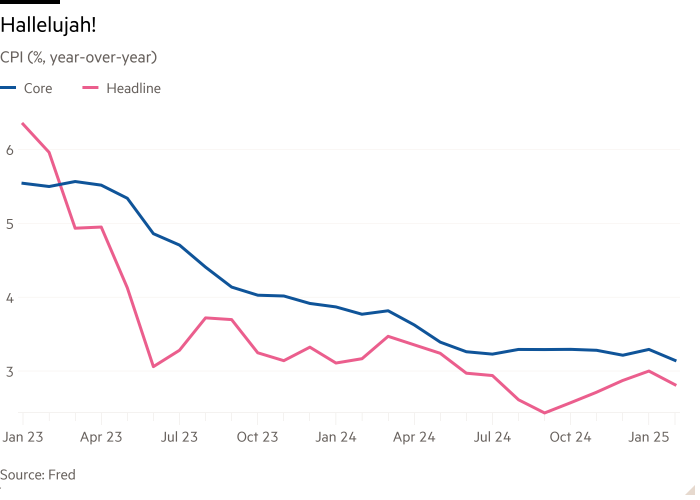

It came in the form of the latest inflation data.

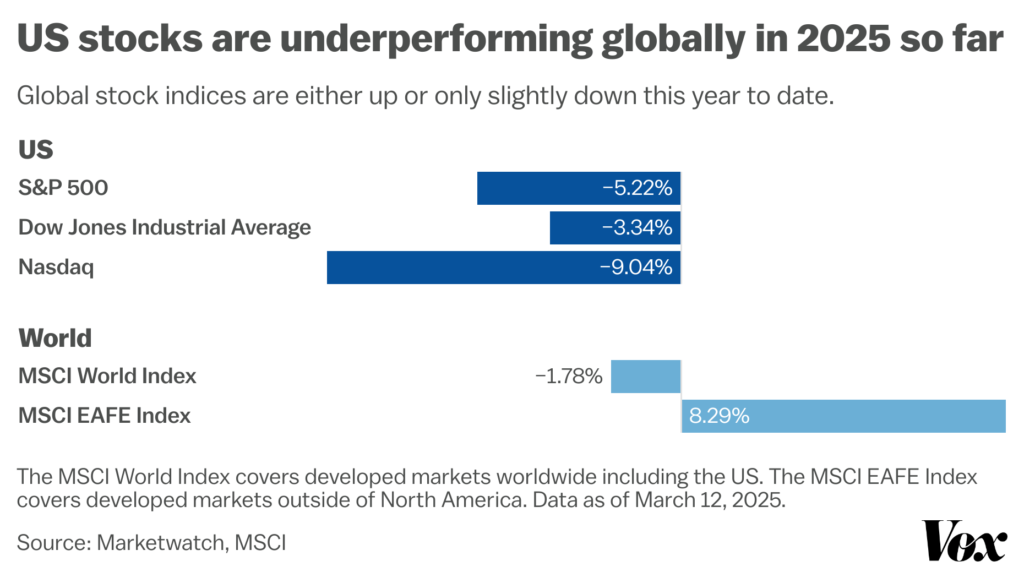

After being dealt blow after blow amid President Donald Trump’s trade war, markets finally found a reason to rise.

The consumer price index rose 0.2%, showing that prices cooled slightly more last month than economists had expected. The increase was the smallest in four months — and enough to immediately lift spirits and markets alike.

Though major US indexes pared increases as the day progressed, Magnificent Seven tech stocks all gained, notably Nvidia and Tesla.

The data was enough to give markets more confidence that the Federal Reserve has additional flexibility to fight a stalling economy with rate cuts — one of its most crucial anti-recession tools, BI’s Jennifer Sor writes.

It also alleviated — at least temporarily — half the equation for a fate worse than a recession: stagflation (the dreaded S-word).

So, are we at the bottom yet?

David Kostin, the chief US equity strategist at Goldman Sachs, issued a note on Tuesday that laid out three factors that could drive a swift recovery in the stock market:

- Change in the economic growth outlook

- Valuations have to hit attractive levels

- Depressed investor positioning

Kostin added that only one of these things needs to be triggered for the rally to restart — and at least one of them is starting to happen.

3 things in markets

BI

1. A silver lining amid Trump-induced market mayhem. Investors are exhausted after recent financial market chaos, but there’s one perk for weary homebuyers: lower mortgage rates. The 30- and 15-year mortgage rates have both steadily dipped for six weeks straight alongside bond yields.

2. Balyasny’s intern-recruiting tactic involves some friendly competition. The $23 billion hedge fund hosted its first-ever stock-pitching contest for college students last October, and it’s now a regular part of the recruiting process. The top teams get prize money, but the real reward is an interview for the firm’s summer internship.

3. Can Morgan Stanley’s AI leader help turn around Citi’s wealth tech? Dipendra Malhotra, an 11-year veteran of Morgan Stanley, is joining Citi as the head of wealth technology, BI has learned. He’ll be tasked with modernizing the bank’s tech in an attempt to restore its wealth business.

3 things in tech

subjug/Getty, undefined/Getty, spxChrome/Getty, iStock/Baris-Ozer, Ava Horton/BI

1. Streaming is more expensive — and uneven— than ever. Services like Netflix and Spotify used to charge one price for everything. Now, you get what you pay for. It’s splitting users into haves and have-nots.

2. Another shuffle at Google Cloud. The strategy and operations team became the latest to undergo restructuring, according to an internal memo viewed by BI. The company consolidated teams to “respond faster” to the market and to boost sales productivity, the memo said.

3. AMD CEO Lisa Su won’t settle for second in the family affair. When analysts criticized AMD’s software, Su got back on the horse and listened to their feedback. Despite rival Nvidia’s dominance, sources said Su won’t rest until she defeats the chip giant, led by her cousin Jensen Huang.

3 things in business

Scott Eisen/Getty Images; AP; Rebecca Zisser/BI

1. Harvard’s plan to “play by Trump’s rules.” President Trump has been targeting elite universities on various fronts, from campus protests to DEI initiatives. Harvard’s solution? Cozy up with Trump’s allies. Here’s the Ivy League school’s threefold strategy to fend off federal cuts.

2. Costco looks like the big winner following Target’s DEI rollback. Corporate social responsibility was part of both retailers’ brand identities until Target recently seesawed its position on DEI. Now, that might be coming back to bite it. A new survey indicates customers are shopping at Costco instead.

3. Klarna employees are on edge ahead of IPO. The buy-now, pay-later startup is getting lean by restructuring teams and moving some employees into a “talent pool” as it preps for a public debut. BI heard from 11 current and former staffers about what the changes mean for their jobs and the company’s future.

In other news

What’s happening today

- Commerce Secretary Howard Lutnick meets with Ontario Premier Doug Ford for trade talks in Washington, DC.

The Insider Today team: Dan DeFrancesco, deputy editor and anchor, in New York (on parental leave). Grace Lett, editor, in Chicago. Ella Hopkins, associate editor, in London. Hallam Bullock, senior editor, in London. Amanda Yen, associate editor, in New York. Elizabeth Casolo, fellow, in Chicago. Lisa Ryan, executive editor, New York.