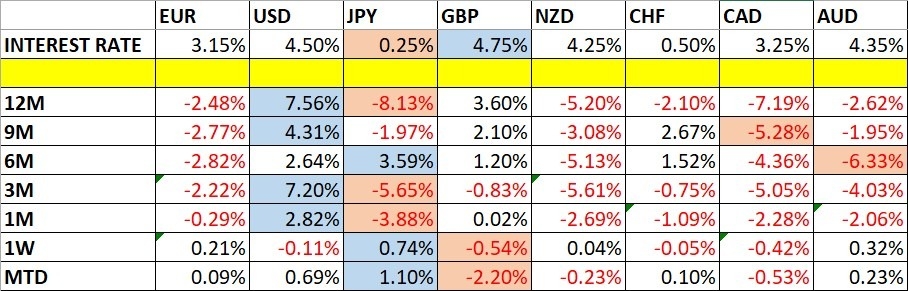

The yen is almost unchanged on Monday. In the European session, USD/JPY is trading at 156.37, up 0.06% on the day. We can expect a quiet day, as the US observes Martin Luther King Day and Donald Trump will be sworn in as President.

The yen is coming off a busy week, with sharp swings on each of the past three trading days. The Japanese currency gained 0.95% last week, its best week since November. Still, USD/JPY remains high and investors are anxiously awaiting the Bank of Japan rate decision on Jan. 24.

BoJ expected to raise rates to 0.50%

There are no tier-1 releases out of Japan this week but investors will be busy keeping an eye on the Bank of Japan rate decision on Friday. The central bank tends not to telegraph its intentions but has hinted at a rate hike and the market will be on the lookout for any hints or signals from BoJ policy makers ahead of the rate decision. The BoJ is widely expected to raise rates to 0.50%, which would be the highest level since the 2008 global financial crisis. After decades of deflation and an ultra-loose monetary policy, inflation has taken root and the BoJ is slowly moving towards normalization.

Inflation has been above the BoJ’s 2% target for almost three years and higher wage growth means that inflation should remain sustainable as it moves higher. The weak yen is another reason for the BoJ to raise rates and make the yen more attractive to investors.

The big question mark is Donald Trump, whose has promised tariffs on US trading partners, which threatens to shake up the financial markets and damage Japan’s crucial export sector. The Trump factor is unlikely to prevent a rate hike this week, but supports the case for the BoJ to wait several months before delivering another rate hike.

USD/JPY Technical

- USD/JPY tested support at 155.88 earlier. Below, there is support at 155.39

- There is resistance at 156.79 and 157.28