2025 was the year of the Swiss Franc, and there were quite a few reasons.

De-dollarization, flows moving towards Europe, the Yen losing some of its Safe-Haven characteristics amid fiscal trouble in Japan, and general diversification towards quality as the World faces troubled times ahead.

Reaching 14-year lows less than a month ago, USD/CHF had become a bear dream for those who thrive on Dollar outflows. 2025 began with a 17% decline in the Major pair and was at the center of the essential themes driving FX flows.

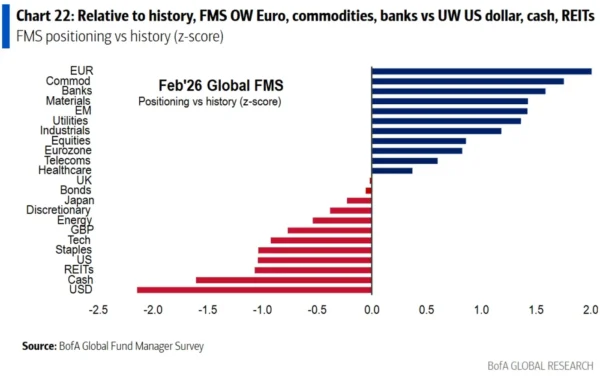

But as Dollar bearish positioning also reaches decade lows, some questions regarding the extended moves are arising.

If the US Dollar finds reasons to catch a serious bid, troubled times could be coming ahead for heavy Greenback-Short sellers. A question evoked in our recent Dollar Index analysis.

Dollar Bear Positioning is at Extremes – Source: Bank of America Survey

With safe havens like Gold and Silver seeing sudden outflows at the end of last month, coinciding with Kevin Warsh’s appointment as head of the Federal Reserve, the appeal of these no and low-yielding assets is being called into question. And the Swiss Franc is no stranger to such.

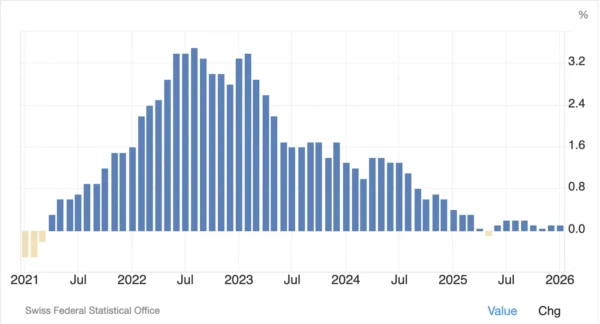

Switzerland is a victim of quite heavy deflationary pressures, with its currency strengthening (hurting Swiss exports) and the rougher US trade policies, which exacerbate a fundamentally low-inflation regime.

Swiss Inflation – Courtesy of Trading Economics

After reaching a new deal, trade is seemingly bouncing back, but pressure remains on the Swiss National Bank.

The latest inflation report showed a modest 0.1% increase, but if inflation doesn’t show a material increase in the coming few reports, the Central Bank might be forced to turn to negative rates. And such come at high costs.

In the meantime, USD/CHF has carved out a pretty strong bottom in recent days and could offer interesting mean-reversion setups for those looking for FX volatility ahead.

Let’s dive right into a multi-timeframe analysis of USD/CHF to spot where the action stands and where it could be heading.

USD/CHF Multi-Timeframe Technical Analysis

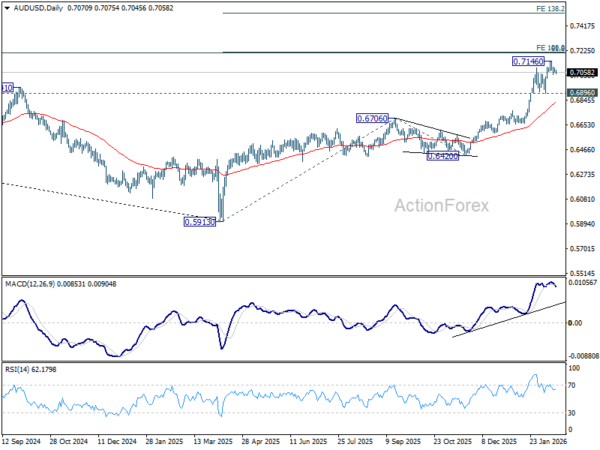

Daily Chart

USD/CHF Daily Chart – Source: TradingView. February 19, 2026

USD/CHF is carving out a breakout from its mid-February Triangle consolidation, and will soon face a key test for its buying momentum.

The Daily RSI and Uptrend are working together to provide a fresh push in the pair, with traders leaning on the Monday Lows (0.7675) to drive the action higher.

- If the action falls back below the weekly lows, the breakout will be void but for now it gives high probabilities of holding.

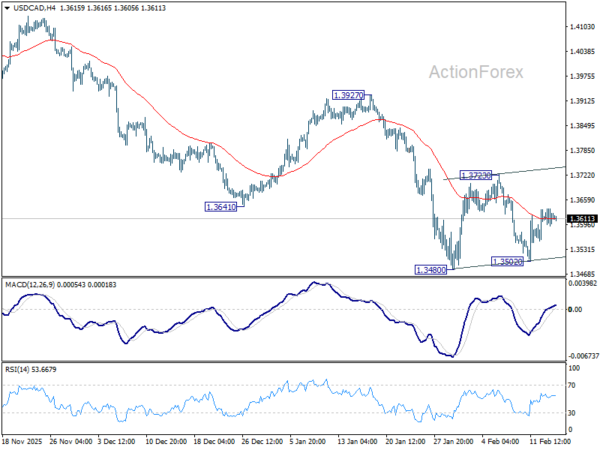

4H Chart and Technical Levels

USD/CHF 4H Chart – Source: TradingView. February 19, 2026

USD/CHF is breaking out on quite strong price action, but will face a short-term barrier from overbought conditions. Check trading setups on the 1H timeframe just below.

Trading Levels for USD/CHF

Resistance Levels

- 0.7780 to 0.78 Momentum Pivot

- 0.7850 2025 lows Pivotal Resistance (Bullish Above)

- 0.7950 Minor Resistance

- 0.8075 to 0.81 Late 2025 Range highs

Support Levels

- 0.7725 50H Moving Average

- 0.77 to 0.7725 August 2011 Lows Support

- 0.76292 2026 and 14-year lows

- 0.76 Support zone July 2011

- 0.70696 All-Time lows (August 2011)

1H Chart

USD/CHF 1H Chart – Source: TradingView. February 19, 2026

The pair now looks slightly overextended on the 1H timeframe, but remains in an upward formation, as seen on the intraday bull channel.

- Traders looking to capture a potential bull move could wait for a retracement to the 50-Hour Moving average at 0.77250.

- If the action doesn’t pullback lower, traders can look for breakout setups

- Breaching the February highs 0.78175 would point to a swift test of the Pivotal resistance around 0.7850.

- Any daily close below the 200-Hour MA could prompt a retest of the 2026 low and further bearish action, but technicals aren’t pointing to such outcomes for now.

Safe Trades!