The USD/CAD is within sight of highs from the climatic days of coronavirus in March and April of 2020, this time around it is because financial institutions are nervous about economic ramifications via the incoming Trump White House.

- Traders who have a bias towards the Canadian Dollar and believe the USD/CAD is overbought and have been looking for downside to suddenly emerge have a problem on their hands.

- The implications of the dislike between President-elect Donald Trump and Prime Minister Justin Trudeau are having a chilling effect on the Canadian Dollar.

It isn’t only that Donald Trump has threatened tariffs/ sanctions against Canada if they do not help with security on the U.S border, and trade agreements between the two nations that Trump finds unfair. It is also because in the past couple of years Prime Minister Trudeau had stated publicly his dislike of Trump. And while the Prime Minister is not being scolded for this, he now is facing the consequences having to negotiate with a President-elect that is in a much more stable political situation compared to his own.

Behavioral Sentiment and Consequences for the USD/CAD

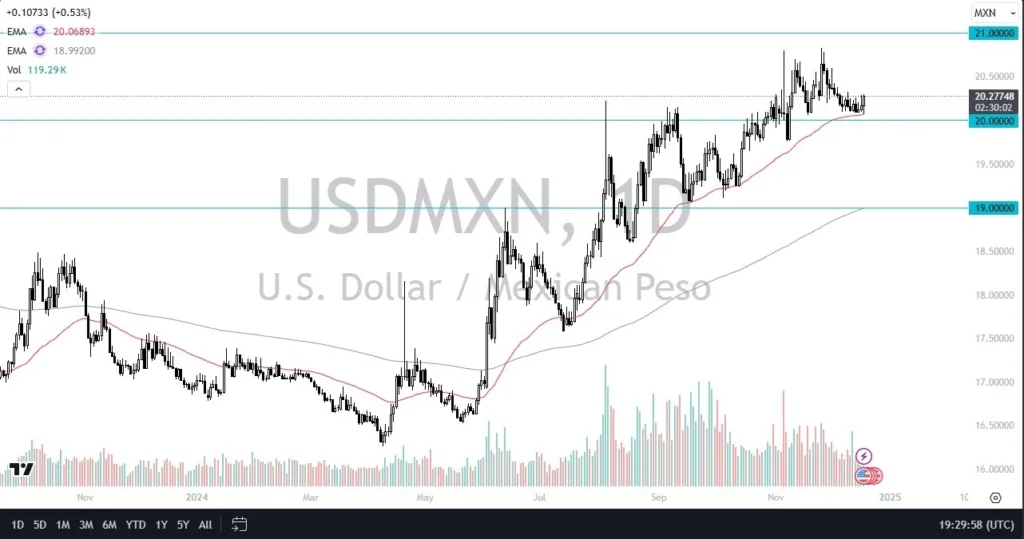

Some Forex traders may question what the significance of the above is on the USD/CAD. The U.S is Canada’s largest trading partner. The USD/CAD was trading near 1.34250 on the 23rd of September. The USD/CAD is now trading around the 1.43225 mark at the time of this writing. The currency pair is trading within sight of highs during the height of initial coronavirus fears when the USD/CAD touched the 1.45000 and 1.46000 levels in March and April of 2020. The Trump effect has been real on the USD/CAD.

While it is justified to say all major currencies have struggled against the USD since late September and certainly into the U.S election results from the first week in November, the USD/CAD has not seen a tranquil resting place emerge as it continues to prove resistance is vulnerable. The U.S Fed FOMC Statement later today is not likely to add to optimism for the USD/CAD. The Fed is expected to lower its Federal Funds Rate by 0.25, but if the U.S central bank sounds overtly cautious about future outlook the interest rate cut today might not soften the viewpoints of nervous financial institutions.

Near-Term Volatility and Resistance Levels for the USD/CAD

The USD/CAD is traversing highs that are difficult to judge technically except to say the currency pair will eventually stabilize, but the question is when exactly. Breaking through the 1.40000 in the middle of November and trading above this level in a sustained manner since the 29th of November is a warning sign that financial institutions remain nervous about the dynamics between Trump and Canada.

- The negotiations between the incoming White House and Canadian government have already started in many respects.

- The USD/CAD is within high values and the past two days have produced more buying.

- Some speculators might want to test the existing trend with selling positions, but the currency pair may remain choppy in the near-term and its ability to go higher early this week is a signal financial institutions are not ready yet to reverse their nervous outlooks.

Canadian Dollar Short Term Outlook:

Current Resistance: 1.43275

Current Support: 1.431175

High Target: 1.43750

Low Target: 1.42960

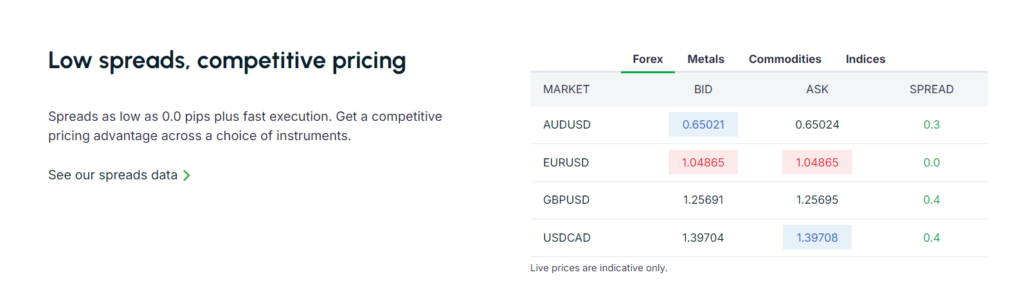

Ready to trade our daily Forex analysis? We’ve made a list of the best forex brokers in Canada for beginners to trade Forex worth using.