The U.S. dollar rose against the Taiwan dollar Friday, gaining NT$0.041 to close at NT$32.369.

Visited 1 times, 1 visit(s) today

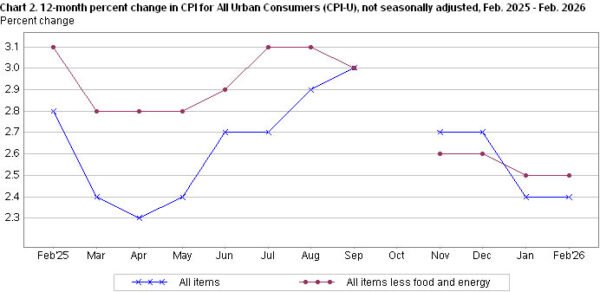

US inflation rose slightly faster than expected in February, though the broader price trend remained stable. Headline CPI increased 0.3% mom, above the expected 0.2% rise, while core CPI—which excludes food and energy—rose 0.2% on the month, matching market expectations. Housing costs continued to play the largest role in the monthly increase. The shelter index

EUR/USD is recovering losses from 1.1500. USD/JPY is correcting gains from 159.00 and might decline further if it stays below 158.30. Important Takeaways for EUR/USD and USD/JPY Analysis Today The Euro struggled to stay in a positive zone and declined below 1.1700 before finding support. There was a break above a connecting bearish trend line

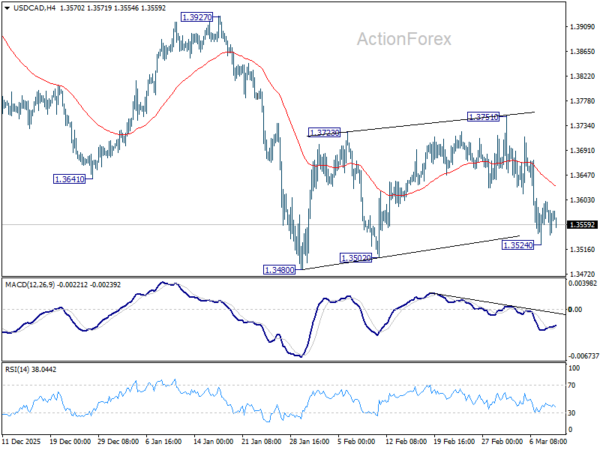

Daily Pivots: (S1) 1.3547; (P) 1.3575; (R1) 1.3609; More… Intraday bias in USD/CAD is turned neutral first with a temporary low formed at 1.3524. Nevertheless, outlook is unchanged that consolidation pattern from 1.3480 could have completed at 1.3751, after hitting 55 D EMA (now at 1.3704). Risk will stay on the downside as long as

Daily Pivots: (S1) 0.7058; (P) 0.7115; (R1) 0.7177; More… AUD/USD’s rally resumed by breaking through 0.7146 resistance today. Intraday bias is back on the upside for 100% projection of 0.5913 to 0.6706 from 0.6420 at 0.7213. Decisive break there could prompt upside acceleration to 161.8% projection at 0.7703. For now, outlook will remain bullish as

HONG KONG SAR – Media OutReach Newswire – 11 March 2026 – KCM Trade, a leading global CFD broker, has been honored with the “Best Forex Trading Platform 2026” award at the 2026 Industry Awards hosted by international financial media outlet FX Daily Info in March 2026, underscoring the Group’s brand strength and industry influence

Aussie has staged a remarkable breakout today, surging broadly higher to clip a near four-year peak against Dollar. AUD/USD is now knocking on the door of a critical resistance zone at 0.72. Firm break above this level wouldn’t just be a win for the bulls—it would signal strong underlying momentum that could pave the way

WTI oil extends pullback from Monday’s 3 ½ year high ($119.44) on Tuesday, following unexpected and sharp change in the sentiment after President Trump said that war in the Middle East could end soon. He also signaled that the US may lift some sanctions on sales of Russian oil, to partially compensate negative impact from

In today’s Market Outlook, let’s take a look at Forex Trading on Silver, XAGUSD, Gold, XAUUSD, AUDUSD, the NASDAQ, and WTI & Brent Crude Oil. If we look at WTI and Brent side by side, we see a very rare phenomenon. For a while, the price per barrel was equal, as we know, Brent Crude

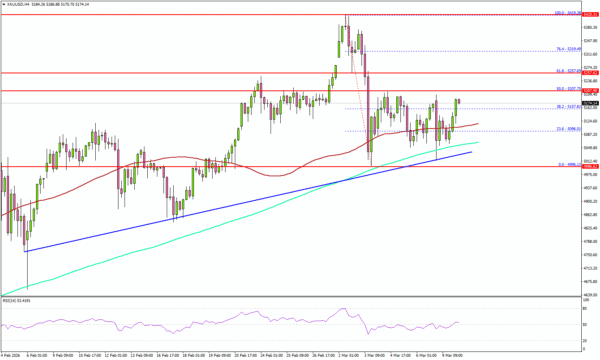

As the XAU/USD chart shows, the gold price has been holding within the $5,060–$5,200 range over the past several sessions. Bullish view: the key support is the lower boundary of the long-term channel that has been in place since the beginning of 2026. Bearish view: pressure on the price comes from statements by President Trump

Analysing the EUR/USD chart five days ago, we: → constructed a downward channel, noting signs that the bears remained in control; → outlined a scenario in which the rate would decline to a new yearly low (and test the lower boundary of the channel). Yesterday’s price action confirmed these assumptions – the low at H

Today, we will take a look at Forex Trading on the Dow Jones Industrial Average, EURUSD, AUDUSD and Gold, XAUUSD. Last time we looked at buying the dip on gold, and we did, in fact, get a result. What we have now, however, is a range trading opportunity with price action almost perfectly placed between

As I was completing an upcoming piece on the US Dollar, things just changed swiftly (coming up soon) Trump just said during an interview that the War was “pretty much complete”, implying a significant advance on his initial 4-5 week estimate. It seems a bit early for the warning however, so this report and move

Key Highlights Gold started a fresh decline from $5,420 and traded below $5,200. A major bullish trend line is forming with support at $5,040 on the 4-hour chart. WTI Crude Oil surged toward $120 before there was a sharp correction. USD/JPY extended gains and traded above 158.50. Gold Price Technical Analysis Gold remained well bid

The London session matters because it is the part of the forex day when liquidity usually rises, spreads often tighten, and major pairs such as EUR/USD and GBP/USD tend to move with more consistency. London also remains the world’s largest foreign exchange center. In the latest BIS triennial survey, the UK accounted for 38.1% of

The price of oil has continued to surge higher at the start of this week driven by the ongoing conflict in the Middle East. The price of Brent has hit a fresh high overnight of USD119.50/barrel before dropping back below USD110/barrel. At the worst point it had extended its advance to almost two thirds since

AUD/USD failed to stay in a positive zone and declined below 0.7000. NZD/USD is also moving lower and might extend losses below 0.5850. Important Takeaways for AUD/USD and NZD/USD Analysis Today The Aussie Dollar started a fresh decline from well above 0.7100 against the US Dollar. There is a bearish trend line forming with resistance

Created on March 09, 2026 The Swiss Franc has risen against the Japanese yen on Friday, as traders will look at this as a major signal. CHF/JPY The Swiss Franc has rallied significantly against the Japanese Yen during the trading session on Friday to threaten the idea of a major breakout yet again. This is

Another shocking Monday for the energy market. Last week’s start was remembered for a bullish gap of more than 10% (which was later followed by a pullback), but today’s market open proved even more volatile (as reflected by the ATR indicator). After a bullish gap of roughly 11%, the price continued to climb, reaching a

Game 7, LLC, the parent company of prop trading technology provider FPFX Tech as well as prop white label operator PropAccount, and retail prop firm BullRush, has announced that Quadcode, the fintech group behind IQ Option, Amaiz, and Quadcode AI, has acquired a “significant strategic stake” in the business. The actual size of the investment,

Daily Pivots: (S1) 0.7781; (P) 0.7810; (R1) 0.7838; More…. Intraday bias in USD/CHF remains neutral for the moment. On the downside, break of 0.7671 support will revive near term bearishness and bring retest of 0.7603 low. Decisive break there will resume larger down trend. On the upside, though, break of 0.7877 will bring stronger rally