Asia-Pacific markets fell on Thursday as investors reacted to US President Donald Trump’s proposal to impose 25% tariffs on auto, semiconductor, and pharmaceutical imports.

While Trump indicated that the duties could take effect as early as April 2, he did not specify whether they would target specific countries or apply broadly.

The uncertainty weighed on investor sentiment, leading to declines across major Asian indices.

In China, the CSI 300 slipped 0.37%, while Hong Kong’s Hang Seng index dropped 1.13%.

Japan’s Nikkei 225 lost 1.19%, with the broader Topix index down 1.06%.

South Korea’s Kospi edged 0.53% lower, and the small-cap Kosdaq shed 0.17%.

Meanwhile, Australia’s S&P/ASX 200 declined 1.39%, marking its fourth consecutive day of losses.

China holds key lending rates steady

The People’s Bank of China (PBOC) kept its benchmark 1-year loan prime rate (LPR) unchanged at 3.1% and the 5-year LPR at 3.6%.

The decision reflects Beijing’s focus on financial stability rather than further rate cuts to stimulate the economy.

Japanese government bond yields hit 15-year high

The yield on Japan’s 10-year government bonds (JGBs) rose to 1.434%, reaching a 15-year high.

The five-year JGB yield also hovered around 1.07%.

The move follows comments from Bank of Japan board member Hajime Takata, who warned that prolonged low interest rates could lead to excessive risk-taking and inflationary pressures, suggesting the need for further rate hikes.

Meanwhile, South Korea’s producer price index (PPI) rose 1.7% year-on-year in January, unchanged from December, according to preliminary data from the Bank of Korea.

The increase was driven by higher prices in livestock products, coal, petroleum, electricity, and utilities.

Australia’s job growth outpaces expectations

Australia added 44,000 jobs in January, more than double the 20,000 estimated in a Reuters poll, according to data from the Australian Bureau of Statistics.

Despite the strong job additions, the seasonally adjusted unemployment rate rose to 4.1%, in line with market expectations but higher than the previous month’s figure.

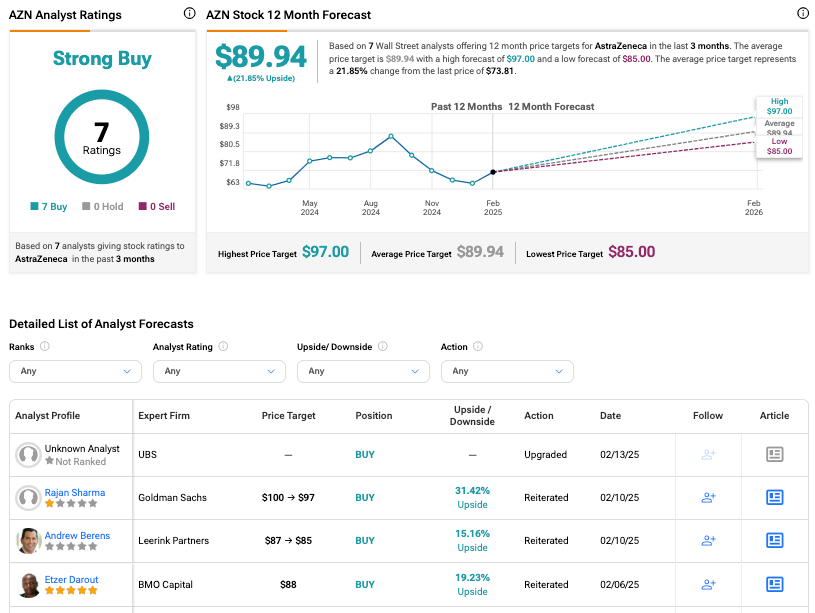

Wall Street remains resilient

US markets continued to climb overnight, even as the Federal Reserve remained cautious and Trump raised the prospect of new tariffs.

- S&P 500 gained 0.24%, closing at 6,144.15, marking its second consecutive record high.

- Nasdaq Composite edged up 0.07% to 20,056.25.

- Dow Jones Industrial Average rose 71.25 points (0.16%) to 44,627.59.

As markets digest the implications of Trump’s proposed 25% tariffs, investors remain on edge, with economic data and central bank policies playing a critical role in shaping sentiment.