Silver prices are ending the week on firm footing, with XAG/USD trading near $68.98 after decisively breaking above a long-watched…

•

Last updated: Monday, December 22, 2025

Quick overview

- Silver prices are showing strong momentum, trading near $68.98 after breaking above a key resistance zone.

- The breakout above the $66.90–$67.00 area has shifted sentiment positively, turning former resistance into support.

- Technical indicators, including candlestick patterns and moving averages, confirm the bullish trend, with key support levels at $67.00 and $65.80.

- Traders are targeting higher levels at $69.45 and $70.70, with pullbacks expected to be corrective rather than trend-reversing.

Silver prices are ending the week on firm footing, with XAG/USD trading near $68.98 after decisively breaking above a long-watched resistance band. The move has shifted short-term sentiment and put fresh upside levels back on traders’ radar as momentum builds into the new week.

Silver Breaks Key Resistance Zone

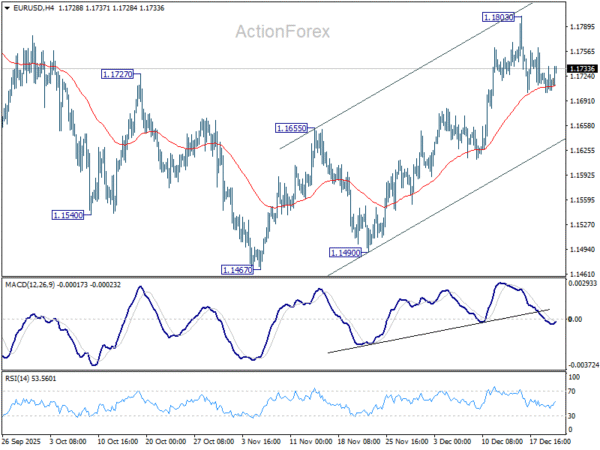

The breakout above the $66.90–$67.00 area marks an important technical development. That zone capped price action multiple times earlier this month, but once cleared, buyers stepped in with conviction. What matters now is that former resistance has turned into support, a classic sign of trend continuation rather than a one-off spike.

Silver remains comfortably inside a rising price channel that’s been intact since early December. Higher highs and higher lows continue to define the structure, keeping the broader bias tilted to the upside.

Candlesticks and EMAs Confirm Momentum

Candlestick behaviour reinforces the bullish case. The initial breakout candle showed a wide bullish body, followed by smaller consolidation candles near the highs. That pattern often reflects absorption of supply rather than aggressive profit-taking.

From a trend-following perspective, silver is holding well above its key moving averages:

- 50-EMA near $65.87, acting as dynamic support

- 100-EMA around $64.14, anchoring the broader trend

As long as price remains above these levels, pullbacks are likely to be corrective rather than trend-breaking.

Fibonacci Levels and RSI Outlook

Fibonacci extensions drawn from the latest pullback show that silver has already tagged the $68.15 level. The next technical objectives sit at $69.45, followed by $70.70, which also aligns with a psychological round number.

Momentum indicators remain supportive. The RSI near 71 reflects strong buying pressure, though it also suggests short-term cooling phases are possible. Importantly, there’s no bearish divergence yet, meaning momentum hasn’t rolled over.

What Traders Are Watching Next

Going into the week ahead, silver’s outlook hinges on whether buyers defend the newly formed support zone.

Key levels to watch:

- Support: $67.00, then $65.80

- Resistance: $69.45 and $70.70

Trade setup: Buy pullbacks toward $67.00, targeting $69.45–$70.70, with invalidation below $65.80.

With structure intact and momentum still favoring the upside, silver’s latest breakout looks more like a continuation move than a short-lived surge.

Arslan Butt

Lead Markets Analyst – Multi-Asset (FX, Commodities, Crypto)

Arslan Butt serves as the Lead Commodities and Indices Analyst, bringing a wealth of expertise to the field. With an MBA in Behavioral Finance and active progress towards a Ph.D., Arslan possesses a deep understanding of market dynamics.

His professional journey includes a significant role as a senior analyst at a leading brokerage firm, complementing his extensive experience as a market analyst and day trader. Adept in educating others, Arslan has a commendable track record as an instructor and public speaker.

His incisive analyses, particularly within the realms of cryptocurrency and forex markets, are showcased across esteemed financial publications such as ForexCrunch, InsideBitcoins, and EconomyWatch, solidifying his reputation in the financial community.

![Government officials pose for a photo before an inter-ministerial meeting on measures to strengthen foreign currency liquidity held at the government complex in Jongno District, central Seoul, on Dec. 18. From left, Financial Supervisory Service Gov. Lee Chan-jin, Deputy Prime Minister and Finance Minister Koo Yun-cheol, Financial Services Commission Chairman Lee Eog-weon and Bank of Korea Senior Deputy Gov. Ryoo Sang-dai. [YONHAP]](https://charm-retirement.com/wp-content/uploads/2025/12/ac07d7fc-9fd0-4527-8d58-14e318c230d8-1024x665.jpg)