Key Points

-

Investors are growing concerned that a downturn could be looming.

-

History shows, however, that there’s no such thing as a bad time to invest.

-

The right strategy can help you build long-term wealth, no matter what the market does.

- 10 stocks we like better than S&P 500 Index ›

After years of record-breaking growth, the S&P 500 (SNPINDEX: ^GSPC) has been stagnant in recent weeks — up by just 0.24% since the beginning of the year, as of this writing.

Many investors are also divided on where stocks are headed. While around 35% feel optimistic about the next six months, according to the most recent weekly survey from the American Association of Individual Investors, 37% feel pessimistic about the future — an increase from 29% in early February.

Will AI create the world’s first trillionaire? Our team just released a report on the one little-known company, called an “Indispensable Monopoly” providing the critical technology Nvidia and Intel both need. Continue »

So is it really safe to invest right now? Or should you hold off on buying? History offers a crystal-clear answer.

Image source: Getty Images.

History has good news for investors

With many stocks reaching record high after high, many investors worry that the only way to go is down. Historically, though, the market has proven that it always has room for more growth — if you’re willing to stay invested for the long haul.

By keeping a long-term outlook, it doesn’t necessarily matter when you buy. Even if you invest at the seemingly worst moment, you can still build substantial wealth over time.

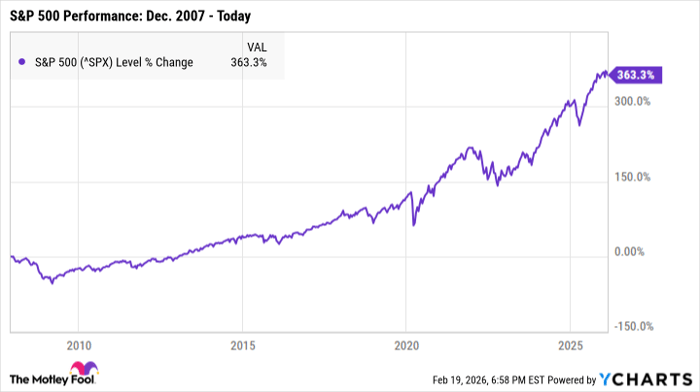

For instance, say that you had invested in an S&P 500 index fund or ETF in December 2007. The U.S. was just entering the Great Recession, which would last until mid-2009, and the S&P 500 wouldn’t reach a new all-time high until 2013.

In other words, investing in late 2007 would mean buying at record-high prices immediately before one of the longest and most severe recessions in U.S. history. Those years between 2007 and 2013 would have been rough, but by today, the S&P 500 has earned total returns of more than 363%.

Now, could you have earned more if you’d held off on investing until 2009, when stock prices were at rock bottom? Of course. But trying to time the market is a double-edged sword. Wait too long to invest, and you could miss out on much of the lucrative recovery period.

In most cases, it’s safer to continue investing consistently, no matter what the market is doing. Even if you invest at a “bad” moment, you can still earn significant returns over time.

The secret to ensuring your portfolio survives

The overall market is incredibly likely to pull through economic rough patches, but not all individual stocks will be that lucky. Unstable companies are more likely to crash and burn, whether due to a weak business model, shaky finances, lack of a competitive advantage, or poor leadership decisions.

Companies with strong foundations, however, have a much better chance of surviving even prolonged bear markets or recessions. The more of these stocks you own, the more protected your portfolio will be against volatility.

Right now is the perfect time to comb through your stocks and double-check that every one deserves its place in your portfolio. If you find any that are no longer strong investments, it could be wise to sell while prices are still high. And if you can swing it, investing more can set you up for significant long-term earnings.

Should you buy stock in S&P 500 Index right now?

Before you buy stock in S&P 500 Index, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and S&P 500 Index wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $415,256!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,151,865!*

Now, it’s worth noting Stock Advisor’s total average return is 892% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 21, 2026.

Katie Brockman has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.