The rupee appreciated 14 paise to 86.46 against the U.S. dollar in morning trade on Monday (January 20, 2025). Image for representative purposes only

| Photo Credit: Reuters

The rupee appreciated 14 paise to 86.46 against the U.S. dollar in morning trade on Monday (January 20, 2025), tracking a positive trend in domestic equities and Asian currencies.

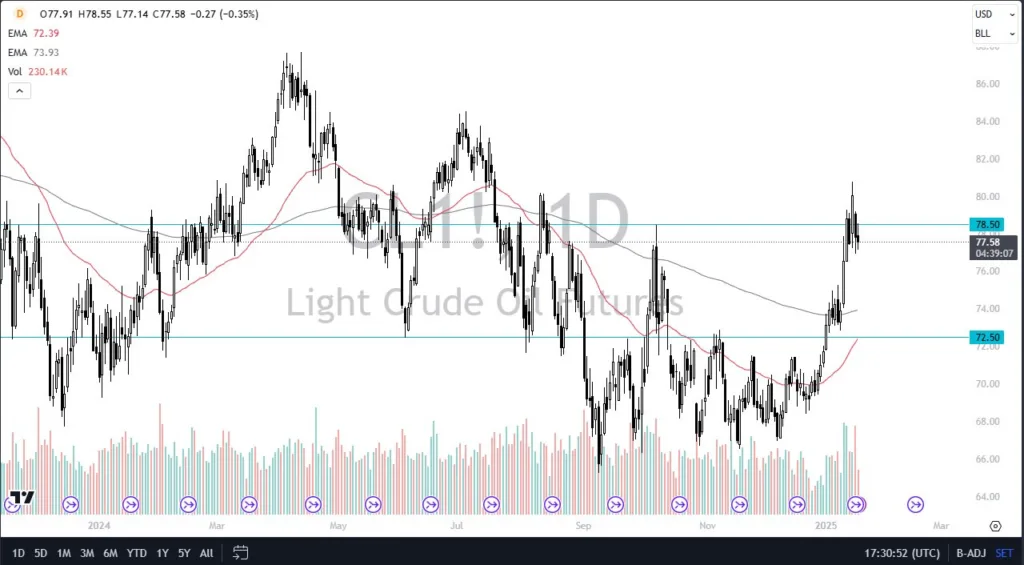

Forex traders said factors like elevated Dollar Index level as well as surging crude oil prices pose significant headwinds for the USD/INR pair.

At the interbank foreign exchange, the rupee opened at 86.48 and touched 86.46 against the greenback, registering a gain of 14 paise over its previous close.

On Friday (January 17, 2025), the rupee had settled at 86.60 against the U.S. dollar.

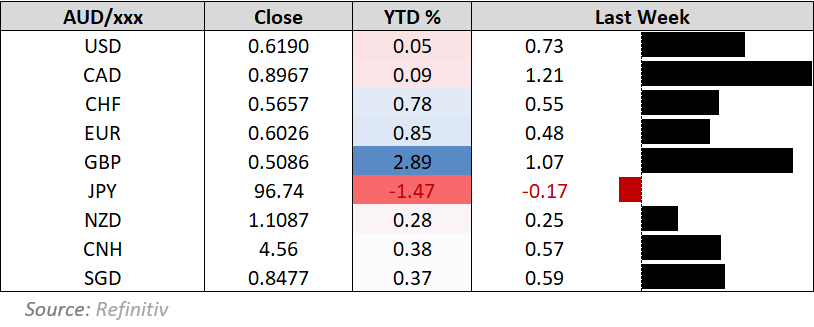

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, was trading lower by 0.22% at 109.10.

Brent crude, the global oil benchmark, fell by 0.12% to $80.69 per barrel.

The overall strength of the American currency and elevated crude oil prices are likely to strain India’s trade balance, creating challenges for sustained rupee appreciation, forex traders said.

As Asian currencies rose Indian rupee opened on a positive note against the U.S. dollar and is expected to trade within a range of 86.40/70 for the day which could become volatile as it progresses, Anil Kumar Bhansali, Head of Treasury and Executive Director Finrex Treasury Advisors LLP.

“Dips are still busy for importers as we expect the rupee to depreciate by ₹1.50 to 88.00 by March to bring the real effective exchange rate (REER) towards 105 levels,” Mr. Bhansali added.

On the domestic equity market front, the 30-share sensitive index Sensex climbed 398.21 points to 77,017.54 in early trade; Nifty was up 105.15 points to 23,308.35.

Foreign Institutional Investors (FIIs) remained net sellers in the capital markets on Friday (January 17, 2025), as they offloaded shares worth ₹3,318.06 crore, according to exchange data.

India’s forex reserves dropped by $8.714 billion to $625.871 billion in the week ended January 10, the RBI said on Friday (January 17, 2025).

Earlier, the overall kitty dropped by $5.693 billion to $634.585 billion in the week ended January 3, the Reserve Bank of India said.

Published – January 20, 2025 10:59 am IST