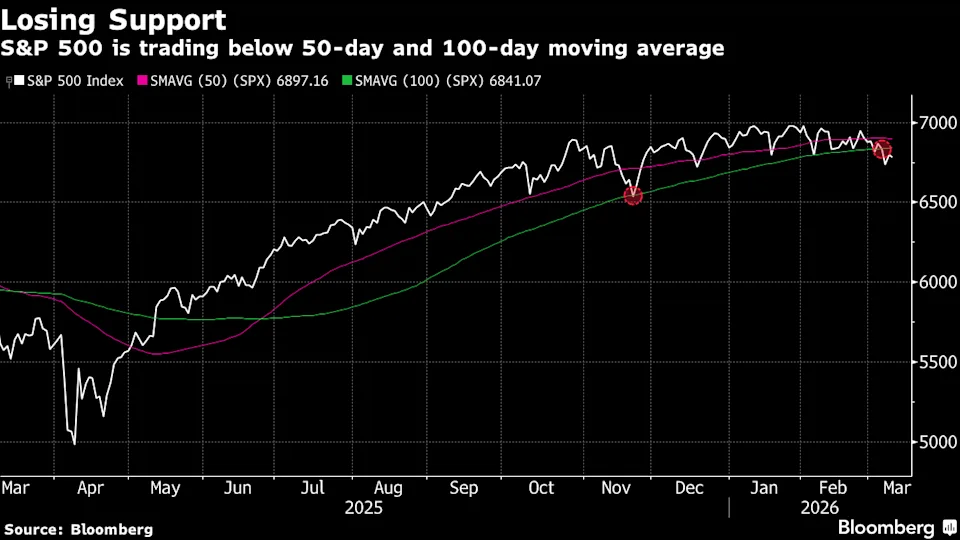

We last updated our retail flows data in April, before the summer “slowdown.” Since then, the S&P 500 has continued to rally (Chart 1, green line), now up over 20% year-to-date. As that happened, we’ve some notable shifts in sector and asset classes being traded by retail investors.

Stock buying pivoted from TSLA to NVDA

Looking at trading in company stocks, we see that retail moved into the Mag-7 and AI trade as early as last year, with strong net buying of TSLA.

However, in 2024, retail investors have switched their favorite stock to Nvidia (NVDA), trading almost $4 billion of NVDA daily. They have also been net buyers of the advanced chip design company to the tune of nearly $13 billion.

Chart 1: Retail buying of NVDA has dominated single-stock flows as the market rally extends

These levels of single-stock concentration aren’t unusual

Retail often has a “favorite stock” that they trade more than other tickers. However, even then, their trading remains relatively diversified. For example:

- This year, NVDA made up only 13.4% of all retail dollars traded and was the most popular stock (by value traded) for only 64% of days.

- Back in 2020, Tesla (TSLA) was regularly the most popular trade, peaking at almost 30% of all value traded in February 2023.

In the nearly six years since the start of 2019, TSLA holds many “most-popular retail stock” records. It has spent 678 days (48% of the period) as the most traded stock by retail investors, averaging 8.6% of retail dollar volume for every day between January 2019 and today.

Interestingly, AAPL is in second place for number of days as the most popular stock, although its last day it led retail trading came in September 2022.

Chart 2: Top retail stocks over the past five years

Retail investors aren’t always net-buyers of company stocks. But in 2024, they have been, adding to total net buying of around $32 billion year-to-date. Since June, as the promise of Fed rate cuts firmed, we can see there have been relatively few days where retail were not net buyers of companies (Chart 3, blue bars).

Retail still buying ETFs (almost every single day)

In contrast, we see retail investors are net-buyers of ETFs (almost) every single day (Chart 3, yellow bars). This has added to $120 billion in ETFs year-to-date.

Chart 3: Retail buying remains strong across the board

ETF buying in bonds

Importantly, with the prospect of rate cuts improving late in 2023, only to be delayed until recently, we’ve seen retail investors turn net buyers of broad maturities of bond ETFs. We’ve seen almost $26 billion of the ETF buying, or around 22% of all ETF buying, going into fixed income ETFs, adding duration to their holdings as short-term rates fall.

Chart 4: Retail Fixed Income ETP Buying at Highs since Start of Fed Rate Hiking Cycle

Retail trading remains above pre-Covid levels

Market-wide value traded remains elevated at around $600 billion per day (Chart 5, grey zone). However, part of the increase is now due to the market rallying. With higher prices it’s easy to trade more value.

To account for the market returns, we look at retail trading value ($) and volume (shares) as a proportion of the whole market. The data also shows that trading levels of retail remain elevated compared to the levels before Covid, but not at 2020 highs. In fact:

- Value traded, based on our method of identifying retail trades, remains around 6.5% of market-wide trading (green line), averaging $38 billion per day.

- Retail is an even higher proportion of share volumes, recently touching 9% (blue line). That’s because retail tends to trade more in lower-priced stocks (adding to shares more than value traded).

Interestingly, we see that value traded dipped back to pre-Covid levels (as a proportion of elevated value traded) in 2022 but has since recovered. Meanwhile, shares traded seems to have peaked with the meme stock craze of 2021 and has been in a slow general decline ever since.

Chart 5: Retail Activity Remains Elevated Relative to Pre-Pandemic Levels

Retail remains an important source of liquidity

Although data suggests many households have spent their Covid savings, we see that retail trading in stocks and ETFs market remains a material proportion to market.

In short, retail remains an important source of liquidity for many stocks and ETFs.