High valuation metrics prop up Apple’s market valuation.

Apple (AAPL 0.75%) is the world’s second-largest company after Nvidia (NVDA 0.56%), with a market cap of about $4.2 trillion. That’s a monster business, but I don’t think it will stay in second place for long. I don’t think it will become the world’s largest company, either. I believe some other stocks will pass Apple during the next few years, based on its slow growth and high valuation.

It’s likely that Alphabet (GOOG +1.08%) (GOOGL +1.15%), Microsoft (MSFT +0.43%), and Amazon (AMZN +0.16%) will grow to become larger companies than Apple by market cap.

Image source: Getty Images.

Alphabet

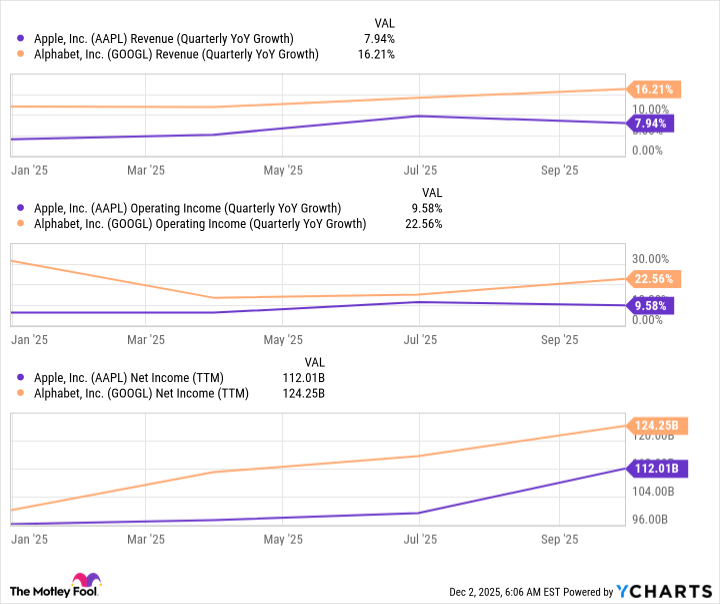

As the third-largest company in the world, Alphabet doesn’t have a long way to go to pass Apple as the second-largest company in the world. It’s about $300 billion behind Apple right now, but if every company were valued the same, it would already be larger:

AAPL Revenue (Quarterly YoY Growth) data by YCharts.

Alphabet generates more net income than Apple does, so if it received the same valuation on its stock price, it would actually be worth more. Furthermore, Alphabet is growing far faster. Its revenue and operating income growth rates are nearly double those of Apple’s, and its prospects are far brighter.

It’s openly challenging Nvidia‘s dominance in the artificial intelligence (AI) computing market, as it may sell its tensor processing units (TPUs) to Meta Platforms as an alternative to Nvidia’s graphics processing units (GPUs). Its advertising platform Google is also doing quite well, and if that keeps up, Alphabet will have no issue passing Apple in market cap during the next three years.

Microsoft

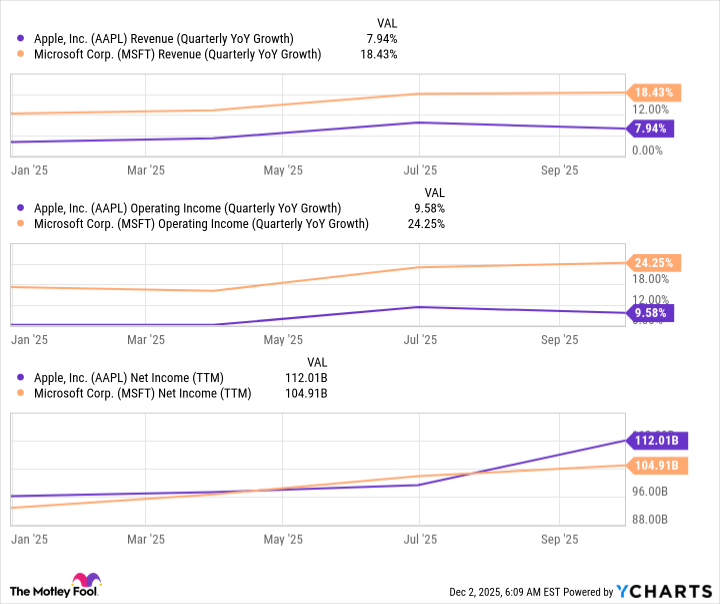

Microsoft is in a similar boat as Alphabet, just with less impressive net income figures:

AAPL Revenue (Quarterly YoY Growth) data by YCharts.

Microsoft’s net income is only a sliver behind Apple’s total. If you factor in Microsoft’s growth rates, it will be no time before it passes Apple in market cap. (It’s about $3.6 trillion now.)

Microsoft has a thriving software business and a strong cloud computing platform that’s growing on the back of powerful AI demand. These tailwinds aren’t going to slow during the next few years, and they make Microsoft a strong candidate to pass Apple in market cap.

Amazon

Last in this group is Amazon. It has the toughest road by far. It’s market value is about $1.7 trillion smaller than Apple’s ($2.5 trillion at this writing) and is valued in roughly the same ballpark, at about 30 times forward earnings. It’s revenue is growing only slightly faster, with its most recent quarter delivering 13% growth versus Apple’s 8%. That isn’t going to cut it to make up the $1.7 trillion difference in three years.

However, Amazon has two tricks up its sleeve. The first is its cloud computing business, Amazon Web Services. AWS experienced a growth resurgence during the third quarter, with revenue rising 20% year over year — the fastest in many quarters. With AWS accounting for 66% of operating income in Q3, it’s a key part of Amazon’s profitability picture.

Today’s Change

(0.16%) $0.36

Current Price

$229.47

Key Data Points

Market Cap

$2454B

Day’s Range

$228.55 – $231.24

52wk Range

$161.38 – $258.60

Volume

1.1M

Avg Vol

48M

Gross Margin

50.05%

Dividend Yield

N/A

The second key to Amazon’s rising profitability is its advertising business. This is its fastest-growing business unit, accounting for 24% growth in Q3. Although Amazon doesn’t break out division profitability as it does with AWS, we know from other advertising-focused businesses like Alphabet that its margins are likely quite healthy.

A combination of Amazon’s sustained growth and Apple’s premium valuation decreasing due to low growth rates could push Amazon to become a larger company than Apple during the next three years. While this isn’t a sure bet, I think it’s probable.

Keithen Drury has positions in Alphabet, Amazon, Meta Platforms, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.