On Semiconductor ON is expanding its footprint in Europe with an initiative, which is aimed at bolstering its capabilities in silicon carbide (SiC) manufacturing.

The company recently announced its plans to invest up to $2 billion (44 billion CZK) in a vertically-integrated SiC manufacturing facility in the Czech Republic.

The multi-year investment underscores ON’s commitment to meeting the rising global demand for advanced power semiconductors essential for enhancing energy efficiency across key sectors such as electric vehicles, renewable energy and AI data centers.

By establishing a SiC manufacturing facility, On Semiconductor reinforces its presence in Europe and contributes significantly to the region’s semiconductor value chain, aligning with the goals of the European Chips Act.

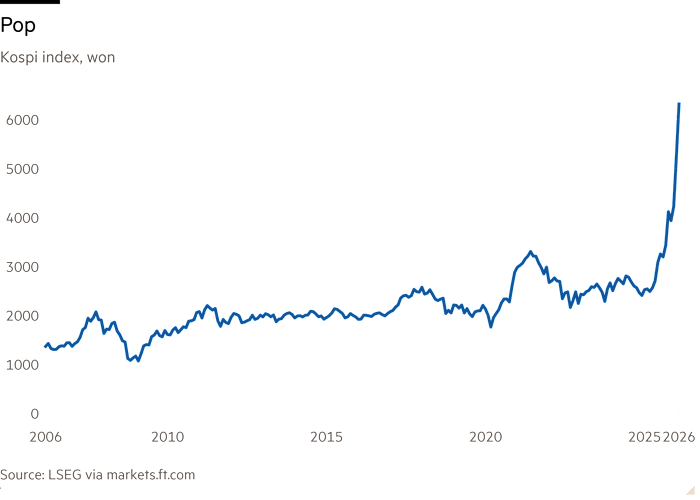

ON Semiconductor Corporation Price and Consensus

ON Semiconductor Corporation price-consensus-chart | ON Semiconductor Corporation Quote

Expanding Portfolio Aids Prospect

The latest move underscores the company’s focus on advancing SiC manufacturing in Europe, reinforcing its role in meeting global demands for energy-efficient power semiconductors in key sectors like electrification, renewables and AI.

The company’s SiC solutions are gaining traction in automotive and industrial applications, which has been a major growth driver. In the first quarter of 2024, ON Semiconductor’s silicon carbide business demonstrated robust performance, with more than 50% of substrates coming from internal production.

ON’s dominant position in silicon carbide has been a major factor driving its strong partner base with the likes of BorgWarner BWA, Volkswagen VWAGY and Magna International MGA, thereby driving growth.

ON Semiconductor’s extended silicon carbide partnership with BorgWarner is noteworthy. It integrates EliteSiC technology for enhanced efficiency and performance in EV traction inverters, reinforcing its commitment to innovative mobility solutions.

Volkswagen partnered with ON to use EliteSiC technology in its electric vehicles. Its EliteSiC 1200 V silicon carbide power module supports VW models front and rear traction inverters.

ON Semiconductor and Magna signed a long-term supply agreement (LTSA) to incorporate ON Semiconductor’s EliteSiC intelligent power solutions into Magna’s eDrive systems, enhancing electric vehicle efficiency and performance.

Expanding portfolio has also been a critical catalyst. The company recently introduced an energy-efficient solution combining the T10 PowerTrench family and EliteSiC 650V MOSFETs, aiming to significantly reduce data center power consumption and enhance performance for AI workloads.

Conclusion

Despite a broadening portfolio across diverse end-markets and strong partner base, ongoing macroeconomic uncertainty, and frequent buyouts have been affecting ON’s financial position.

The stock has declined 17.3% against the Zacks Computer & Technology sector’s growth of 25.7% year to date.

This Zacks Rank #3 (Hold) company expects second-quarter 2024 revenues to be between $1.68 billion and $1.78 billion. The Zacks Consensus Estimate is pegged at $1.73 billion, indicating a decline of 17.32% year over year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Non-GAAP earnings are expected between 86 cents per share and 98 cents. The Zacks Consensus estimate for earnings has decreased by a penny to 93 cents in the past 30 days, indicating a year-over-year fall of 30.8%.

Free Report – 3 Stocks Sneaking Into Hydrogen Energy

Demand for clean hydrogen energy is projected to reach $500 billion by 2030 and grow 5-FOLD by 2050. No guarantees, but three companies are quietly getting the jump on their competition.

Zacks Investment Research is temporarily offering an urgent Special Report naming and explaining these emerging powerhouses primed to boom. Click below for Hydrogen Energy: 3 Industrial Giants to Ride the Next Renewable Energy Wave.

BorgWarner Inc. (BWA) : Free Stock Analysis Report

Magna International Inc. (MGA) : Free Stock Analysis Report

ON Semiconductor Corporation (ON) : Free Stock Analysis Report

Volkswagen AG Unsponsored ADR (VWAGY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.