- The Japanese Yen bulls retain control amid worries about the economic fallout from Trump’s tariffs.

- The risk-off mood and relatively hawkish BoJ expectations further lend support to the safe-haven JPY.

- The USD selling bias keeps USD/JPY close to a multi-month low ahead of the crucial US NFP release.

The Japanese Yen (JPY) seesaws between tepid gains/minor losses against its American counterpart heading into the European session on Friday and remains close to a multi-month peak touched the previous day. Fears of an all-out trade war, which could trigger a global recession, continue to weigh on investors’ sentiment. This is evident from a sea of red across the global equity markets and underpins the safe-haven JPY.

Furthermore, firming expectations that the Bank of Japan (BoJ) will raise interest rates further in 2025, amid signs of broadening inflation in Japan, turn out to be another factor benefiting the JPY. In contrast, the US Dollar (USD) sticks to its bearish bias amid bets that the Federal Reserve (Fed) will resume its rate-cutting cycle soon amid a tariffs-driven slowdown in the US. This, in turn, acts as a headwind for the USD/JPY pair.

Meanwhile, investors remain concerned about the potential economic fallout from US President Donald Trump’s sweeping trade tariffs announced late Wednesday. This might force the BoJ to keep policy rates steady for the time being, which, in turn, holds back the JPY bulls from placing fresh bets. Furthermore, investors seem reluctant and opt to wait for the release of the US Nonfarm Payrolls (NFP) report later this Friday.

Japanese Yen bulls retain control amid risk-off mood, hawkish BoJ expectations

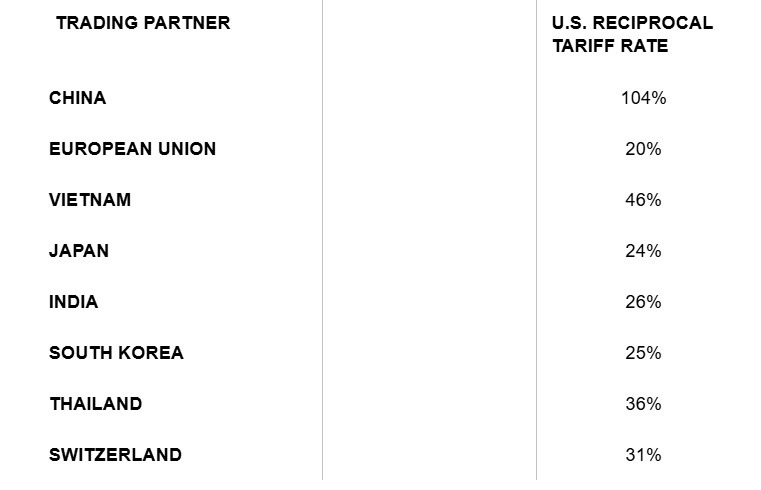

- In a major blow to Japan’s auto industry, which accounts for around 3% of gross domestic product, US President Donald Trump’s 25% tariff on car imports takes effect as scheduled on Thursday. Moreover, bets for early interest rate hikes by the Bank of Japan retreated amid concerns that harsher US reciprocal tariffs announced on Wednesday could negatively impact Japan’s economy.

- The yield on the benchmark 10-year Japanese government bond tanked on Thursday, posting its biggest drop since August 5 and hitting its lowest level since February 26. This, in turn, is seen weighing on the Japanese Yen during the Asian session on Friday and assisting the USD/JPY pair to register a modest recovery from the lowest level since October touched the previous day.

- Meanwhile, Japan’s Prime Minister Shigeru Ishiba said on Thursday that he will not hesitate to directly approach US President Donald Trump, if appropriate, and will continue to demand the US to reconsider tariff measures. Separately, Japan’s Finance Minister Shunichi Kato warned earlier this Friday that tariffs could have a significant impact on trade systems and global economies.

- BoJ Governor Kazuo Ueda said that Trump tariffs are likely to put downward pressure on Japan, and global economies, though reiterated that the BoJ will guide monetary policy appropriately from the standpoint of sustainably achieving a 2% inflation target. BoJ Deputy Governor Shinichi Uchida said that the central bank will raise interest rates if underlying inflation heightens.

- This comes on top of strong Tokyo consumer inflation figures on Friday, which backs the case for further tightening by the BoJ. In contrast, traders are ramping up expectations for the Federal Reserve to start lowering borrowing costs again in June and cut interest rates four times this year amid concerns that Trump’s policies will trigger an all-out trade war and a global recession.

- The outlook, in turn, led to the overnight slump in the US Treasury bond yields, dragging the yield on the benchmark 10-year US government bond and the US Dollar to their lowest level since October. This might keep a lid on the USD/JPY pair’s attempted recovery. Traders might also opt to wait for the release of the US monthly employment details before placing aggressive bets.

USD/JPY might struggle to move back above 146.55-146.50 support-turned-resistance

From a technical perspective, the overnight break below the previous year-to-date low, around the 146.55-146.50 area, was seen as a fresh trigger for the USD/JPY bears. Moreover, oscillators on the daily chart are holding deep in negative territory and are still away from being in the oversold zone. This, in turn, suggests that the path of least resistance for spot prices remains to the downside and supports prospects for a further depreciating move. Hence, a subsequent fall below the overnight swing low, around the 145.20-145.15 region en route to the 145.00 mark and the next relevant support near the 144.50-144.45 zone, looks like a distinct possibility.

On the flip side, any attempted recovery back above the 146.50-146.55 region (the previous YTD low) is likely to attract fresh sellers and remain capped near the 147.00 round figure. A sustained strength beyond the latter, however, might trigger a short-covering rally and lift the USD/JPY pair to the 147.75-147.80 hurdle. This is closely followed by the 148.00 mark, which if cleared decisively should pave the way for additional gains towards the 148.60 intermediate barrier en route to the 149.00 mark and the 149.20 horizontal zone.

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months’ reviews and the Unemployment Rate are as relevant as the headline figure. The market’s reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.