Shares of the technology giant have dipped after a massive spending push related to artificial intelligence.

Investors know Amazon (AMZN 0.41%) as one of the best-performing stocks of the 21st century. However, the trillion-dollar technology giant has actually severely underperformed the stock market indexes in recent years. Amazon stock is up just 22% cumulatively in the last five years, while the S&P 500 index has produced a total return level of 87%.

After its fourth-quarter earnings report earlier this month, Wall Street has soured on the e-commerce and cloud computing giant once again. Why? Because of its ambitious capital spending plans, which could have the business burning free cash flow in 2026.

Here’s why investors may be wrong about Amazon stock, and why it is a buy today.

Data by YCharts.

Capital expenditures and the long-term vision

Amazon Web Services (AWS), the company’s cloud infrastructure division, is seeing resurgent demand because of the insatiable spending needs of artificial intelligence (AI) start-ups. Companies like Anthropic, with fast-growing revenue, spend billions of dollars with AWS each year, and plan to spend more in the future.

Last quarter, AWS revenue grew 24% year over year to $35.6 billion, with expectations for further revenue acceleration in 2026. To build enough data centers to meet customer demand, Amazon needs to spend aggressively up front, which is why it plans to spend $200 billion on capital expenditures this year, up from $132 billion last year and $83 billion the year before.

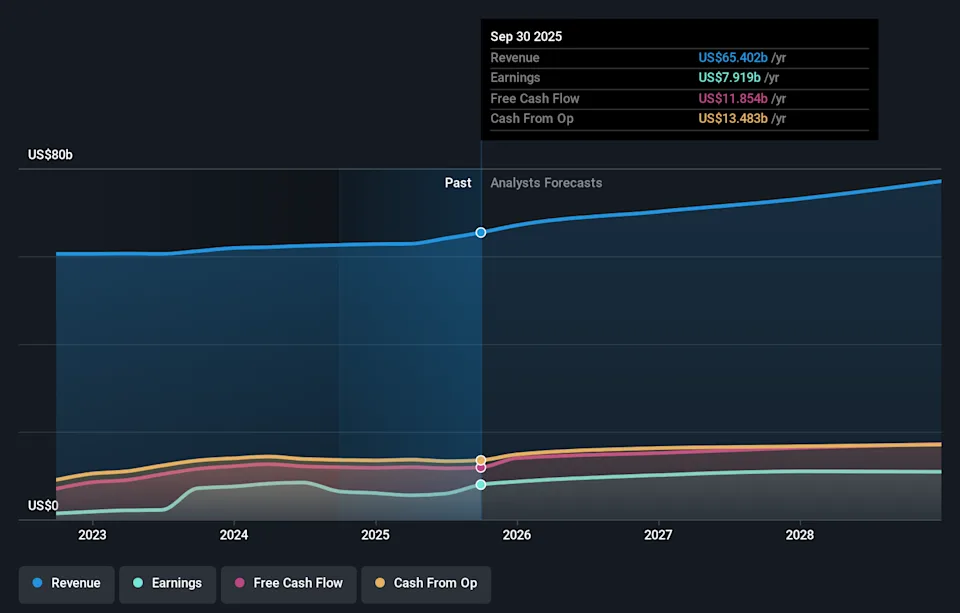

Investors are scared because this exceeds Amazon’s 2025 operating cash flow of $140 billion, likely leading to negative free cash flow in 2026. However, I believe this should be seen as bullish for the company, as it suggests Amazon sees a massive runway to reinvest and expand its revenue base. This happened during the COVID-19 pandemic, when the company needed to invest in additional cloud and delivery infrastructure to support its e-commerce business, temporarily leading to negative free cash flow.

Then, in a few years, Amazon was back to generating record free cash flow. The same should be expected a few years from now.

Image source: Getty Images.

Amazon is a cheap stock for patient investors

Right now, Amazon’s free cash flow is moving in the wrong direction due to heavy upfront investments in data center infrastructure. At the same time, operating earnings keep growing, hitting a record high of $85 billion over the last 12 months.

This is due to rising AWS revenue and margin expansion in its retail operations. Both trends should continue in 2026 due to the AI infrastructure build-out and the rapid growth of Amazon’s high-margin businesses, such as advertising. Consolidated operating margin was 11.8% in 2025. I expect this figure to eventually reach 15% or even higher over the next decade.

Today’s Change

(-0.41%) $-0.81

Current Price

$198.79

Key Data Points

Market Cap

$2.1T

Day’s Range

$197.28 – $201.16

52wk Range

$161.38 – $258.60

Volume

66M

Avg Vol

47M

Gross Margin

50.29%

Once these accelerated AI investments are finished, free cash flow should begin to converge back with operating earnings. If Amazon can grow its consolidated revenue by 15% a year over the next three years (it grew 14% last quarter, with accelerating AWS growth), the business will be doing over $1 trillion in revenue by the end of the decade.

A 15% profit margin on $1 trillion in revenue is $150 billion in bottom-line earnings, or around double today’s levels. Follow this trend, don’t worry about a short-term hit to free cash flow, and watch Amazon stock crush it for your portfolio over the next five years.