After a huge year, shareholders in the Detroit car company are ready for more gains.

Ford (F 1.25%) is an iconic Detroit-based car company known for its F-Series lineup of trucks, which have been the best-selling vehicles in the U.S. for 49 straight years. This is a phenomenal trend that reveals just how much the business has come to dominate this corner of the car market. With its history dating back all the way to 1903, investors aren’t worried that Ford is going anywhere anytime soon.

This automotive stock just had a great year, with shares producing a total return of 42% in 2025. Looking ahead, though, can Ford be a millionaire-maker? The answer is obvious.

Image source: Getty Images.

Don’t expect outsize growth

Ford collected $35.8 billion in automotive revenue in the third quarter of 2015. Exactly 10 years later, in Q3 2025 (ended Sept. 30), the business reported automotive revenue of $47.2 billion. This translates to a compound annual gain of just 2.8%. That’s an incredibly slow pace of growth, and it should tell investors that they should not expect big expansion numbers from Ford. For comparison’s sake, U.S. gross domestic product increased at an annualized clip of 5.4% in the past decade.

This company has reached a level of maturity that doesn’t set itself up for meaningful top-line gains. To be fair, though, that’s because the global auto industry sold 15.9 million vehicles (on a seasonally adjusted annual rate) in November. That was lower than the amount in November 2015. Unless there’s a sudden surge in the number of driving-age people in the countries Ford serves, this will remain a low-growth business.

It also doesn’t help that demand for new cars is very cyclical. These are huge purchases for the average household. When economic hardships occur, as they do on occasion and unpredictably, sales can decline.

Ford’s profitability is disappointing

Like other mass market car companies, Ford doesn’t produce high profits. On $141.4 billion in total revenue through the first nine months of 2025, it registered $2.9 billion in net income and $5.7 billion in adjusted free cash flow. In order to remain competitive and keep up with rivals, Ford must invest a significant amount in research and development, labor, materials, and manufacturing capacity. This will always be the case.

Today’s Change

(-1.25%) $-0.18

Current Price

$14.22

Key Data Points

Market Cap

$57B

Day’s Range

$14.09 – $14.40

52wk Range

$8.44 – $14.50

Volume

3M

Avg Vol

85M

Gross Margin

7.58%

Dividend Yield

4.23%

What are some factors that can support higher profits for the business? For one, Ford could attempt to see if it possesses pricing power, a valuable trait that a luxury super car purveyor like Ferrari has. However, this would imply that its brand is powerful enough that it can ask consumers to pay more for its cars when there are a number of options on the market with similar features at lower price points. This strategy might not work out well, and it could force Ford to lose customers, since price is a significant purchasing factor.

The company could also figure out how to cut costs and lean on its scale to improve margins. Indeed, it was on track to reduce expenses by $1 billion in 2025. But Ford has been a sizable car maker for a long period of time, and its profitability is still wildly disappointing. The company’s quarterly operating margin has averaged just 3.1% in the past five years.

Valuation expansion and dividends won’t get you in the seven-figure club

Despite having some notable unfavorable characteristics, Ford might draw the attention of value investors. After all, the stock trades at a very inviting forward price-to-earnings ratio of 9.7. Moreover, the dividend yield of 4.17% can be particularly enticing for income-hungry investors.

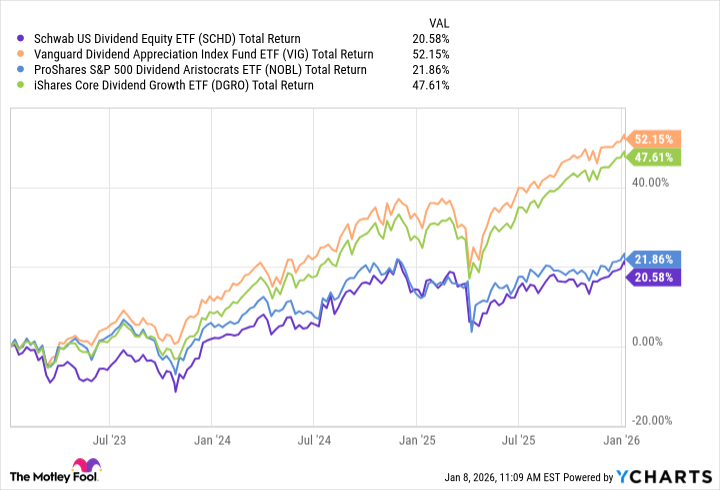

In my view, though, these variables aren’t enough to make Ford a stock worth buying for long-term investors. Shares have seriously lagged the S&P 500 in the past decade, and this will likely continue. Therefore, it’s not a millionaire-making business.