Donald Trump broke a whole lot of economic-policy conventions when last he was in the White House. One he stopped short of, however, was action against Hong Kong’s pegged-exchange rate, according to Bloomberg.

That may seem arcane when measured against the Republican’s other first term-grenade tosses. Like when he crippled the World Trade Organization’s judicial oversight of commercial disputes, or used dubious national security concerns to justify tariff hikes on treaty allies (as he did against the European Union over steel and aluminium.)

It may also seem minor when considering how President Joe Biden engaged in convention-breaking of his own, albeit tied to a brutal war of aggression that’s killed tens of thousands. Biden froze Russia out of the dollar-based international financial system and participated in an initiative to send Ukraine the earnings on seized Russian assets.

But Hong Kong’s exchange-rate peg to the dollar, along with its broader role as a globally respected centre for cross-border finance, offers China perhaps its best opportunity of constructing a parallel system to the current one based on the greenback. And with Trump’s adjutants on the warpath to maintain the dollar’s dominance, it’s something that’s worth keeping an eye on come Jan 20.

China’s policymakers have long hoped to diminish the dollar’s global role, with a central bank chief once calling for a “super sovereign” reserve currency. But setting up some new international denomination is inordinately complex, and coordinating such a thing across many major economies seems a stretch. (Just consider how many questions still remain with regard to the euro.)

For a while, it seemed China would try and make the yuan a new force in global finance. In the early 2010s, there was talk of fully opening the nation’s capital account, allowing free use of the Chinese currency overseas. But a botched devaluation in mid-2015 and a subsequent mass exodus of capital from China put an end to that idea, undermining the credibility of Beijing regulators who had backed market-based reform.

More broadly, allowing for free use of the yuan around the world is incompatible with a Communist government that prioritizes control of both the cost of capital and deciding where it should flow. So there’s that as well.

But China does have another currency available to it: the Hong Kong dollar. This one is freely convertible and issued by an authority that has a different (read: Western) legal system. Since 1983, the Hong Kong dollar has been pegged to the more famous one.

Ironically, that move was made to address a crisis of confidence tied to China. At the time, investors were spooked by talks regarding the territory’s handover by Britain to Communist-run China. The New York Times reported that, before the dollar-fix was made, residents were hoarding “what are considered the three staples of life here: rice, toilet paper and liquor.” The peg helped calm things down.

In 1997 Hong Kong returned to mainland control. But it retained its UK legal system and connection to the broader international trade and financial system. Today, Hong Kong’s status as an international financial centre — though wavering — makes it a key pillar in “Beijing’s vision of becoming a financial superpower,” according to Huang Yiping, a member of the People’s Bank of China’s Monetary Policy Committee who is ranked fourth in Trivium China’s list of the country’s top economic advisers.

“The city is a Chinese territory, but it is also where market forces dominate, where its institutions and its way of life are in line with international standards with international recognition. We must continue to keep all of these in place,” Huang said, adding “the peg makes a lot of sense, given the dominance of the US dollar.”

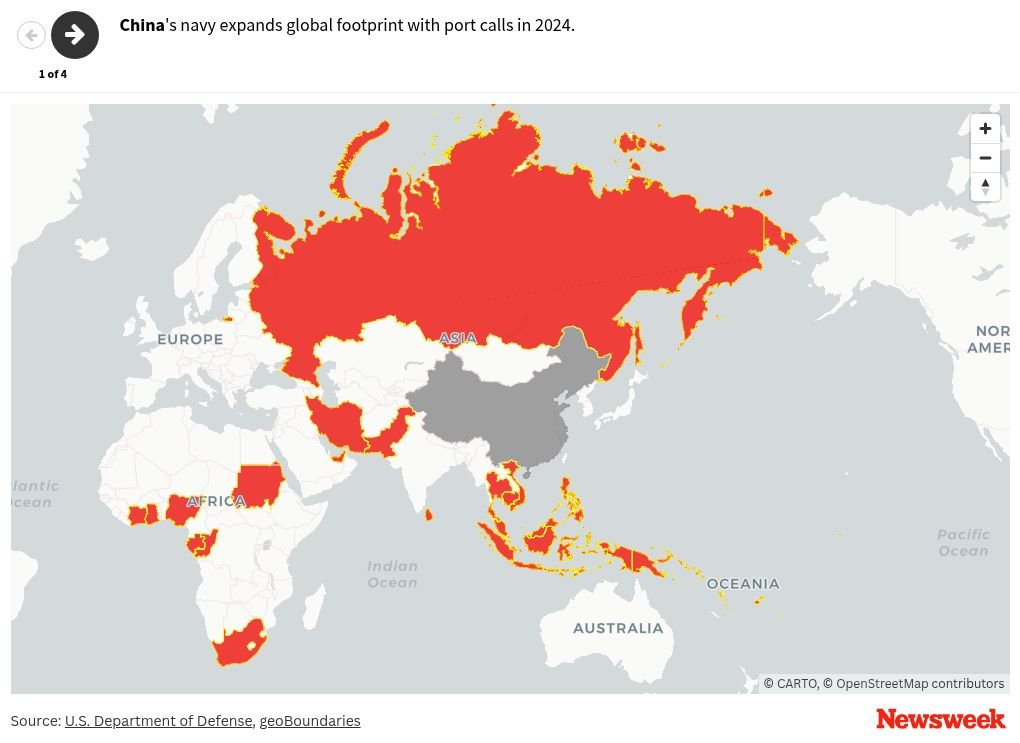

Indeed, Charles Gave, founder of the Gavekal research group, speculated this week that Hong Kong could become the potential nucleus of a new international financial system. Gave highlighted a buildup of US dollar reserves in Hong Kong in recent years, a potential sign of Asian exporters opting to keep their earnings outside of the US.

“If these deposits were to be converted into Hong Kong dollars, and lent to borrowers in countries around Asia, we would see the emergence of a new pyramid of credit,” Gave wrote in a note Thursday. “In effect, this credit would be denominated in US dollars, but the US authorities would have no oversight over it or how it gets used.”

As for Trump, the real estate developer-turned-politician is hardly someone who likes being told he has no say over something. And Hong Kong was indeed a focus of his previous administration. Back in mid-2020, Trump’s advisers decided against moving to undermine the Hong Kong dollar peg to the greenback. The context was how to punish China for its draconian crackdown on freedom of speech, assembly and the press in the territory under what Beijing called a “national security law.”

Fast forward several years, and things may be viewed differently in Trump’s second term. This will especially be the case if the peg emerges as a key facet of a cross-border financial system that can compete with the dollar.—News Desk