- For four consecutive trading sessions, the gold price index has been subjected to selling pressure, pushing it towards the $2633 per ounce support level before stabilizing around $2645 per ounce at the beginning of trading today, Wednesday.

- Meanwhile, this comes ahead of a significant event for the financial markets in general: the announcement of the US Federal Reserve’s policies.

- The results of US economic data have supported the strength of the US dollar, which has further increased gold selling.

What to Expect from US Interest Rate Decisions?

Widely, it is expected that the Federal Reserve will cut US interest rates by 25 basis points. The greatest focus will be on the US central bank’s policy statement and the statements of its governor, Jerome Powell, through which investors will make predictions about future US interest rate movements. In general, the fate of additional US interest rate cuts in 2025 is now a matter of exciting and confusing questions due to stronger-than-expected US economic data.

Trading Tips:

The recent sales have not deviated from the general upward trend. Moreover, so always expect gold to buy back from its lowest levels if important releases this week come as headwinds for gold.

Will gold prices rise tomorrow?

According to gold trading platforms, the price of gold may rise tomorrow, Wednesday, if the US Federal Reserve’s statement contradicts the expectation of sticking to further interest rate cuts in the coming meetings. Or if the conflict in the Middle East renews and expands. However, if the US Federal Reserve’s announcement is cautious in providing further rate cuts, it may increase downward pressures on gold prices.

Future of China’s Gold Demand

Undoubtedly, China’s return to buying gold after a six-month hiatus has provided more positivity to gold price performance recently. According to commodity experts, China may be ready to provide some new support for gold prices, with the country’s leadership signalling stronger incentives to help support domestic consumer demand. Regarding China’s demand for gold, it increases with the approach of the Lunar New Year – a period characterized by high demand for jewellery in gift-giving traditions. Without that, jewellery demand appears to be weaker in the holiday season.

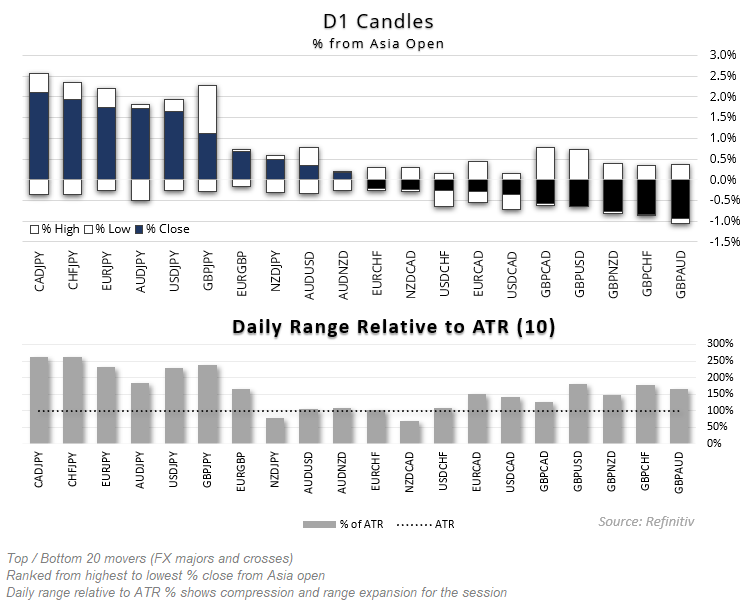

Gold Price Technical Analysis and Expectations Today:

According to the performance on the daily chart above and the expectations of gold analysts today, the general trend of gold prices is still upwards, and the eyes of bulls are watching with great interest the return to the psychological resistance area of $ 2,700 per ounce before the close of trading in 2024, during which it achieved gains exceeding 30 percent. Meanwhile, China’s return to buying gold bullion after a hiatus of months weakened recent gold sales. Currently, the closest important support levels for gold prices are $ 2,628 and $ 2,605 per ounce, respectively. Therefore, we still prefer the strategy of buying gold from every downward level, but without risk and activating profit and stop loss orders.

In general, the price of an ounce of gold will remain in a wait-and-see mode until the markets and investors react to the announcements of central banks, led by the US Federal Reserve. Also, the Bank of Japan, and the Bank of England, as well as the reaction to any global geopolitical tensions, especially from the Middle East and the Russian/Ukrainian war.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.