My previous GBP/USD signal on 2nd October was not triggered as none of the key support or resistance levels I had identified were reached that day.

Today’s GBP/USD Signals

- Risk 0.75%.

- Trades must be taken prior to 5pm London time Thursday.

Long Trade Ideas

- Place a long entry following a bullish price action reversal on the H1 timeframe immediately upon the next touch of $1.3054, $1.3029, $1.3011, or $1.3000.

- Place the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 25 pips in profit.

- Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

Short Trade Idea

- Place a short entry following a bearish price action reversal on the H1 timeframe immediately upon the next touch of $1.3218 or $1.3312.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 25 pips in profit.

- Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

I wrote in my previous GBP/USD forecast just over a week ago that the technical picture had become more bearish, so I was looking for a short trade from either $1.3357 or $1.3315.

I was correct to be looking to the bearish side as the price has fallen over the past week, although the nearest point of resistance which I noted was not quite reached.

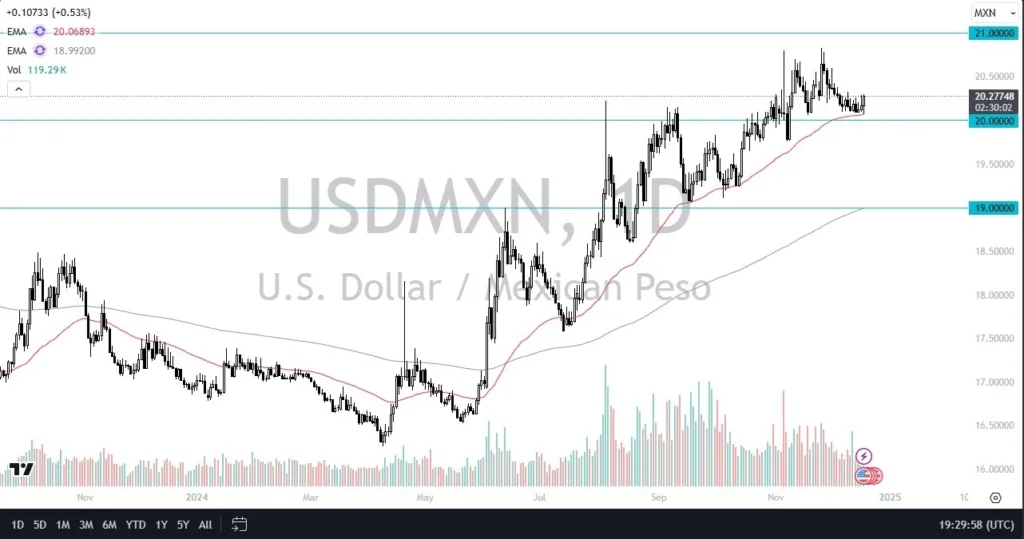

We have reached an interesting technical point, as the US Dollar Index has broken above a key resistance level and continued to advance, but this currency pair seems to have met an area of very strong support evidenced by a group of tightly packed support levels sitting between the big round number at $1.3000 and $1.3050.

The price looks likely to make some kind of bullish bounce from this zone, especially if US CPI data later is lower than expected. The bounce may not be large or sustained, but it is likely to be enough to at least grab a few quick pips. It may be that normal or stronger CPI data could spike the price down to $1.3000 or even lower for just a minute to pick up orders.

Overall, I see the best likely opportunity today as a long trade, but it could be fast.

There is nothing of high importance due today concerning the GBP. Regarding the USD, there will be a release of CPI (inflation) data at 1:30pm London time.

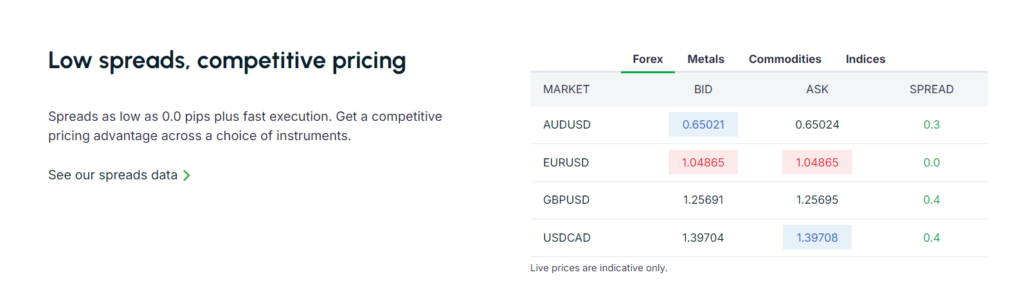

Ready to trade our free Forex signals? Here is our list of the top 10 Forex brokers worth reviewing.