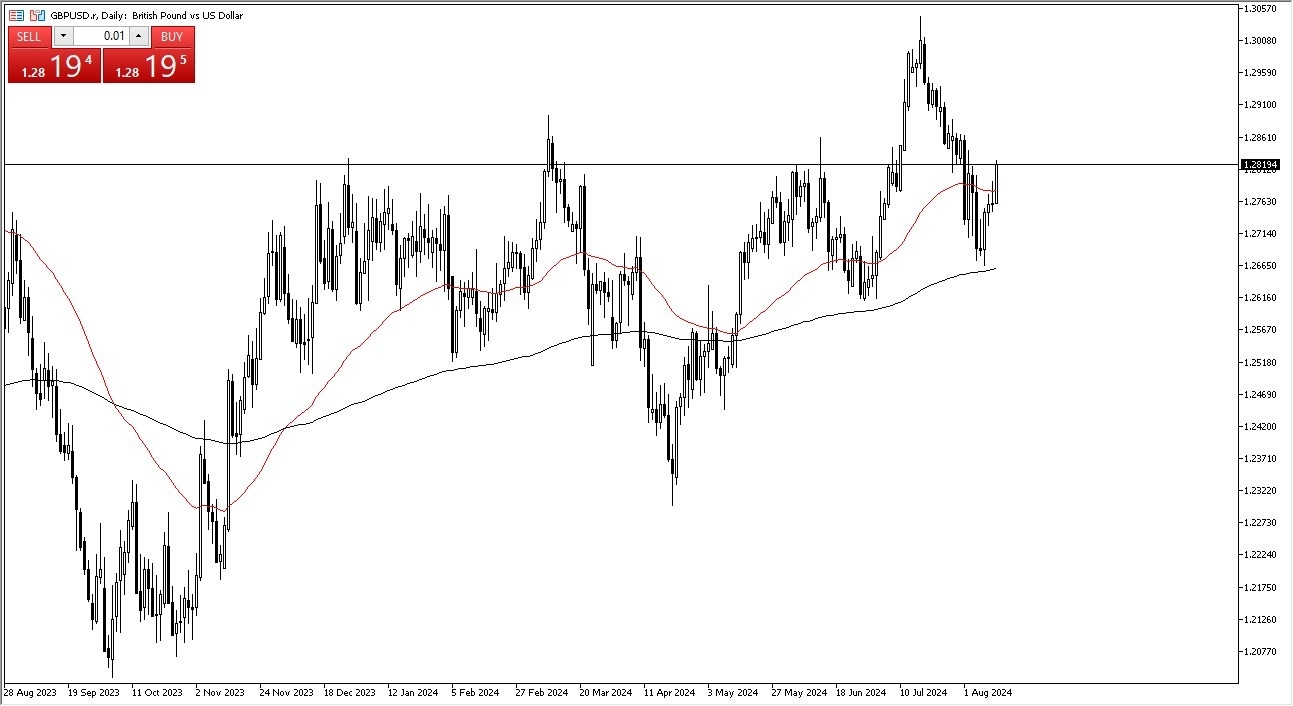

- The British Pound has rallied significantly during the early hours on Tuesday as the PPI numbers in the United States came out weaker than anticipated.

- By doing so, we have broken the back of the shooting star from the previous session, which is typically a very bullish sign, and I think you’ve got to look at this through the prism of whether or not we are going to continue to go higher.

- I think it’s very likely that we will do, at least in the short term.

The signs of the candlestick does suggest that perhaps there will be a little bit of follow through, and I do think that it’s probably only a matter of time before short term pullbacks get bought into. However, it’s also worth noting that if we were to break down below the bottom of the shooting star from the Monday session, then we could send this market down to the 1.27 level. This is a significant move during the day on Tuesday and now we are starting to focus on the idea of whether or not we can break above the 1.2875 level an area that has been a little bit of a resistance barrier previously.

Choppiness Going Forward

I do expect this to be a very choppy move regardless and with that being the case I think you have to look at the GBP/USD market through the prism of whether or not we are going to continue to see the US dollar price in the idea of the Federal Reserve cutting rates, or if we eventually flip over and start to worry about the economy and money goes flowing into the Treasury market. I do think this is a situation where there are a lot of people out there that are starting to look for central bank help. But the question then becomes sooner or later, they will look for safety. I don’t think we’re to that point yet. So therefore, another swing higher looks more likely than not.

Ready to trade our Forex daily analysis and predictions? Here are the best forex trading platforms UK to choose from.