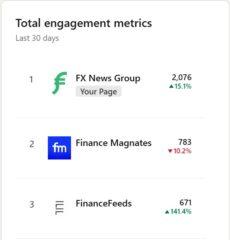

This week presented some more examples as to why FNG has become, by far, the most read, most shared, and most trusted FX and CFDs industry news site. (Here below are LinkedIn Analytics’ own Competitor stats for the past 30 days – FNG articles get several x the Engagement more than the “other guys”.)

In addition to about a half-dozen FNG Exclusive articles including reports about C-Suite executive moves at brokers such as STARTRADER and EC Markets…

In addition to about a half-dozen FNG Exclusive articles including reports about C-Suite executive moves at brokers such as STARTRADER and EC Markets…

Last week CMC Markets, one of the “original” and publicly traded online brokers, reported its latest financial results, for fiscal year 2025.

FNG’s headline – focusing on what the real “news” was – read “CMC Markets sees 8% Revenue decline and 24% drop in Profit in 2H FY2025”.

Other “FX News” sites, basically parroting the company’s rosy statements in its press release, posted headlines such as “CMC Markets Ends FY25 with 33% Annual Profit Jump”.

CMC’s shares promptly fell by 17%.

Now whose coverage do you think folks that matter (traders, shareholders, regulators, industry insiders…) actually read? Or paid attention to?

And who do you think they dismissed (or, just didn’t bother to read at all) as more promotional nonsense?

Whose newsletter do you think that industry decision-makers and traders worldwide open and read every day?

Some of the most read and commented-on FX/CFD industry news stories to appear over the past seven days on FNG included:

Top FX and CFDs industry news stories this week

CMC Markets sees 8% Revenue decline and 24% drop in Profit in 2H FY2025. Following a strong first half of fiscal 2025, London based online trading group CMC Markets plc (LON:CMCX) has reported its full year 2025 results (fiscal year ended March 31, 2025) indicating a slowdown in both top and bottom line results in the second half of the year, i.e. October 2024 through to March 2025. The company also announced some senior management and Board changes.

CMC Markets sees 8% Revenue decline and 24% drop in Profit in 2H FY2025. Following a strong first half of fiscal 2025, London based online trading group CMC Markets plc (LON:CMCX) has reported its full year 2025 results (fiscal year ended March 31, 2025) indicating a slowdown in both top and bottom line results in the second half of the year, i.e. October 2024 through to March 2025. The company also announced some senior management and Board changes.

CySEC issues statement on allegations against Cypriot Forex brokers. An interesting exchange just happened between Cyprus regulator CySEC and Paphos mayor Phedonas Phedonos, after the latter made accusations that drug networks from Mexico and other Latin American countries are funneling profits through Cyprus-based FX and CFDs brokers. What did CySEC have to say on the matter?

CySEC issues statement on allegations against Cypriot Forex brokers. An interesting exchange just happened between Cyprus regulator CySEC and Paphos mayor Phedonas Phedonos, after the latter made accusations that drug networks from Mexico and other Latin American countries are funneling profits through Cyprus-based FX and CFDs brokers. What did CySEC have to say on the matter?

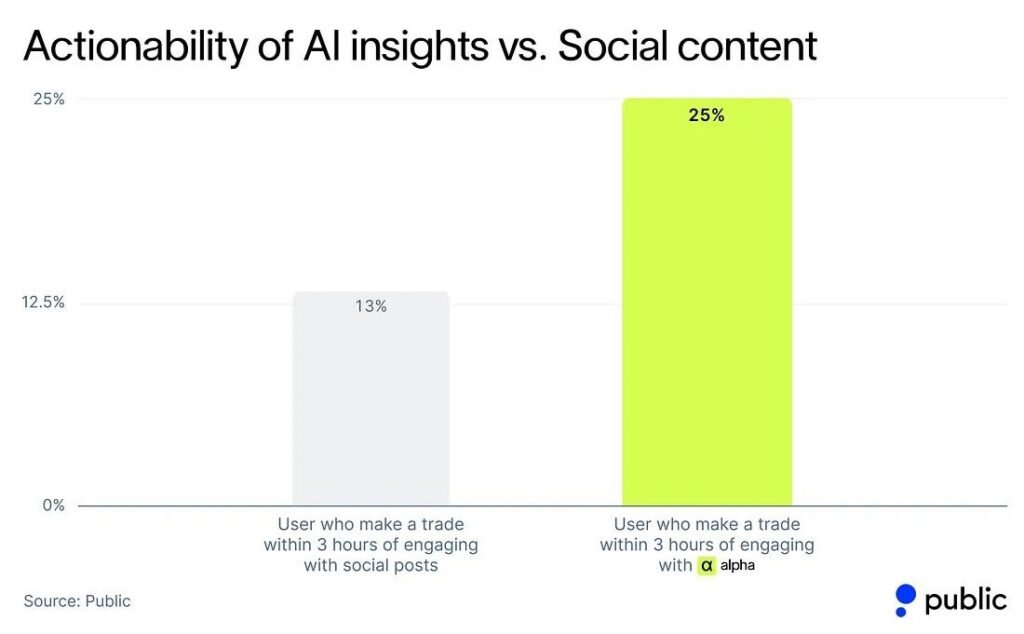

Public shuts down social trading. Online investing provider Public.com, which began life as a social trading focused app, has announced that it is now shuttering social trading. And the reason given? AI, of course. In a blog post entitled “Sunsetting Social”, Public explained that when it first launched, a key feature of the product was the ability to see other people’s trades and their insights around the markets — all coming together in a social feed. It was a novel idea that helped make Public not just a place to trade but a community.

Public shuts down social trading. Online investing provider Public.com, which began life as a social trading focused app, has announced that it is now shuttering social trading. And the reason given? AI, of course. In a blog post entitled “Sunsetting Social”, Public explained that when it first launched, a key feature of the product was the ability to see other people’s trades and their insights around the markets — all coming together in a social feed. It was a novel idea that helped make Public not just a place to trade but a community.

IG partners with Uphold to launch crypto trading in the UK. Leading UK online investing and trading platform IG Group (LON:IGG) has announced that it has launched crypto trading, becoming the first UK-listed business to allow customers to buy, sell and hold crypto assets. The launch comes as crypto adoption continues to grow in the UK, and follows the government’s recent unveiling of plans for a UK crypto regulatory regime.

IG partners with Uphold to launch crypto trading in the UK. Leading UK online investing and trading platform IG Group (LON:IGG) has announced that it has launched crypto trading, becoming the first UK-listed business to allow customers to buy, sell and hold crypto assets. The launch comes as crypto adoption continues to grow in the UK, and follows the government’s recent unveiling of plans for a UK crypto regulatory regime.

Robinhood completes $200 million acquisition of Bitstamp. US neobroker Robinhood Markets (NASDAQ:HOOD) has announced that it has closed its acquisition of Bitstamp a global cryptocurrency exchange. Bitstamp, founded in 2011 with offices in Luxembourg, the UK, Slovenia, Singapore, and the US, has agreed to be acquired by Robinhood back in July 2024 for $200 million. The acquisition introduces Robinhood’s first institutional crypto business.

Robinhood completes $200 million acquisition of Bitstamp. US neobroker Robinhood Markets (NASDAQ:HOOD) has announced that it has closed its acquisition of Bitstamp a global cryptocurrency exchange. Bitstamp, founded in 2011 with offices in Luxembourg, the UK, Slovenia, Singapore, and the US, has agreed to be acquired by Robinhood back in July 2024 for $200 million. The acquisition introduces Robinhood’s first institutional crypto business.

Top FX industry executive moves this week

❑ Exclusive: Moe Padhani joins STARTRADER as Chief Commercial Officer.

❑ Exclusive: Equiti sales exec Yassin Mismar joins prop firm FundingPips.

❑ Exclusive: EC Markets hires MetaQuotes exec Fivos Georgiades as Executive Director.

❑ Exclusive: PrimeXM BizDev Manager Alan Samuel leaves for Pluridio.

❑ Citadel FX Business Development head Bryan Seegers departs.

❑ Exclusive: STARTRADER hires Allan Maira and Clarice Frost for Operations.

❑ B2PRIME hires oneZero institutional sales head Stuart Brock.

❑ Prop firm tech provider Axcera hires Lubomir Marasi as Commercial Director.