btc-usd

Skerdian Meta•Monday, January 20, 2025•3 min read

Reading List

Register now to be able to add articles to your reading list.

”

aria-hidden=”true”>

Share in Facebook

“>

This week the Bank of Japan is expected to cut interest rates, while Donald Trump will take office today, which should be a positive factor for cryptos, with BTC already above $105K and XRP above $3, following last week’s surge.

Last week the Ripple case heated up again as SEC appeal challenged the Howey Test ruling. The SEC filed an appeal on January 15, 2025, challenging a federal court’s decision in its ongoing case against Ripple Labs. Besides that, the Securities and Exchange Commission Chair, Gary Gensler, will step down from the Commission later today. XRP buyers found this development interesting and jumped in on the long side again, sending XRP/USD to $3.38. Over the weekend we also saw the release of the Trump coin, which surged right away.

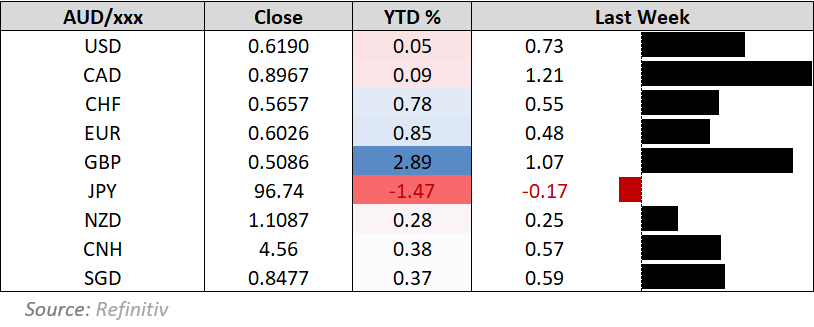

In forex, the US PPI producer inflation and CPI consumer inflation took all the attention, with core inflation coming softer than expected, which sent the USD down initially, but the situation reversed later in the week and the US dollar ended the week near the highs. The data from the UK such as the GDP and retail sales continued to show increasing weakness in the UK economy, which will likely keep the GBP soft this week.

This Week’s Market Expectations

The week starts with some important events, particularly for the crypto market, as Donald Trump will take the White House today, while the Securities and Exchange Commission Chair, Gary Gensler, will step down from the Commission. While these two events should offer some positive price action, traders are watching for any crypto comments from Trump, which might catch the market by surprise.

Key Upcoming Economic Events:

- Monday:

- China: People’s Bank of China (PBoC) Loan Prime Rate (LPR) decision.

- United States: Presidential Inauguration Day.

- United States: SEC Chair Gensler Resigns

- Canada: Bank of Canada (BoC) Business Outlook Survey release.

- New Zealand: Services PMI report.

- Tuesday:

- United Kingdom: Employment report, including unemployment rate and wage growth.

- Germany: ZEW Economic Sentiment Index.

- Canada: Consumer Price Index (CPI) for December.

- New Zealand: Q4 Consumer Price Index (CPI).

- Thursday:

- Canada: Retail Sales data for November.

- United States: Weekly Jobless Claims report.

- Friday:

- Japan: Consumer Price Index (CPI) and Bank of Japan (BoJ) policy decision.

- Global: Flash PMI data for January from Australia, Japan, Eurozone, United Kingdom, and the United States.

Last week markets were slow, but we opened 29 trading signals nonetheless. We ended the week with 22 winning forex signals and seven losing trades, which gives us a 75-25% win/loss ratio. we also had several long term signals which closed, such as in Hold and in Bitcoin.

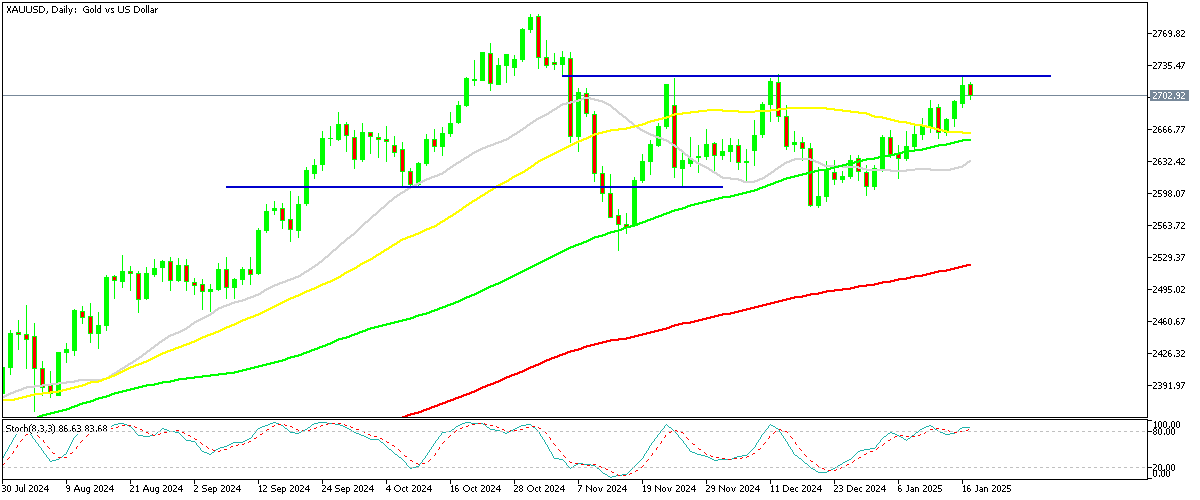

Gold Rejected by the Resistance Again

Gold (XAU/USD) has resumed its upward momentum this month after finding strong support at the 20-week SMA. Last month, it failed to break through the critical resistance level of $2,725, leading to a $100 decline. However, the price stabilized near the 20-week SMA, where a doji candlestick indicated a potential bullish reversal. This was followed by three consecutive bullish weekly candles, with the price rising above $2,700 yesterday. For further gains, buyers need to push past the resistance at $2,730.

XAU/USD – Daily Chart

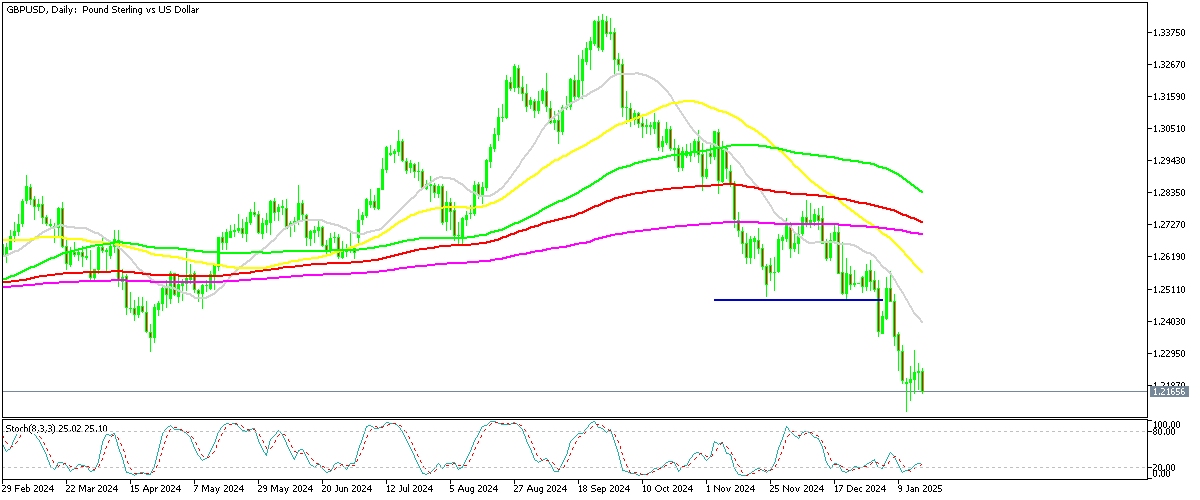

GBP/USD Turns Lower as It Heads for 1.20

GBP/USD turned bearish above 1.34 in late September and the decline doesn’t seem to end, as sellers keep pushing the price down. Last week the price pierced below 1.21 on Monday, but retraced higher on some USD weakness following the softer inflation reports/ However, sellers returned and now it seems like they will target the 1.20 level.

GBP/USD – Daily Chart

Cryptocurrency Update

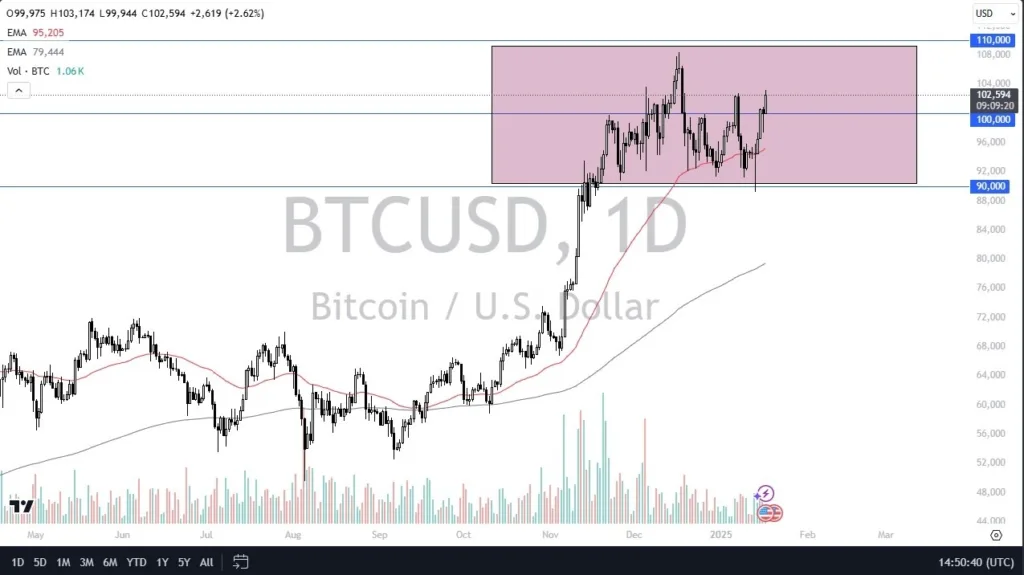

Bitcoin Climbs Above $105K Ahead of Donald Trump’s Presidency but Falls back to $100K

Bitcoin (BTC/USD) has been highly volatile recently. It started the week near $108,000 but dropped below $100,000 following a 25 basis point rate cut, eventually reaching the low $90,000s. The price briefly rebounded to $95,000 but encountered resistance near the 20-day SMA before falling again. Earlier this week, BTC/USD recovered 10% after an initial $3,000 drop, closing above $100,000 yesterday.

BTC/USD – Daily chart

Ethereum Returns Lower to MAs

Ethereum (ETH/USD) has also experienced significant fluctuations. It initially found support near its 50-day SMA but faced bearish pressure, causing it to drop below $3,500 and then to $3,200. On Monday, a sell-off pushed the price briefly below $3,000 before fresh buying led to a rebound. Midweek, Ethereum surged to $4,000 but soon pulled back below $3,000. Over the past two weeks, the broader cryptocurrency market has strengthened, helping Ethereum approach $3,500 again.

ETH/USD – Weekly Chart

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank’s local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.