Is the US dollar gearing up for a significant reversal? There are early warning signs everywhere.

Watch today’s forex mid-week analysis to see how I’m trading the DXY, EURUSD, GBPUSD, and USDJPY this week!

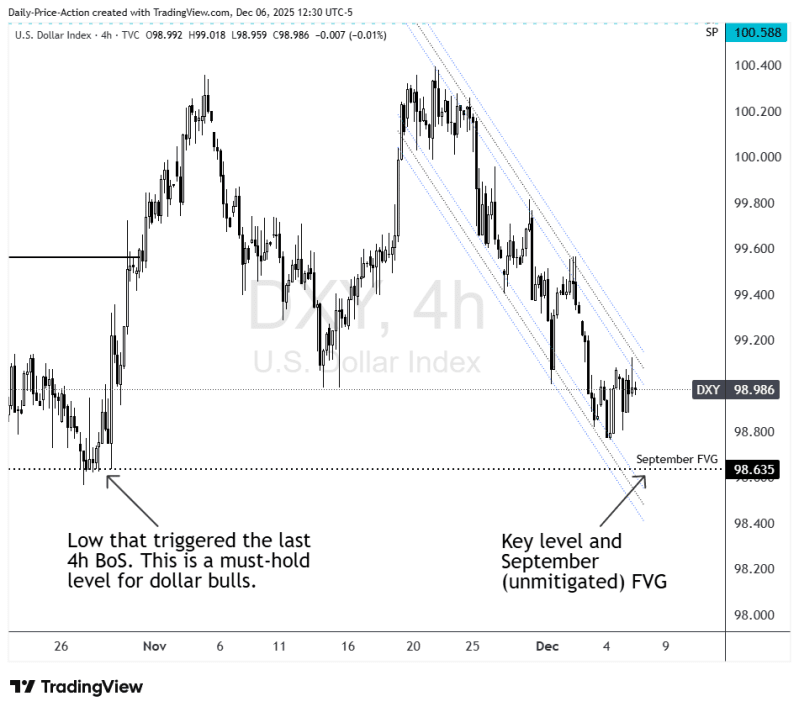

US Dollar Index (DXY) Forecast

The US dollar could be on the verge of a significant turning point. For all of 2025, the DXY has trended lower steadily and aggressively. It’s been a relentless selloff that has wiped out several key levels.

However, no trend lasts forever, and a significant buy-side imbalance is evident near 106.00. Imbalances or inefficiencies like the one at 106.00 can often serve as magnets.

But without a technical trigger, imbalances like 106.00 don’t mean much. There also needs to be a trigger, such as a high-timeframe breakout, to confirm the reversal and open the door to those imbalances.

So far, USD bulls have cleared the 98.30 level. That was the first hurdle that I discussed in the last Weekly Forex Forecast. The next big test for buyers is the February trend line at 99.00.

That’s resistance for now, but a sustained break above would support the idea of a bullish reversal. It would also expose higher levels, such as 100.20 and 101.90.

Until then, the DXY remains range-bound and indecisive, oscillating between the 99.00 resistance level and the 98.30 support level.

EURUSD Forecast

The EURUSD uptrend could be in trouble as Tuesday’s session failed to hold above 1.1530. Additionally, the DXY broke above the 98.30 level I discussed in the Weekly Forex Forecast.

In that video, I shared how the DXY had been testing channel support from over a decade ago. I have also shared in recent weeks how the DXY 106.00 region could become a magnet.

The US dollar index left a significant imbalance at 106.00 during the March selloff. EURUSD shares a similar imbalance at 1.0600.

However, a couple of things need to occur to confirm these reversals.

First, EURUSD needs a sustained break below 1.1530 and 1.1440. That could confirm a significant top for the euro. So far, sellers have only dealt with 1.1530.

Second, the DXY needs to hold above 98.30, which is breaking today, and clear its February trend line at 99.00.

If that occurs, the EURUSD could target lower levels, such as 1.1275 and 1.1060. My final target on a confirmed top (if we get it) will be the 1.0600 region.

However, as mentioned above, the current price action serves as a warning sign. Both the EURUSD and DXY have work to do to confirm a full reversal pattern.

GBPUSD Forecast

GBPUSD is also flashing warning signs of a potential top. In previous videos, I discussed the similarities with the 2024 top, including a multi-month rising wedge and RSI bearish divergence.

The pound broke its rising wedge on Tuesday, closing the session right on the 1.3430 support area.

Where Wednesday’s session closes could determine if this key support area broke down on Tuesday. If the GBPUSD closes convincingly above 1.3430/40 on Wednesday, it will keep the area intact as support for now.

As with the DXY and EURUSD, the pound left a massive imbalance in the 1.2900 region during the April rally. That could serve as a magnet for GBPUSD if the breakdown is confirmed this week.

USDJPY Forecast

USDJPY remains range-bound between 145.40 resistance and 142.40 support. There has been no change to recent forecasts, but the potential remains.

One idea I have discussed in recent videos is a potentially weaker yen in the coming weeks. However, the Yen Basket remains above its 2020 descending trend line, so nothing is confirmed.

The same goes for USDJPY and other yen pairs. USDJPY is selling off from 145.40 yet again, so the pair remains range-bound until proven otherwise.

I’ll continue to monitor the Yen Basket as it tests its 2020 trend line. Recent price action suggests a possible buy-side fakeout, which could be bearish for the yen; however, I need to see more evidence before taking action.