European capital market infrastructure Euronext today published its results for the fourth quarter and full year 2025.

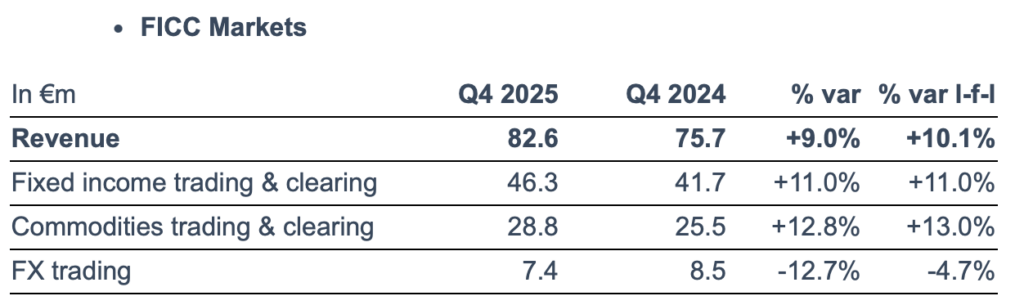

FX trading revenue was down 12.7%, at €7.4 million in the final quarter of 2025, reflecting lower volatility and the negative currency impact of the USD.

Financial derivatives trading and clearing revenue was €12.3 million in Q4 2025, down 5.0% compared to Q4 2024. This mostly reflects lower volatility.

Depreciation and amortisation accounted for €54.2 million in Q4 2025, up 9.3% more than Q4 2024. The increase mainly relates to acquisitions. PPA related to acquired businesses accounted for €27.7 million. The ramp up reflects the integration of the PPA for Admincontrol from this quarter.

Adjusted operating profit was €253.2 million, up 9.5% compared to Q4 2024. Euronext reported a net financing expense of €4.3 million in Q4 2025, compared to €6.5 million net financing income in Q4 2024. The variation reflects decreasing interest rates and the recognition of non-cash interest expense related to the convertible bonds, partly offset by the benefit of the tender offer and early redemption of a portion of the EUR 2026 bonds.

Euronext received €10.9 million of results from equity investments in Q4 2025, mostly reflecting the dividend received from Sicovam.

Income tax for Q4 2025 was €56.8 million. This translated into an effective tax rate of 26.7% for the quarter, compared to 26.6% in Q4 2024. Share of non-controlling interests amounted to €11.7 million, mostly correlated with the resilient performance of MTS and Nord Pool.

As a result, the reported net income (share of the parent company shareholders) was stable compared to Q4 2024, at €144.7 million. This represents a reported EPS of €1.42 basic and €1.41 diluted.

Adjusted net income, share of the parent company shareholders, was up 4.2% to €179.6 million. Adjusted EPS (basic) was €1.77 and adjusted EPS (diluted) was €1.75.

In Q4 2025, Euronext reported a net cash flow from operating activities of €85.5 million, compared to €175.0 million in Q4 2024, mainly reflecting the negative impact of working capital from Euronext Clearing and Nord Pool CCP activities in Q4 2025. Excluding the impact of working capital from Euronext Clearing and Nord Pool CCP activities, net cash flow from operating activities accounted for 60.3% of EBITDA in Q4 2025.