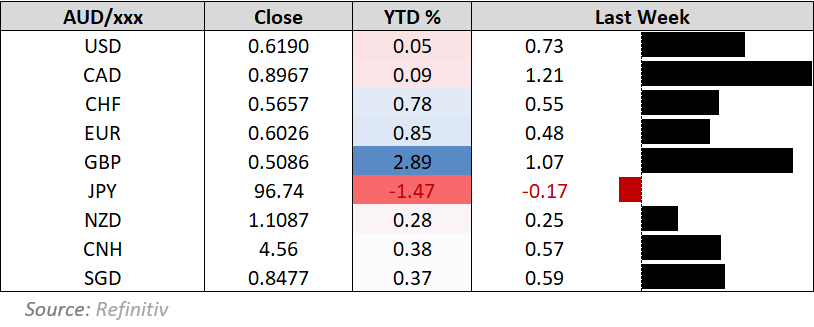

The EUR/USD went into this weekend near the 1.02669 mark, this price remains within the long-term lows for the currency pair as it traverses near values last seen in November 2022. It should be noted that the prices seen in November of 2022 occurred during a bullish move, this after the EUR/USD had touched lows near 0.96300 ratios in September and October of the same year.

Technical traders who do not care about fundamentals can look at the lower values in a few ways. One could be to see the lows and remind themselves the EUR/USD has traded at lower price levels before. Another may be a perception the currency pair has been oversold and will revert to upwards price action at some juncture. The third perception could be a combination of the two – more lows will be seen with an eventual reversal higher. However, fundamentals are playing into the value of the EUR/USD also.

Sentiment and Nervousness Moving Forward with the EUR/USD

Tomorrow’s volume in Forex will likely be lower than normal because U.S financial institutions will be closed because of the MLK Day commemoration. However, the EUR/USD should be watched because sentiment in the currency pair tomorrow may be a barometer regarding the thinking coming from Asia and Europe. Then there is the not so small matter of Donald Trump, who will be sworn in as the 47th President of the United States tomorrow.

The EUR/USD did come off of lows produced last Monday when the 1.01790 vicinity saw price action. However the currency pair did not exactly produce a dynamic avenue of buying in the aftermath of the lows. Closing around the 1.02669 price should not excite speculators quite yet who have visions of a sustained move higher. Nervousness remains abundant in Forex and USD centric strength is unlikely to suddenly vanish over the near-term.

Lack of Volume and the Coming Week for the EUR/USD

Trading last week in the EUR/USD saw plenty of price action below the 1.03000 level. The ability to prove the 1.02000 ratio was vulnerable early on Monday likely caused surprise among many speculators, but it is a clear sign that behavioral sentiment remains fragile. The 1.03000 mark worked as fairly good resistance last week.

- The prospect of the European Central Bank being confronted by the need to cut interest rates further, and a potentially more cautious U.S Federal Reserve not cutting interest rates is a loud warning sign.

- The addition of President Trump into the mix this coming week will provide volatility into Forex.

- Risk management should be conducted acknowledging the potential for different waves of sentiment shifts in Forex this coming week.

- The lack of big European and U.S data will also leave the EUR/USD vulnerable to existing sentiment which remains fragile.

EUR/USD Weekly Outlook:

Speculative price range for EUR/USD is 1.01200 to 1.03400

Traders who do not believe the EUR/USD can move lower should take into consideration that long-term values are hovering within a range that has seen weaker values demonstrated. While it will likely prove correct that the EUR/USD will recover value, timing a sustained reversal upwards remains a guessing game based on factors which remain elusive. The ability of the EUR/USD to puncture the 1.0200 ratio lower early last week should be used as a warning sign.

Tomorrow’s trading while providing insight into the minds of financial institutions in Europe and Asia in Forex, will be met with larger U.S volumes on Tuesday and the potential of reactive trading based on rhetoric generated from Donald Trump’s inauguration speech. While it may seem odd to factor Trump’s speech into the mindset of trading the EUR/USD, short-term sentiment could be affected. The USD has also been strong for over three months and the strength is unlikely to change in the near-term, meaning choppiness should be expected early this week and it would not be surprising to see risk adverse USD buying to continue.

Ready to trade our weekly Forex forecast? Here’s a list of some of the top forex brokers in Europe to check out.