- The EUR/USD currency pair has been declining since the beginning of the week due to risk-off flows, weak September inflation figures in the region, and mixed leading employment indicators in the United States.

- The upcoming ADP non-farm employment change report, which is expected to show a slight rebound in employment for the previous month, may determine the future direction of the US dollar.

- Currently, the EUR/USD is trading around the support level of 1.1030 at the time of writing this analysis.

At the same time, note that renewed tensions in the Middle East are also driving risk-off flows and thus boosting the US dollar as a safe haven recently. Iran launched missile attacks on Israel in response to the killing of two Hezbollah leaders, raising concerns of contagion and consequences for global economic activity. In contrast, there are no major reports due from the Eurozone, so traders may take cues mostly from US reports and overall market sentiment. The escalation of geopolitical tensions could bring further gains to the low-yielding dollar, while easing tensions could see profits taken from recent gains.

According to reliable trading platforms, the euro could come under fresh pressure as the unstable French government prepares to pass a deeply unpopular budget. Recently, the new French prime minister has warned that his government will seek to cut two-thirds of the country’s growing deficit through “spending cuts” as he seeks to get the country’s finances back on track.

Michel Barnier told the French parliament that the goal of reducing the country’s growing deficit to 3% would be postponed to 2029 and that the cuts would be achieved through tax increases and spending cuts. In this regard, Charlotte de Montpellier, a leading economic expert for France and Switzerland, says: “Reaching the 3% target that France promised its European partners in 2027 will require saving 110 billion euros between now and 2027, an effort that has never been made in France (and is almost impossible).” She describes the situation as “explosive.”

The cost of financing French debt has risen sharply in recent weeks amid growing investor concerns, with French bond yields rising above Spanish bond yields for the first time since 2008. Therefore, Forex market analysts warn that these concerns may soon be reflected in the foreign exchange markets through a premium on the euro.

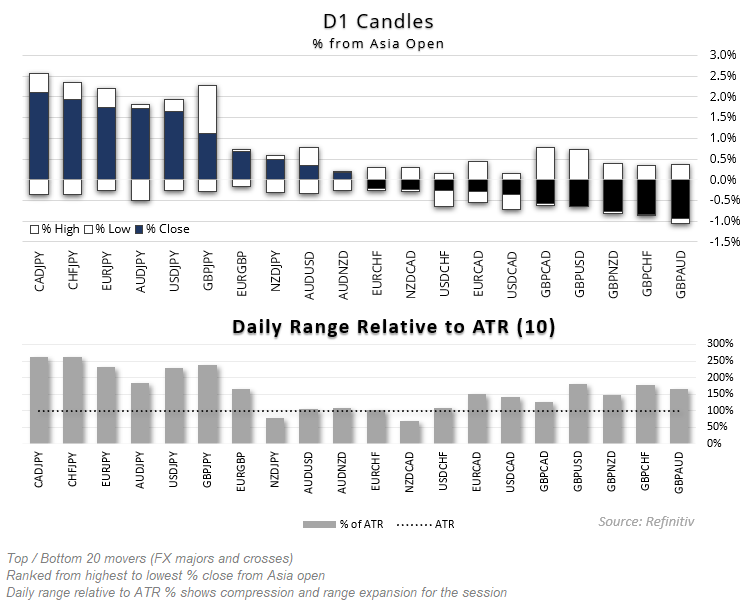

EUR/USD Technical analysis and forecast:

EUR/USD has failed in its last two attempts to break the key psychological resistance level of 1.1200, forming a double top pattern with the neckline at 1.1000. The price is approaching this support area and could be on the verge of breaking lower, which could lead to a decline of the same height as the reversal pattern or 200 pips. At the same time, the 100 SMA is currently above the 200 SMA to reflect bullish momentum, but the gap between the moving averages has narrowed enough to signal a potential bearish crossover. The price is also moving below both technical indicators as an early indicator of selling pressure.

However, Stochastic is pointing to oversold levels, so a turn higher could attract buyers and trigger a bounce from the key psychological level of 1.1000. furthermore, the RSI has a bit more room to move lower before reaching oversold territory to signal exhaustion among sellers. So far, the bearish momentum could remain in place until that happens.

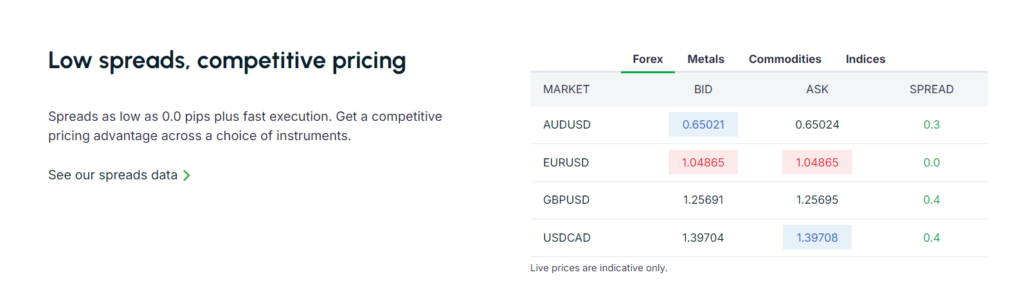

Ready to trade our daily EUR/USD Forex analysis? We’ve made a list of the best forex trading platforms for beginners worth trading with.