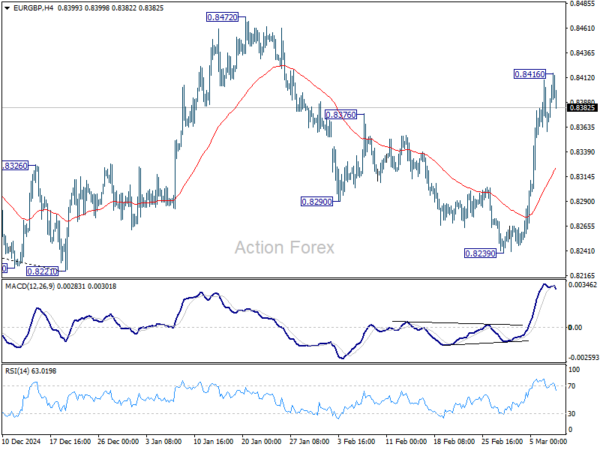

EUR/GBP’s strong rally last week suggest that fall from 0.8472 has completed as a corrective three-wave move down to 0.8239. However, the cross lost momentum after final push to 0.8416. Initial bias is neutral this week for consolidations. Downside should be contained above 55 4H EMA (now at 0.8323) to bring another rise. Break of 0.8416 temporary top will target 0.8472 resistance next.

In the bigger picture, EUR/GBP is still bounded inside medium term falling channel. While rebound from 0.8221 might extend higher, it could still develop into a corrective pattern. Overall outlook will be neutral at best and down trend from 0.9267 (2022 high) could extend, at least until decisive break of channel resistance (now at 0.8511).

In the long term picture, price action from 0.9499 (2020 high) is seen as part of the long term range pattern from 0.9799 (2008 high). Range trading should continue between 0.8201 and 0.9499, until there is clear signal of imminent breakout.