US stock markets suffered another brutal session overnight, with NASDAQ leading the decline, shedding nearly -2%. All three major indexes closed below their respective 55 W EMAs, reinforcing the bearish case that the markets are now in a medium-term correction phase. This technical breakdown suggests that downside momentum is gaining traction, with investors recalibrating their expectations amid escalating economic uncertainty, particularly regarding the relentless stream of tariff threats.

A major driver of the selloff remains the intensifying trade war, which shows no signs of slowing down. Tariff threats are mounting almost daily, as analysts argue that markets have yet to fully price in the potential economic fallout. The momentum of these escalations is expected to persist well into the second quarter, particularly with reciprocal tariffs set to take effect in April.

The European Union has already signaled its intent to retaliate against US tariffs, and similar counter measures would be seen from other countries too. Beyond the EU response, additional tariffs are in the pipeline, targeting China with higher duties, and likely extending to non-border-related tariffs against Canada and Mexico. Japan could also find itself in Washington’s crosshairs, particularly over criticism about its weak currency. The sheer breadth of these tariff initiatives suggests that the market’s current adjustment may just be the beginning of a broader risk-off shift. Investors have just started offloading positions to hedge against further risks.

Meanwhile, despite the turbulence in equities, currency markets have remained relatively steady. So far this week, the Sterling is currently the strongest performer, followed by Euro and Dollar. On the weaker end of the spectrum, Swiss Franc is the worst performer, trailed by Loonie and Aussie. Kiwi and Yen are positioned in the middle. However, almost all major currency pairs and crosses are still trading within last week’s range, suggesting that the forex market is in a consolidation phase.

Looking ahead, today’s key data releases—UK GDP and the University of Michigan consumer sentiment and inflation expectations—will be closely watched. U.S. consumer sentiment has already plunged by -10 points over the past two months, reflecting the growing unease surrounding tariff policies. A further steep decline in sentiment could significantly heighten recession fears and deepen the market’s risk-off mood.

In Asia, at the time of writing, Nikkei is up 0.87%. Hong Kong HSI is up 2.33%. China Shanghai SSE is up 1.71%. Singapre Strait Times is down -0.21%. Japan 10-year JGB yield is down -0.018 at 1.528. Overnight, DOW fell -1.30%. S&P 500 fell -1.39%. NADSAQ fell -1.96%. 10-year yield fell -0.044 to 4.274.

NZ BNZ manufacturing hits 53.9 as recovery gains unexpected momentum

New Zealand’s BusinessNZ Performance of Manufacturing Index rose from 51.7 to 53.9 in February, marking its highest level since August 2022.

This solid improvement was driven by stronger production (52.4) and new orders (51.5), both also reaching their best levels since August 2022. Meanwhile, employment surged to 54.0, climbing 3.2 points from January and hitting its highest level since September 2021.

Despite the stronger data, business sentiment remains cautious. The proportion of negative comments from respondents rose to 59.5% in February, up from 57.7% in January. Many manufacturers cited weak orders and sluggish sales as ongoing challenges, signaling that while expansion has resumed.

BNZ’s Senior Economist Doug Steel welcomed the sustained improvement, noting that “pickup may be a bit faster than we are currently forecasting”.

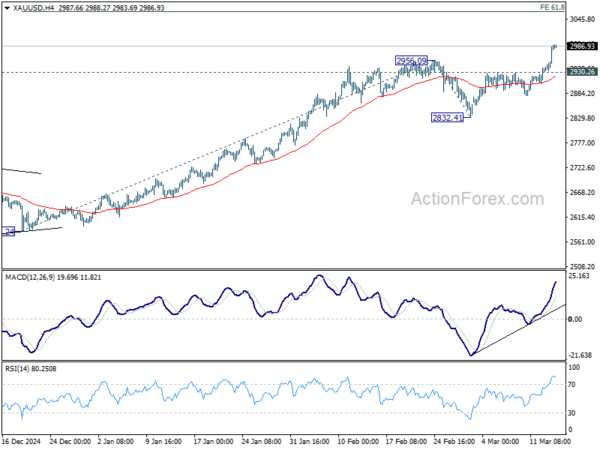

Gold hits record high, approaches 3000 amid ceasefire deadlock

Gold’s up trend resumed overnight and surged to new record highs as the precious metal remains well-supported by escalating global uncertainties. The psychological 3000 level is now in sight as investors flock to the safe-haven asset. The rally is being fueled by multiple factors, including intensifying trade tensions, stalemate in Ukraine-Russia ceasefire negotiations, and the extended broad selloff in US stock markets.

In particular, the latest developments surrounding the ceasefire talks between Russia and Ukraine have kept uncertainty high. Russian President Vladimir Putin stated that he agreed to the US-led ceasefire proposal in principle but stopped short of fully endorsing it.

Putin indicated that further discussions with US President Donald Trump would be necessary to ensure that the ceasefire results in a “long-term peace” and addresses the “root causes” of the conflict. He also expressed skepticism, questioning whether the proposed 30-day ceasefire would be used to “supply weapons” or “train newly mobilized units,” and raised concerns over how violations would be monitored.

Trump, in response, acknowledged that early reports from Russia were “going OK,” but added that “doesn’t mean anything until we hear what the final outcome is.”

With the ceasefire deal still hanging in the balance, geopolitical risks stays high.

Technically, the next near term target for Gold is 61.8% projection of 2584.24 to 2956.09 from 2832.41 at 3062.21.

However, a key test lies ahead in the medium-term rising channel resistance, which has capped price advances since early 2024. Rejection at this level would still maintain gold’s bullish trend but keep its momentum in check.

On the other hand, decisive breakout above the channel resistance would signal acceleration in Gold’s uptrend. In such a scenario, gold could quickly reach 100% projection level at 3204.26.

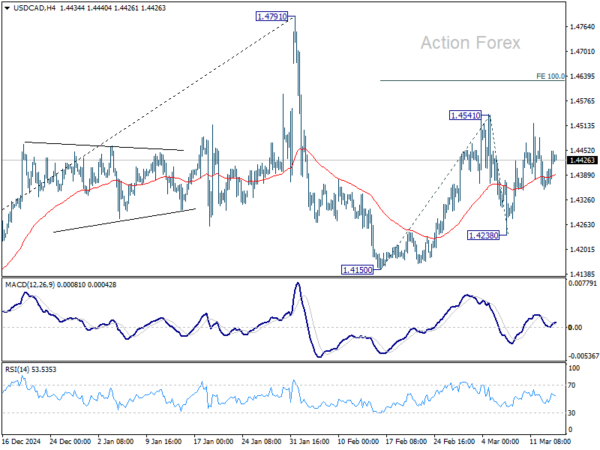

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.4384; (P) 1.4418; (R1) 1.4477; More…

Intraday bias in USD/CAD stays neutral as sideway trading continues. Price actions from 1.4791 high are seen as a corrective pattern, with rebound from 1.4150 as the second leg. On the upside, break of 1.4541 will target 100% projection of 1.4150 to 1.4541 from 1.4238 at 1.4629 and above. But for now, strong resistance is expected from 1.4791 to limit upside to bring the third leg. On the downside, break of 1.4238 will confirm that the third leg has started through 1.4150 support.

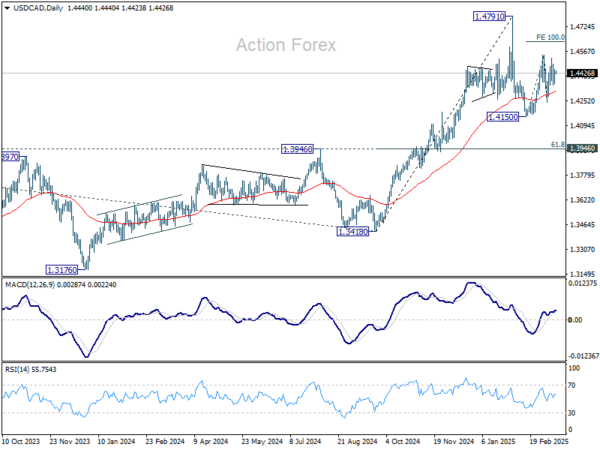

In the bigger picture, long term up trend is tentatively seen as resuming with prior breach of 1.4667/89 key resistance zone (2020/2015 highs). Next target is 100% projection of 1.2401 to 1.3976 from 1.3418 at 1.4993. This will remain the favored case as long as 1.3976 resistance turned support holds (2022 high), even in case of deep pullback.

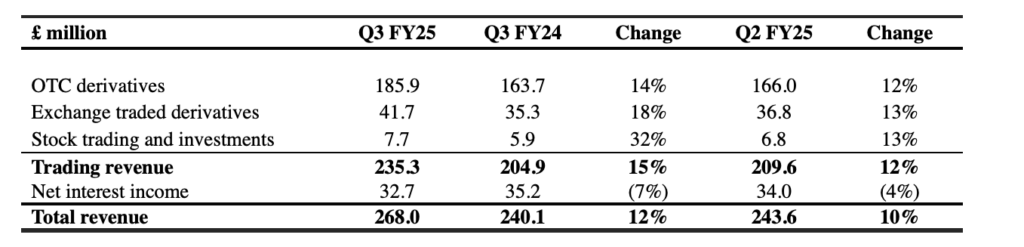

Economic Indicators Update

| GMT | CCY | EVENTS | ACT | F/C | PP | REV |

|---|---|---|---|---|---|---|

| 21:30 | NZD | Business NZ PMI Feb | 53.9 | 51.4 | 51.7 | |

| 07:00 | EUR | Germany CPI M/M Feb F | 0.40% | 0.40% | ||

| 07:00 | EUR | Germany CPI Y/Y Feb F | 2.30% | 2.30% | ||

| 07:00 | GBP | GDP M/M Jan | 0.10% | 0.40% | ||

| 07:00 | GBP | Industrial Production M/M Jan | -0.10% | 0.50% | ||

| 07:00 | GBP | Industrial Production Y/Y Jan | -0.70% | -1.90% | ||

| 07:00 | GBP | Manufacturing Production M/M Jan | 0.00% | 0.70% | ||

| 07:00 | GBP | Manufacturing Production Y/Y Jan | -0.40% | -1.40% | ||

| 07:00 | GBP | Goods Trade Balance (GBP) Jan | -17.1B | -17.4B | ||

| 12:30 | CAD | Manufacturing Sales M/M Jan | 2.00% | 0.30% | ||

| 12:30 | CAD | Wholesale Sales M/M Jan | 1.80% | -0.20% | ||

| 14:00 | USD | UoM Consumer Sentiment Mar P | 63.8 | 64.7 | ||

| 14:00 | USD | UoM Inflation Expectations Mar P | 3.50% |