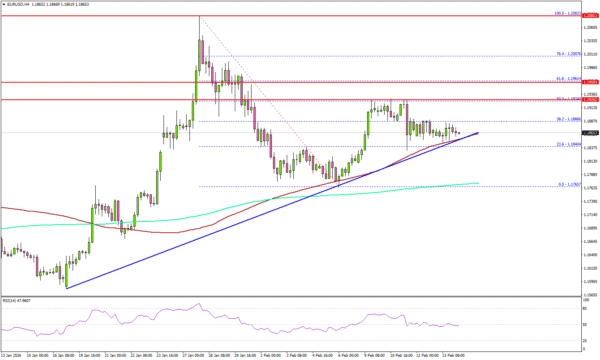

- EURUSD remains prone to consolidation.

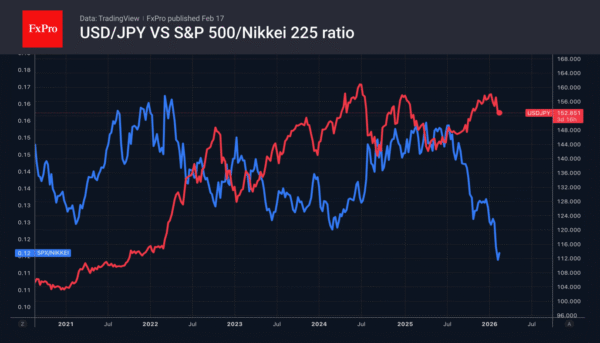

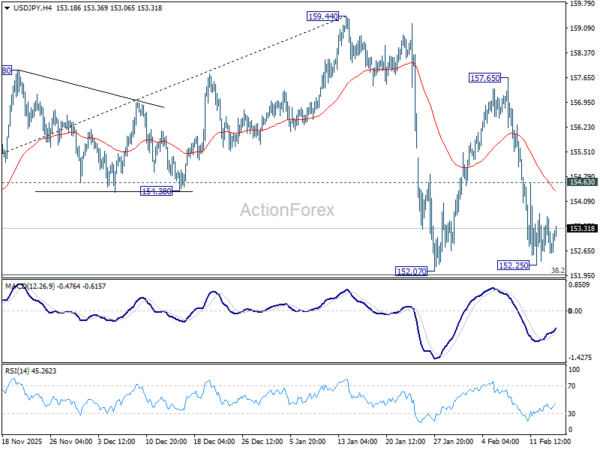

- The yen is strengthening thanks to capital flows.

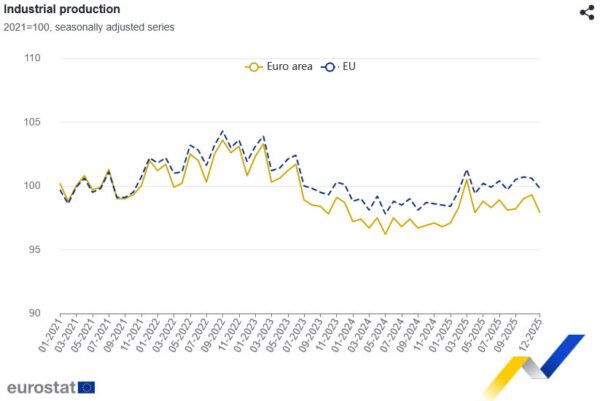

The US markets, closed for Presidents’ Day, brought calm to the Forex market. Traders are not forcing events, awaiting the publication of the January FOMC meeting minutes. This has resulted in EURUSD moving into a narrow trading range. The pair showed no interest in the news that the ECB is ready to offer liquidity to other central banks to prevent tensions in the money markets. This involves an increase in repo operations from the third quarter.

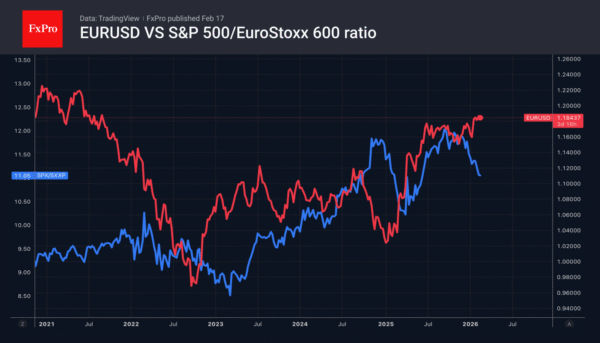

ING believes that the euro’s growing global role is positive for EURUSD. The exchange rate is closely linked to capital flows, and their movement from the US to Europe is good news for the regional currency. Christine Lagarde shares this opinion. According to the Frenchwoman, the general mood is currently in favour of the euro, as money is flowing into the region. The head of the ECB prefers incentives to taxes. Therefore, cheap liquidity will accelerate rotation.

However, in the short term, the US dollar has a counterplay. The longer the Fed pauses in the easing cycle, the wider the rate differential will be. The high attractiveness of US assets will prevent investors from rushing to transfer capital to Europe.

Japan is also scoring points with international investors. According to Kazuo Ueda (BoJ Governor), Sanae Takaichi (Prime Minister) did not make any specific requests that would restrict the activities of the central bank. They discussed economic and financial conditions. If the central bank continues to make decisions independently, political stability will play into the hands of the bears on USDJPY. Investors are trying to understand whether the Prime Minister is pressuring the BoJ to stop raising rates, which also increases debt servicing costs.

Gold is trying to find a balance point, treading water around $5,000 per ounce. According to Jefferies, two main macro factors are supporting the precious metal: the depreciation of the US dollar and high inflation. This allows the company to raise its forecast for the end of the year from $4,200 to $5,000. It notes the high risks of a short-term peak in Gold amid growing fears among traders concerned about the collapse in prices at the end of January.

The situation on the silver market is even worse. Backwardation is intensifying, and futures contracts with distant delivery dates are falling in price. This is usually characteristic of perishable goods such as agricultural products.