Dollar accelerated its broad-based selloff in early US trading, plunging to its lowest level against Euro since 2021. The latest catalyst came from softer-than-expected May PPI data, which followed Wednesday’s downside surprise in CPI. The tandem inflation prints have further calmed fears of immediate tariff-driven price pass-through, at least for now, and are reinforcing expectations that Fed is moving closer to resume policy easing.

As a result, market expectations for Fed easing have firmed up. Fed funds futures are now pricing in an 80% chance of a rate cut in September, up from around 75% just a week ago before the two inflation releases. The tone of both upstream and downstream price measures—despite the tariff backdrop—has strengthened the market’s conviction that Fed will deliver a cut before the fourth quarter, particularly as labor market data has also started to show signs of softening.

Adding to Dollar’s woes is renewed uncertainty over US trade policy. While Treasury Secretary Scott Bessent floated the possibility of extending the current 90-day tariff truce with “good faith” trading partners, President Donald Trump struck a starkly different tone. Trump dismissed the need for any extension and hinted that countries would be unilaterally informed of their new tariff terms in the coming weeks. This reinforces fears that the US may revert to aggressive, one-sided trade actions just as the 90-day tariff truce nears expiration.

In the currency markets, Dollar is clearly the weakest performer of the day, followed by Loonie and Aussie. In contrast, safe-haven demand has lifted Swiss Franc to the top of the board, with Euro and Yen close behind. Euro in particular continues to draw support from a series of ECB officials signaling that the rate-cut cycle is nearing completion. That divergence—between a Fed leaning dovish and an ECB shifting toward a pause—is now starkly reflected in EUR/USD price action.

Sterling and Kiwi are trading in the middle of the pack, with the Pound underperforming its European peers. UK GDP contracted more than expected in April, reinforcing expectations for a BoE rate cut in August. Despite some signs of resilience in the broader three-month growth trend, momentum has clearly slowed, leaving BoE less justification to hold rates elevated for much longer.

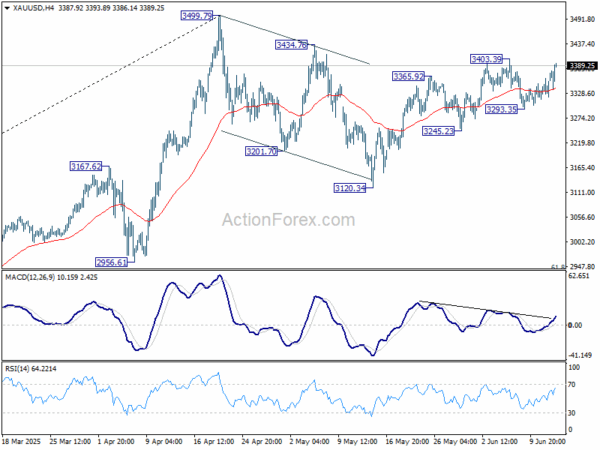

Technically, Gold is also bouncing on Dollar weakness, and focus is back on 3403.49 resistance. Firm break there will resume the rally from 3120.34, and revive the case that correction from 3499.79 high has completed. Further rally should then be seen to retest 3499.79.

In Europe, at the time of writing, FTSE is up 0.18%. DAX is down -0.87%. CAC is down -0.43%. UK 10-year yield is down -0.063 at 4.488. Germany 10-year yield is down -0.059 at 2.478. Earlier in Asia, Nikkei fell -0.65%. Hong Kong HSI fell -1.36%. China Shanghai SSE rose 0.01%. Singapore Strait Times rose 0.08%. Japan 10-year JGB yield fell -0.001 to 1.460.

US initial jobless claims unchanged at 248k, match expectations

US initial jobless claims were unchanged at 248k in the week ended June 7, slightly below expectation of 251k. Four-week moving average of initial claims rose 5k to 240k, highest since August 26, 2023.

Continuing claims rose 54k to 1956k in the week ending May 31, highest sine November 13, 2021. Four-week moving average of continuing claims rose 20k to 1915k, highest since November 27, 2021.

US PPI up 0.1% mom, 2.6% yoy in May

US PPI rose 0.1% mom in May, below expectation of 0.2% mom. PPI services rose 0.1% mom, while PPI goods rose 0.2% mom. PPI less food, energy and trade services rose 0.1% mom.

For the 12 months period, PPI rose from 2.5% yoy to 2.6% yoy, matched expectations. PPI less food, energy and trade services rose 2.7% yoy.

ECB Schnabel: Monetary easing nears end as Europe embraces stronger Euro and fiscal support

ECB Executive Board Member Isabel Schnabel signaled today that the central bank’s monetary easing cycle is “coming to an end,” citing stable medium-term inflation forecasts and improving macroeconomic conditions.

Speaking with notable confidence, Schnabel downplayed the expected dip in inflation—projected at just 1.6% in 2026—as a “temporary deviation” caused by energy base effects and a stronger euro.

Schnabel painted a relatively constructive picture of the Eurozone economy, stating that growth remains “broadly stable” even as global trade tensions intensify. Private consumption continues to provide a key pillar of support, while both manufacturing and construction sectors are showing signs of recovery. She also highlighted that “Additional defense and infrastructure spending counteract tariff shock on growth”.

In her view, these structural shifts, combined with a resilient Euro and outperforming equity markets, reflect a “new European growth narrative” that could elevate the region’s economic standing.

Still, Schnabel acknowledged the risks posed by escalating trade tensions, particularly in the form of inflation volatility and financial market uncertainty. She warned that tariffs can be amplified through global value chains, posing upside risks to inflation. At the same time weaponisation of raw materials threatens to further strain supply chains.

ECB Villeroy and Šimkus emphasize flexibility as policy hits neutral zone

Comments from two ECB Governing Council members today reinforced a cautious stance as the easing cycle appears to have reached a natural pause, following eight consecutive rate cuts.

French member Francois Villeroy de Galhau emphasized flexibility, telling Franceinfo radio that future policy will depend on how inflation evolves, stressing a preference for “pragmatism and agility.”

Lithuanian member Gediminas Šimkus echoed a similar tone, stating that policy has now reached a “neutral level”. It is critical for ECB to maintain the freedom, “not to commit to one direction or another”. He warned of growing uncertainty, particularly around upcoming US trade decisions as the 90-day tariff truce nears expiry on July 9.

UK GDP contracts -0.3% mom in April, as services drag

The UK economy contracted -0.3% mom in April, a sharper decline than the expected -0.1%. The main drag came from the services sector, which fell -0.4% mom and contributed most to the monthly GDP drop. Production also shrank -0.6% mom. In contrast, construction provided a rare bright spot, rising 0.9% mom, though not enough to offset broader weakness.

Despite the poor April print, the broader picture remains more constructive. GDP expanded 0.7% in the three months to April compared to the prior three-month period, with services up 0.6%, production up 1.1%, and construction up 0.5%.

Japanese business confidence sours amid tariff fears and profit warnings

Business sentiment in Japan deteriorated sharply in Q2, with the Ministry of Finance’s survey revealing a broad-based loss of confidence across industries.

The overall index for large firms slipped into negative territory at -1.09, down from Q1’s modest 2.0. Large manufacturers saw sentiment weaken further from -2.4 to -4.8, while large non-manufacturers experienced a steep drop from 5.2 to -5.7, suggesting that economic uncertainty is spreading beyond export-heavy sectors.

The survey also highlighted a growing sense of earnings pessimism. Large manufacturers now expect recurring profits to decline -1.2% in the fiscal year ending March 2026, a downgrade from the -0.6% fall seen in the previous survey. Particularly alarming is the auto sector’s outlook, with automakers and parts suppliers projecting a severe -19.8% drop in profits.

This highlights the mounting concern over the impact of steep US tariffs, which threaten to hit Japan’s flagship export industry hard and weigh on broader economic momentum.

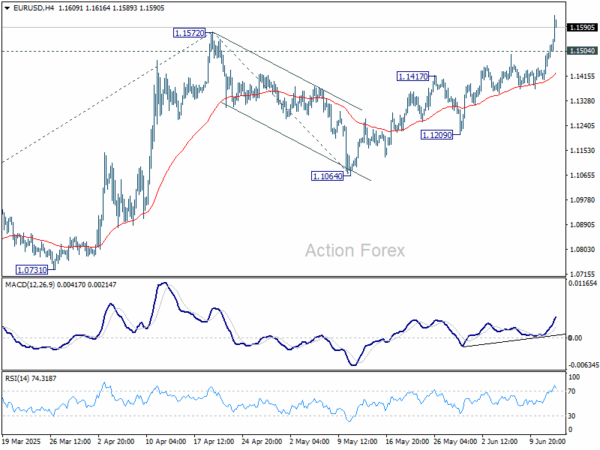

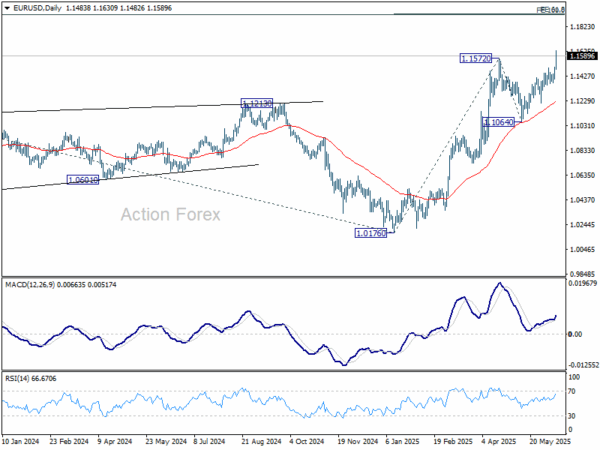

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1429; (P) 1.1465; (R1) 1.1524; More…

EUR/USD’s rally from 1.0176 resumed by accelerating through 1.1572 resistance. Intraday bias stays on the upside at this point. Next target is 61.8% projection of 1.0176 to 1.1572 from 1.1064 at 1.1927. On the downside, below 1.1504 minor support will turn intraday bias neutral and bring consolidations first, before staging another rise.

In the bigger picture, rise from 0.9534 long term bottom could be correcting the multi-decade downtrend or the start of a long term up trend. In either case, further rise should be seen to 100% projection of 0.9534 to 1.1274 from 1.0176 at 1.1916. This will now remain the favored case as long as 1.1604 support holds.

Economic Indicators Update

| GMT | CCY | EVENTS | ACT | F/C | PP | REV |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS Housing Price Balance May | -8% | -3% | -3% | |

| 23:50 | JPY | BSI Large Manufacturing Index Q2 | -4.8 | 0.8 | -2.4 | |

| 01:00 | AUD | Consumer Inflation Expectations Jun | 5.00% | 4.10% | ||

| 06:00 | GBP | GDP M/M Apr | -0.30% | -0.10% | 0.20% | |

| 06:00 | GBP | Industrial Production M/M Apr | -0.60% | -0.40% | -0.70% | |

| 06:00 | GBP | Industrial Production Y/Y Apr | -0.30% | -0.20% | -0.70% | |

| 06:00 | GBP | Manufacturing Production M/M Apr | -0.90% | -0.80% | -0.80% | |

| 06:00 | GBP | Manufacturing Production Y/Y Apr | 0.40% | 0.40% | -0.80% | |

| 06:00 | GBP | Goods Trade Balance (GBP) Apr | -23.2B | -20.8B | -19.9B | |

| 12:30 | USD | PPI M/M May | 0.10% | 0.20% | -0.50% | -0.20% |

| 12:30 | USD | PPI Y/Y May | 2.60% | 2.60% | 2.40% | 2.50% |

| 12:30 | USD | PPI Core M/M May | 0.10% | 0.30% | -0.40% | -0.20% |

| 12:30 | USD | PPI Core Y/Y May | 3.00% | 3.00% | 3.10% | 3.20% |

| 12:30 | USD | Initial Jobless Claims (Jun 6) | 248K | 251K | 247K | 248K |

| 14:30 | USD | Natural Gas Storage | 108B | 122B |