Headlines:

- China announces tariffs of 34% on all US goods in retaliation

- Risk-off flows intensify ahead of US trading

- Traders are now pricing more than 50% chance of a fifth cut by year-end

- AUD hit the hardest amid the risk-off flows

- Gold picks itself back up as the trade war rhetoric escalates

- Oil sinks to lowest in almost two years

- What is the distribution of forecasts for the US NFP?

- Germany February industrial orders 0.0% vs +3.5% m/m expected

- Germany March construction PMI 40.3 vs 41.2 prior

- UK March construction PMI 46.4 vs 46.0 expected

Markets:

- CHF leads, AUD lags on the day

- DAX down 4.7%, CAC 40 down 4.2%; S&P 500 futures down 3.5%

- US 10-year yields down 15 bps to 3.895%

- Gold flat at $3,112.34

- WTI crude down 8.3% to $61.02

- Bitcoin down 0.3% to $82,128

Markets were already staying on the defensive in European morning trade before China decided to retaliate by announcing additional tariffs of 34% on all US goods. That sees the trade war escalate to the next level and fears of a major hit to the global economy reverberated across markets.

That led to intense risk selling across the board, deepening the market rout from yesterday.

S&P 500 futures were already down nearly 1% before extending losses to well over 3% now. Meanwhile, 10-year Treasury yields plunged lower to under 3.90% while USD/JPY took a tumble from 146.30 to a low of 144.54 during the session. The pair is still down 0.8% to 144.90 currently.

As China retaliated, the aussie is one of the biggest losers with AUD/USD now down some 3.6% on the day to test waters below 0.6100. The low earlier hit 0.6050, which was the lowest since the Covid pandemic during March 2020. That comes as traders are now pricing in rate cuts by the RBA for each of the next three policy meetings.

Staying on FX, the Swiss franc remains one of the biggest beneficiaries with USD/CHF marked down by 1.1% to 0.8490 on the day. This comes as European stocks are absolutely ripped to shreds with the DAX down by almost 5% and CAC 40 down by over 4% currently.

In the commodities space, there was also plenty of action to note. Gold was struggling very early on before catching strong bids after China’s retaliation in pushing up from $3,090 to a high of $3,136. The precious metal is giving back gains though as volatile trading continues in the precious metals space. I talked about some of that earlier here.

Then, we also had oil absolutely crater with WTI crude dropping from $66 at the start of the session to near $61 now. That’s the lowest that oil has traded in four years as concerns about a trade war and its impact on global growth hits.

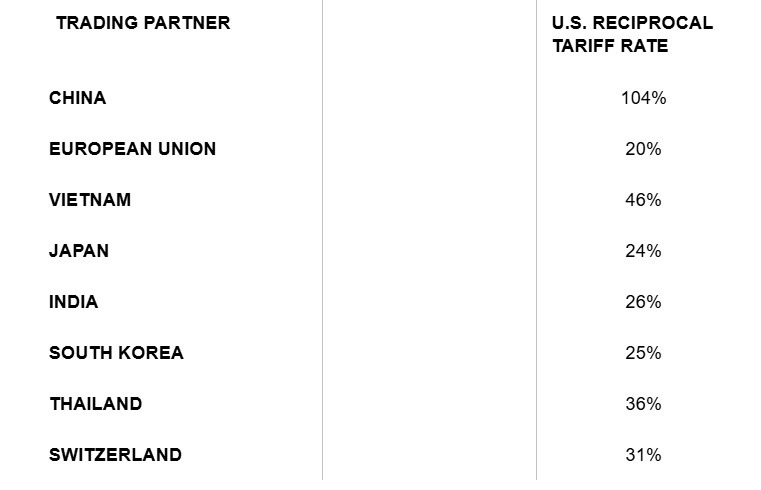

All that said and done, it is best to be reminded that Trump’s reciprocal tariffs will only go into effect on 9 April. And China’s counter-tariffs are to only go into effect on 10 April. There is still time for both sides to negotiate and tone down the rhetoric. That’s the key thing to be aware of in my view.

But for now, emotions are running high in markets and that is what is driving trading sentiment. It’s no time to be catching the falling knife.

Coming up, we’ll still have the US jobs report and Fed chair Powell’s speech to deal with. Don’t underestimate either. A bad set of labour market numbers will only serve to heighten recession risks and a lack of clarity support from Powell could do the same as well.

There’s still much more volatility to deal with before the weekend comes along. Be safe and have a good one, everybody.