My previous BTC/USD signal on 9th February was not triggered.

Today’s BTC/USD Signals

- Risk 0.50% per trade.

- Trades may only be entered before 5pm Tokyo time Tuesday.

Long Trade Ideas

- Go long after a bullish price action reversal on the H1 timeframe following the next touch of $66,773, $65,786, $61,229, or $59,401.

- Place the stop loss $100 below the local swing low.

- Adjust the stop loss to break even once the trade is $100 in profit by price.

- Take off 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to ride.

Short Trade Ideas

- Go short after a bullish price action reversal on the H1 timeframe following the next touch of $69,323, $71,762, or $81,203.

- Place the stop loss $100 above the local swing high.

- Adjust the stop loss to break even once the trade is $100 in profit by price.

- Take off 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

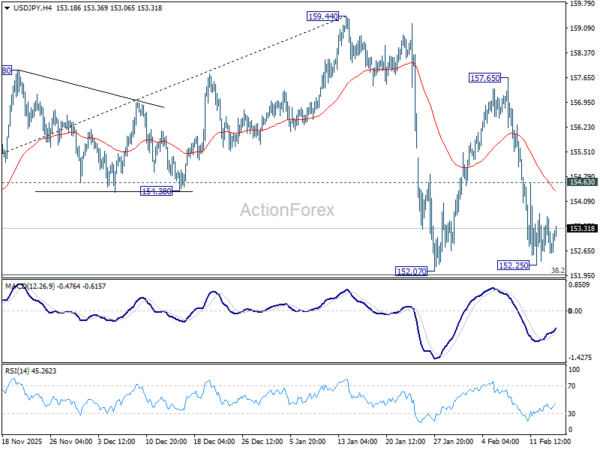

BTC/USD Analysis

In my last BTC/USD forecast exactly one week ago, I thought that the resistance level at $71,762 firmly containing the price was likely to be pivotal and decisive.

This was a good call as the resistance level has held since then, in fact, the level has not even been tested.

The price has just been consolidating below this resistance level over the pas week. There is another key level below it at $69,323 and the price is also below that, which makes the outlook a little more bearish. However, on the bullish side, we have seen a halt to the bearish momentum and a reasonably deep bullish retracement. When you also consider that Bitcoin tends to find long-term buyers after it makes steep falls, it starts to look as if the downwards move might be over.

Despite these bullish factors, Bitcoin and crypto generally has been acting unhealthily for several months so, so I would not rule out a further fall.

I will look to the pivotal level at $71,762:

- A bullish breakout beyond this will likely produce a move higher to at least $81,203.

- A clear failed test and bearish reversal could be an excellent entry signal for a short trade.

There is nothing of high importance due today regarding either Bitcoin or the US Dollar.

Ready to trade our free Forex signals? Here is our list of the best MT4 crypto brokers worth checking out.