GBPUSD continues to find resistance at the 100 weekly SMA, where it has formed a bearish reversing chart pattern.

Visited 1 times, 1 visit(s) today

T-Mobile is about to launch its new satellite phone service powered by Starlink. Dubbed T-Satellite, the network will officially start serving customers on July 23, but if you want a sneak peek right now, it’s easy to apply and take Starlink for a smartphone test drive. In December 2024, T-Mobile launched a beta program that’s available to

Nothing has a new flagship phone – say hello to the Nothing Phone (3). The freshly announced Phone (3) arrives nearly two years after the Phone (2), and there are plenty of differentiating factors between the two. Let’s start with the back, since it’s always been a key area on Nothing devices. Phone (3) brings

“The Glyph interface is not a gimmick,” Nothing founder and CEO Carl Pei told the press as he revealed the Nothing Phone 3 for the first time, shortly before announcing that its new iteration lets you play Spin the Bottle on the back of the phone. It’s mixed messaging, but in Nothing’s defense, you couldn’t

Though new strains of coronavirus are going around, most establishments have lifted mask mandates and aren’t planning to bring them back. Today, we explore how this has been impacting coffee workers. BY MELINA DEVONEYBARISTA MAGAZINE ONLINE Featured photo by Getty Images Lara* is a server at a busy high-end restaurant in Los Angeles. She continued

The Nothing Phone (3) is one of the most anticipated phones of the year and it brings a bold redesign alongside several generational spec upgrades. The Glyph Interface has evolved into the Glyph Matrix – a monochrome LED display located at the top left corner of the phone’s back. Comprised of 489 individually lit

In a short press release Realme promised to be among the first to deliver Android 16 to its flagship lineup. Of course, it’s no surprise that the GT 7 series will be the first phones from Realme’s portfolio to get the latest and greatest from Google. The Realme GT 7 Pro with Snapdragon 8 Elite,

Mobile Phone Insurance Ecosystem Market Introduction: The Mobile Phone Insurance Ecosystem Market is experiencing significant growth, fueled by the increasing sophistication and value of mobile devices, coupled with a heightened consumer awareness of potential risks. The market’s expansion is driven by several key factors, including the rising cost of smartphones, the increasing reliance on mobile

Google is expected to unveil the Pixel 10 series next month, and although the Mountain View-based internet search giant hasn’t divulged any details about the lineup yet, CAD-based renders that leaked in March revealed what the Pixel 10 series smartphones would look like. The same source has now shared specs of the Google Pixel 10

The Sage Luxe Brewer Thermal is a drip coffee maker that brews hot or cold You can also customize your coffee by fine-tuning brewing options It’s available now direct from Sage for £249.95 Sage, maker of some of the best espresso machines I’ve tested this year, has just launched a new filter coffee maker that

RedMagic’s Tablet 3 Pro launched in China last month, and it’s now ready to take on global markets. Now called the RedMagic Astra Gaming Tablet, this is every bit the compact tablet beast that its Chinese counterpart is. The tablet is built around a 9.06-inch display with uniform 4.9mm bezels. The panel is outstanding –

Originally announced back at CES, Baseus is now bringing its Enercore line of chargers and power banks globally. These come in several sizes with multiple ports, up to 100W charging speeds and max out at 20,000mAh capacities. They also share one common killer feature – retractable USB-C cables. Enercore CJ11 is the most compact offering

Today we are taking a look at the new OnePlus Nord CE5, the second phone launching next week alongside the Nord 5. We have already taken a look at the Nord 5 in a separate post and now it’s time to unbox the Nord CE5. For those unaware, the Nord series goes Nord > Nord

Today we have with us the new OnePlus Nord 5, which is the latest mainline entry in the company’s affordable series of smartphones. The phone is set to launch next week alongside the Nord CE5 and today we can share a sneak peek at the device with an unboxing. Starting with the packaging, the Nord

Apple may be looking to change more than the camera islands on its iPhone 17 Pro series as leakster Majin Bu is now confident that the Apple logo on the back is getting repositioned. The logo on the 17 Pro series would be positioned lower, and Apple is apparently also changing the placement of its

BBC Head teacher Louise Cowley took the decision to introduce a blanket ban over concerns smartphones were too disruptive A secondary school has banned smartphones for Year 7 to 11 pupils and will only allow basic “brick” phones from September. Oxford Spires Academy’s head teacher said the move would create a “calmer, more focused environment”.

vivo recently teased the launch of the X200 FE in India, and now the brand has announced the X Fold5 is “coming soon” to the country. vivo hasn’t revealed the launch date of the X Fold5 or the X200 FE in India, but we’ve learned from a reliable source that both smartphones will launch in

Introduction Last year Infinix launched the Xpad tablet with mid-range specs at an incredibly affordable price. This year, the slate is getting a more powerful big brother aimed at gaming and streaming – the Infinix Xpad GT. The Infinix Xpad GT brings a 13.0-inch LCD screen with 2,880 x 1,840 pixels, 10-bit color depth, 144Hz

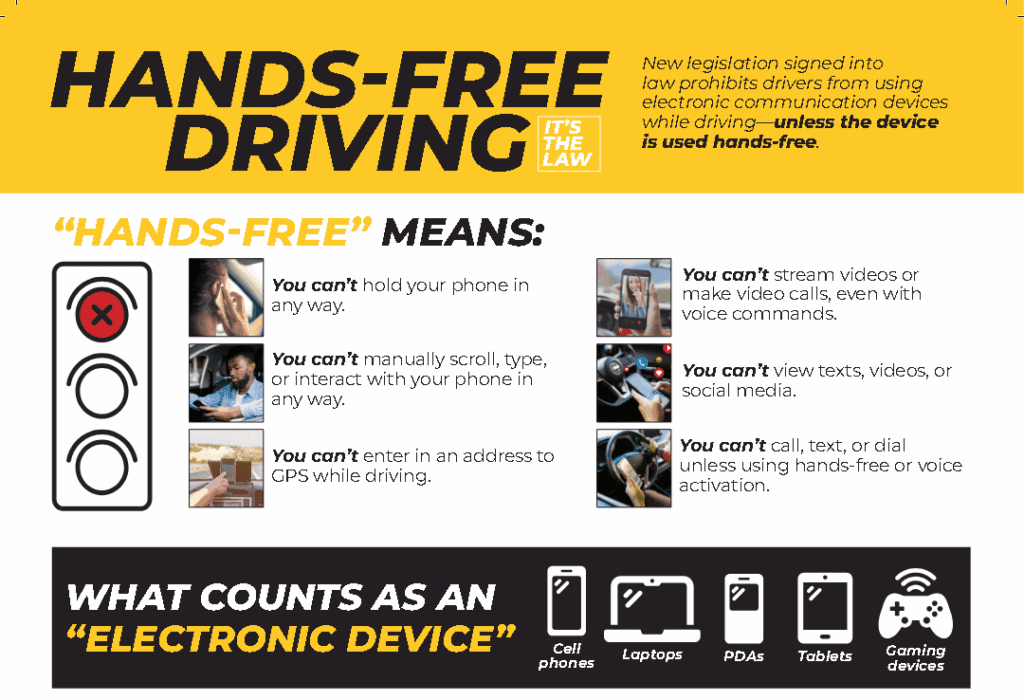

The latest local, regional and national news events of the day are presented by the ABC 6 News Team, along with updated sports, weather and traffic. (ABC 6 News) – Drivers in Iowa should be ready to make some habit changes as a a new law banning all cell phone use while driving goes into

A YouTuber signed up for Trump Mobile and documented the process He struggled for days to get it to work What he found out about the plan, especially its limitations, may surprise you It’ll be months before the Trump Mobile T1 phone, which is apparently not made in America, arrives in the US, but the

Photo: Unsplash // Adam AY PARK CITY, Utah — Starting this fall, all students in grades 6 through 12 in the Park City School District will be required to secure their cell phones in Yondr pouches during the school day. The policy will go into effect at Ecker Hill Middle School and Park City High