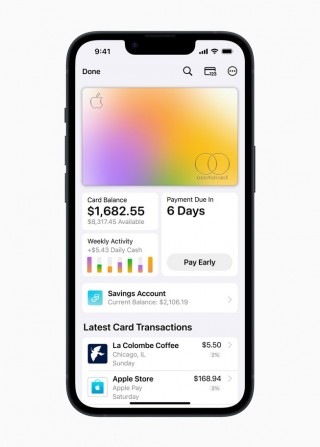

Apple Card is a banking service for Apple users in the United States. It has a Savings feature, allowing customers to earn interest on cashback deals, and the rate was 4.15% when introduced.

The rate changed several times over time – in March, it was 3.75%, and today, it is reduced to 3.65%, its lowest since the service was introduced.

The interest rate matches that Goldman Sachs offers through its savings account. Apple is the main partner for this banking service.

The 3.65% percentage was adjusted based on overall economic conditions, and while it is lower than before, it is still drastically higher than the national average interest rate in the United States (the Average Percentage Yield, or APY, is 0.59%).

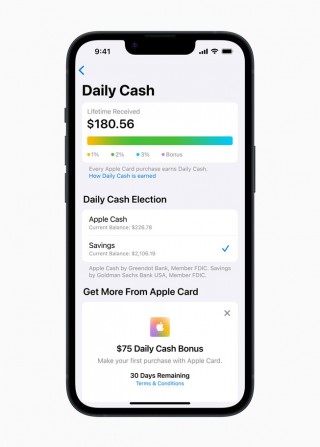

APY is the total rate of return for an interest-bearing account over a one-year period. For Apple customers, the sum is accumulated through cashback programs—1% on all purchases, 2% if they are through Apple Pay, 3% on the Apple Store, and partners like Uber or T-Mobile.

These funds are returned to the Daily Cash account, but they can be transferred to the Savings account, where they’ll earn interest over time. The interest is compounded daily, meaning the money grows every day if the user is patient enough.