The stock market has been on an unstoppable run lately, with the S&P 500 (^GSPC +0.56%) soaring by nearly 74% in the last five years, as of this writing. However, many investors are feeling nervous about what lies ahead for the market. This is a valid concern, given that multiple stock market metrics are sounding the alarm.

The S&P 500 Shiller CAPE Ratio, for example, is the highest it’s ever been since the dot-com bubble burst in the early 2000s. Similarly, the Buffett indicator — popularized by Warren Buffett — currently sits at around 222%. Buffett himself has noted that when this metric nears 200%, investors are “playing with fire.”

Both the Shiller CAPE Ratio and the Buffett indicator are used to determine market valuations. While no stock market metrics are foolproof, both ratios reaching record highs suggests that the market could be overvalued and due for a correction. However, history has two pieces of great news for investors.

Image source: Getty Images.

1. Investing could become much more affordable

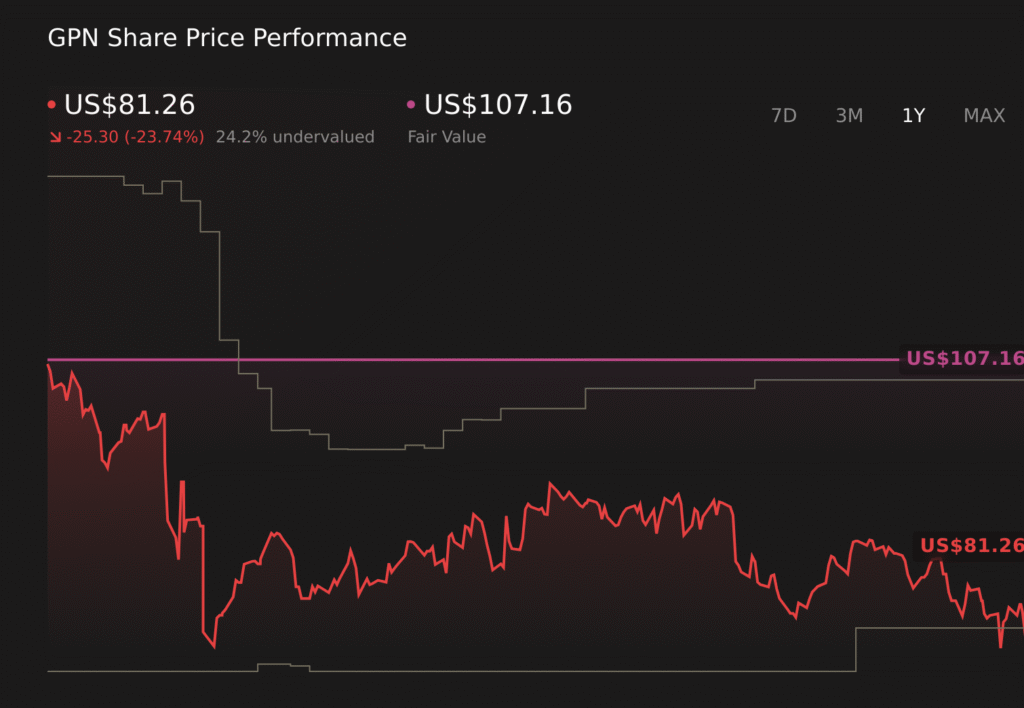

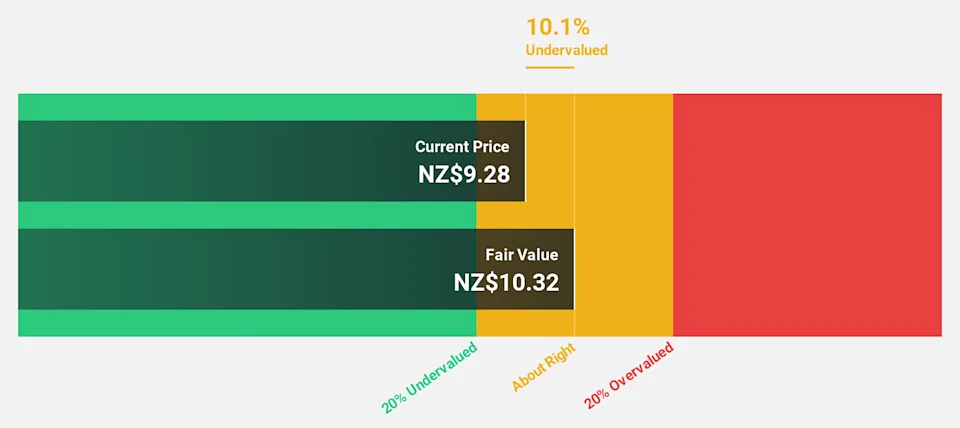

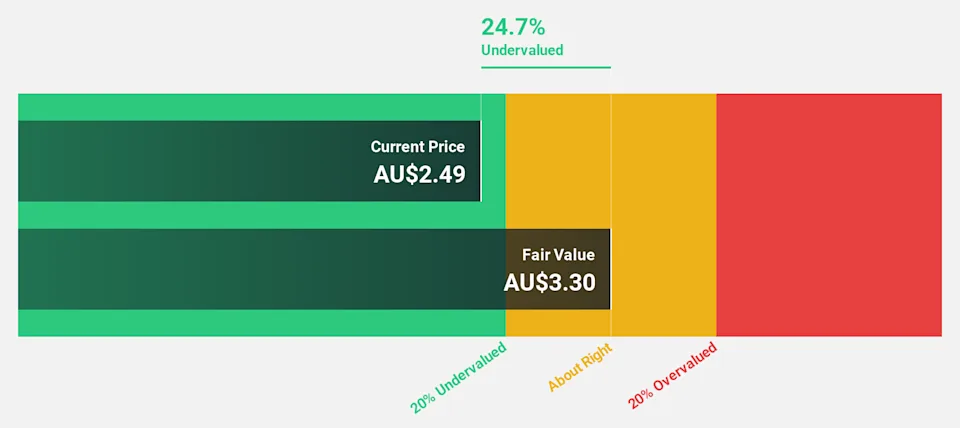

One drawback of a surging stock market is that it’s an incredibly expensive time to invest. Many stocks are consistently reaching record highs, and investors are paying much steeper prices now than even a year ago.

While market downturns aren’t necessarily a good thing, the silver lining is that they can give investors’ wallets a reprieve from the high prices. Nobody knows when the next pullback will begin, but right now is a fantastic time to start planning where you want to buy if prices dip.

It can be challenging sometimes to differentiate strong stocks from weak ones during a downturn, as even healthy companies can be hit hard by bear markets. By researching stocks and building a wish list ahead of time, you’ll be well-prepared to load up on quality investments at discounted prices.

2. The market’s long-term outlook is promising

If history can tell us one thing about the future, it’s that the market can survive nearly anything.

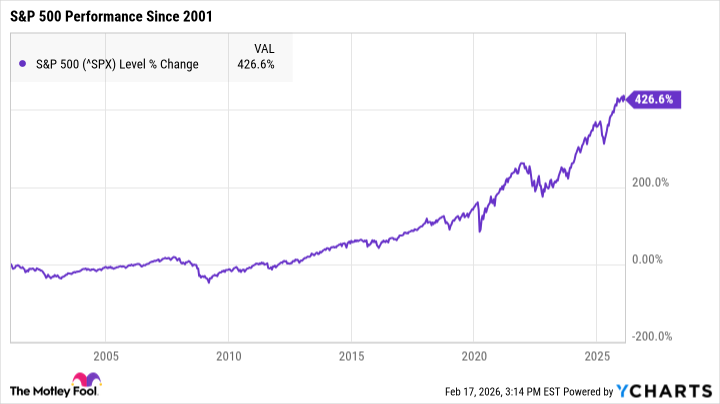

In the last two decades alone, we’ve experienced multiple record-setting downturns — from the dot-com bubble burst (leading to one of the longest bear markets in U.S. history) to the Great Recession (the longest and deepest economic downturn post-WWII) to the crash triggered by the COVID-19 pandemic (the fastest market crash on record).

That said, the market has also experienced unprecedented growth in that time, with the S&P 500 surging by nearly 427% in the last 25 years. In other words, if you’d invested $5,000 in February 2001 and made no additional contributions, you’d have more than $26,000 by today.

With a long-term outlook and the right investments, you’re all but guaranteed to see positive total returns over time. It may take months or even years for stocks to recover from a severe recession or bear market, but history proves time and time again that the market can bounce back from nearly anything.

Downturns can be daunting, especially when nobody knows when the next one will begin or how severe it might be. But by loading up on quality stocks and holding them for at least a few years, your portfolio is far more likely to survive whatever the market throws at it.