Nvidia CEO Jensen Huang delivers a keynote address at the Consumer Electronics Show (CES) in Las Vegas in January.

Patrick T. Fallon/AFP via Getty Images

hide caption

toggle caption

Patrick T. Fallon/AFP via Getty Images

Perhaps nobody embodies artificial intelligence mania quite like Jensen Huang, the chief executive of chip behemoth Nvidia, which has seen its value spike 300% in the last two years.

A frothy time for Huang, to be sure, which makes it all the more understandable why his first statement to investors on a recent earnings call was an attempt to deflate bubble fears.

“There’s been a lot of talk about an AI bubble,” he told shareholders. “From our vantage point, we see something very different.”

Take in the AI bubble discourse and something becomes clear: Those who have the most to gain from artificial intelligence spending never slowing are proclaiming that critics who fret about an over-hyped investment frenzy have it all wrong.

“I don’t think this is the beginning of a bust cycle,” White House AI czar and venture capitalist David Sacks said on his podcast All-In. “I think that we’re in a boom. We’re in an investment super-cycle.”

White House AI adviser David Sacks speaks onstage during The Bitcoin Conference at The Venetian Las Vegas in January.

Ian Maule/AFP via Getty Images

hide caption

toggle caption

Ian Maule/AFP via Getty Images

“The idea that we’re going to have a demand problem five years from now, to me, seems quite absurd,” said prominent Silicon Valley investor Ben Horowitz, adding: “if you look at demand and supply and what’s going on and multiples against growth, it doesn’t look like a bubble at all to me.”

Appearing on CNBC, JPMorgan Chase executive Mary Callahan Erdoes said calling the amount of money rushing into AI right now a bubble is “a crazy concept,” declaring that “we are on the precipice of a major, major revolution in a way that companies operate.”

Yet a look under the hood of what’s really going on right now in the AI industry is enough to deliver serious doubt, said Paul Kedrosky, a venture capitalist who is now a research fellow at MIT’s Institute for the Digital Economy.

He said there is a startling amount of capital pouring into a “revolution” that remains mostly speculative.

“The technology is very useful, but the pace at which it is improving has more or less ground to a halt,” Kedrosky said. “So the notion that the revolution continues with the same drum beat playing for the next five years is sadly mistaken.”

The huge infusion of cash

The gusher of money is rushing in at a rate that is stunning to financial experts.

Take OpenAI, the ChatGPT maker that set off the AI race in late 2022. Its CEO Sam Altman has said the company is making $20 billion in revenue a year, and it plans to spend $1.4 trillion on data centers over the next eight years. That growth, of course, would rely on ever-ballooning sales from more and more people and businesses purchasing its AI services.

There is reason to be skeptical. A growing body of research indicates most firms are not seeing chatbots affect their bottom lines, and just 3% of people pay for AI, according to one analysis.

“These models are being hyped up, and we’re investing more than we should,” said Daron Acemoglu, an economist at MIT, who was awarded the 2024 Nobel Memorial Prize in Economic Sciences.

“I have no doubt that there will be AI technologies that will come out in the next ten years that will add real value and add to productivity, but much of what we hear from the industry now is exaggeration,” he said.

Nonetheless, Amazon, Google, Meta and Microsoft are set to collectively sink around $400 billion on AI this year, mostly for funding data centers. Some of the companies are set to devote about 50% of their current cash flow to data center construction.

Or to put it another way: every iPhone user on earth would have to pay more than $250 to pay for that amount of spending. “That’s not going to happen,” Kedrosky said.

To avoid burning up too much of its cash on hand, big Silicon Valley companies, like Meta and Oracle, are tapping private equity and debt to finance the industry’s data center building spree.

Paving the AI future with debt and other risky financing

One assessment, from Goldman Sachs analysts, found that hyperscaler companies — tech firms that have massive cloud and computing capacities — have taken on $121 billion in debt over the past year, a more than 300% uptick from the industry’s typical debt load.

Analyst Gil Luria of the D.A. Davidson investment firm, who has been tracking Big Tech’s data center boom, said some of the financial maneuvers Silicon Valley is making are structured to keep the appearance of debt off of balance sheets, using what’s known as “special purpose vehicles.”

An aerial view of a 33 megawatt data center with closed-loop cooling system in Vernon, California.

Mario Tama/Getty Images

hide caption

toggle caption

Mario Tama/Getty Images

The tech firm makes an investment in the data center, outside investors put up most of the cash, then the special purpose vehicle borrows money to buy the chips that are inside the data centers. The tech company gets the benefit of the increased computing capacity but it doesn’t weigh down the company’s balance sheet with debt.

For example, a special purpose vehicle was recently funded by Wall Street firm Blue Owl Capital and Meta for a data center in Louisiana.

The design of the deal is complicated but it goes something like this: Blue Owl took out a loan for $27 billion for the data center. That debt is backed up by Meta’s payments for leasing the facility. Meta essentially has a mortgage on the data center. Meta owns 20% of the entity but gets all of the computing power the data center generates. Because of the financial structure of the deal, the $27 billion loan never shows up on Meta’s balance sheet. If the AI bubble bursts and the data center goes dark, Meta will be on the hook to make a multi-billion-dollar payment to Blue Owl for the value of the data center.

Such financial arrangements, according to Luria, have something of a checkered past.

“The term special purpose vehicle came to consciousness about 25 years ago with a little company called Enron,” said Luria, referring to the energy company that collapsed in 2001. “What’s different now is companies are not hiding it. But having said that, it’s not something we should be leaning on to build our future.”

Enormous spending hinging on returns that could be a fantasy

Silicon Valley is taking on all this new debt with the assumption that massive new revenues from AI will cover the tab. But again, there is reason for doubt.

Morgan Stanley analysts estimate that Big Tech companies will dish out about $3 trillion on AI infrastructure through 2028, with their own cash flows covering only half of that.

“If the market for artificial intelligence were even to steady in its growth, pretty quickly we will have over-built capacity, and the debt will be worthless, and the financial institutions will lose money,” Luria said.

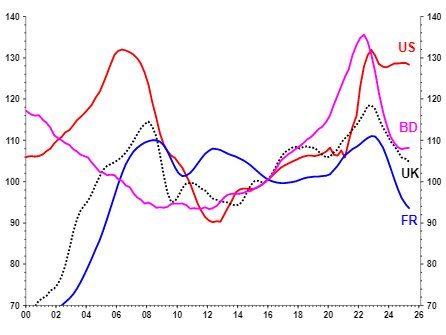

Twenty-five years ago, the original dot-com bubble burst after, among other factors, debt financing built out fiber-optic cables for a future that had not yet arrived, said Luria, a lesson, it appears, tech companies are not worried about repeating.

“If we get to the point after spending hundreds of billions of dollars on data centers that we don’t need a few years from now, then we’re talking about another financial crisis,” he said.

Circular deals raise even more concern

Another aspect of the over-heated AI landscape that is raising eyebrows is the circular nature of investments.

Take a recent $100 billion deal between Nvidia and OpenAI.

Nvidia will pump that amount into OpenAI to bankroll data centers. OpenAI will then fill those facilities with Nvidia’s chips. Some analysts say this structure, where Nvidia is essentially subsidizing one of its biggest customers, artificially inflates actual demand for AI.

“The idea is I’m Nvidia and I want OpenAI to buy more of my chips, so I give them money to do it,” Kedrosky said. “It’s fairly common at a small scale, but it’s unusual to see it in the tens and hundreds of billions of dollars,” noting that the last time it was prevalent was during the dot-com bubble.

Open AI CEO Sam Altman speaks during Snowflake Summit 2025 at Moscone Center in June.

Justin Sullivan/Getty Images

hide caption

toggle caption

Justin Sullivan/Getty Images

Lesser-known companies are getting in on the action, too.

CoreWeave, once a crypto mining startup, pivoted to data center building to ride the AI boom. Major AI companies are turning to CoreWeave to train and run their AI models.

OpenAI has entered deals with CoreWeave worth tens of billions of dollars in which CoreWeave’s chip capacity in data centers is rented out to OpenAI in exchange for stock in CoreWeave, and OpenAI, in turn, could use that stock to pay its CoreWeave renting fees.

Nvidia, meanwhile, which also owns part of CoreWeave, has a deal guaranteeing that Nvidia will gobble up any unused data center capacity through 2032.

“The danger,” said the MIT economist Acemoglu,”is that these kinds of deals eventually reveal a house of cards.”

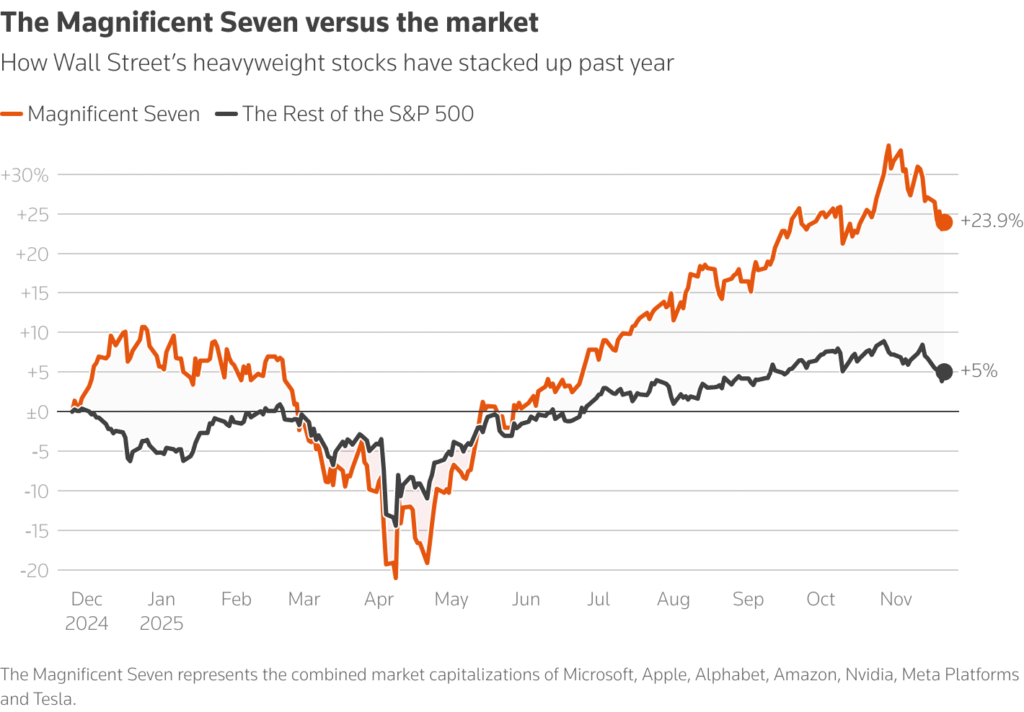

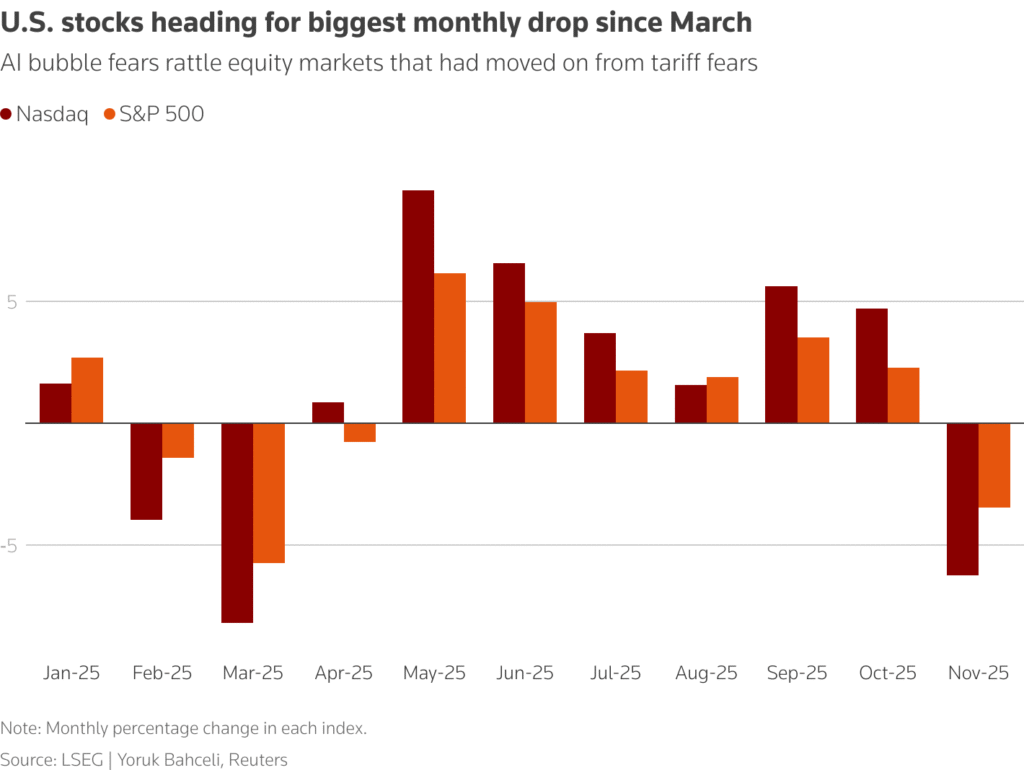

Some high profile investors see bubble-popping on the horizon

Some influential investors are showing signs of bubble jitters.

Tech billionaire Peter Thiel sold off his entire stake in Nvidia worth around $100 million earlier this month. That came after SoftBank sold a nearly $6 billion stake in Nvidia.

And in recent weeks, AI bubble pessimists have rallied around Michael Burry, the hedge-fund investor who made hundreds of millions of dollars betting against the housing market in 2008. He was the subject of the 2015 film The Big Short. Since then, though, he’s had a mixed reputation for market predictions, having warned about imminent collapses that never came to pass.

For what it’s worth, Burry is now betting against Nvidia, accusing the AI industry of hiding behind a bunch of fancy accounting tricks. He’s homed in the circular deals between companies.

“True end demand is ridiculously small. Almost all customers are funded by their dealers,” Burry wrote on X. He later wrote: “OpenAI is the linchpin here. Can anyone name their auditor?”

As tech companies sink billions into data centers, some executives themselves are freely admitting there looks to be some over exuberance.

OpenAI CEO Sam Altman told reporters in August: “Are we in a phase where investors as a whole are overexcited about AI? My opinion is yes. Is AI the most important thing to happen in a very long time? My opinion is also yes.”

And Google chief executive Sundar Pichai told the BBC recently that “there are elements of irrationality” in the AI market right now.

Asked how Google would fare if the bubble burst, Pichai responded: “I think no company is going to be immune, including us.”