- Trade tensions ebb and flow. Markets cheered the news President Trump and his Chinese counterpart Xi agreed to further talks on tariffs and rare earth minerals, while the US Treasury avoids labeling China a currency manipulator.

- The same can’t be said for Switzerland though, which is now included on the US Treasury’s FX monitoring list, complicating Swiss National Bank (SNB) policies.

- Trading blows. A dramatic and public fallout between President Trump and Tesla CEO Elon Musk sent Tesla shares tumbling 14%, weighing on wider equity markets this week and containing risk appetite globally.

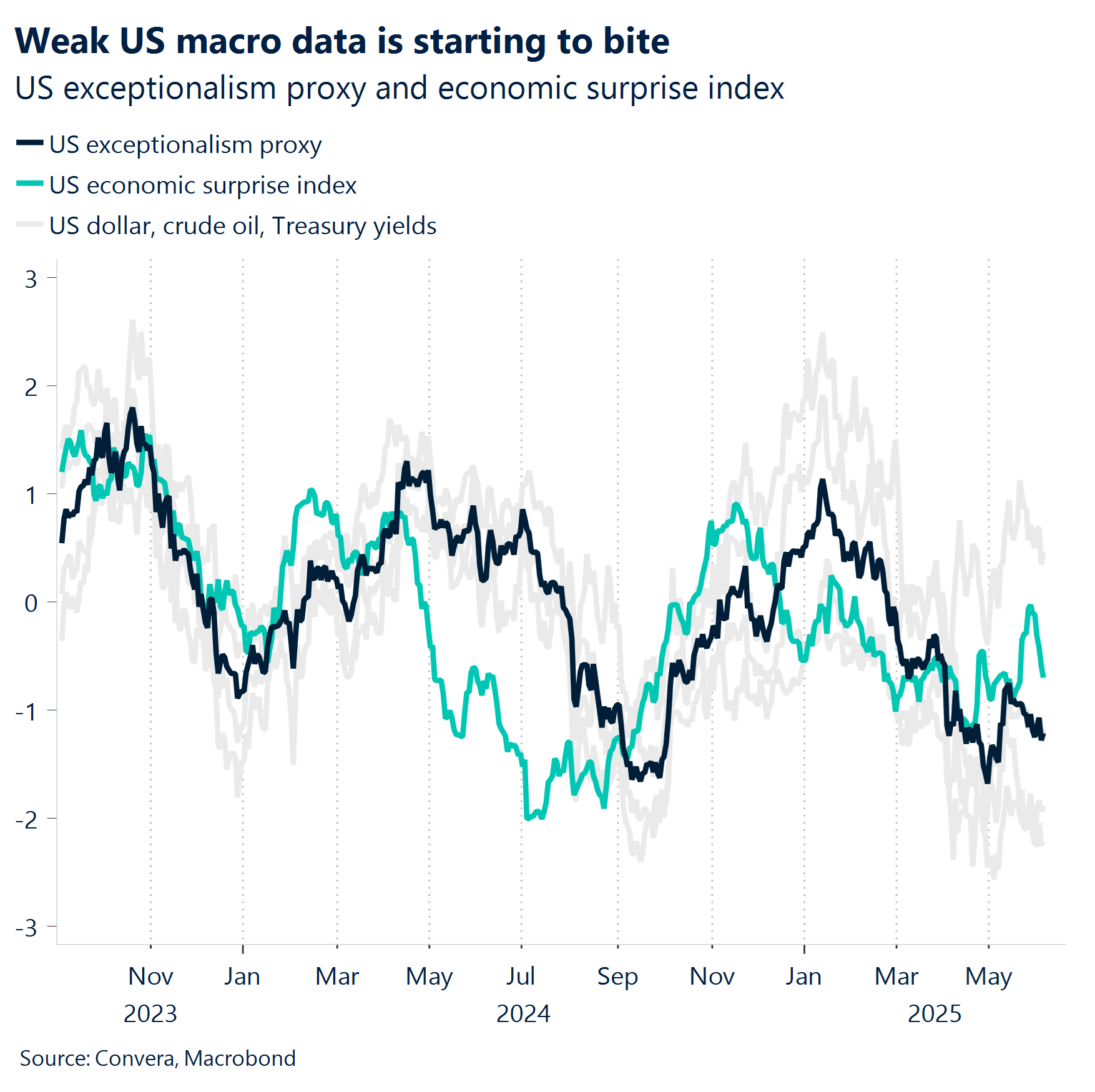

- Shifting focus to macro data. Tariff fatigue is setting in, bringing US economic fundamentals back into the spotlight. De-dollarization may finally have a macro trigger, as weaker US data and accelerated Fed rate cut expectations challenge dollar stability.

- Monetary policy. Meanwhile, indications that other central banks may be nearing the end of easing cycles could put further pressure on the buck, with the BoC holding rates steady and the ECB cutting rates to 2%, but signaling this rate is appropriate for navigating ongoing economic uncertainty.

- FX focus. EUR/USD jumped to a 6-week high near $1.15, but like GBP/USD’s climb to over 3-year highs above $1.36, the positive momentum waned and both pairs reversed course from their peaks.

- Market positioning already reflects broad skepticism toward the dollar, so the scale of additional bearish shifts may be constrained in the short term.

Global Macro

Stagflation worries reignite

Central Banks action. No surprises from the Bank of Canada (BoC) and the European Central Bank (ECB). The BoC held rates steady at 2.75% for a second straight meeting after seven consecutive cuts. Uncertainty remains the theme, just as it was in the April meeting. The ECB cut rates as expected, but Lagarde stated that policymakers are approaching the end of the monetary policy cycle, as the current rate is deemed appropriate for navigating ongoing economic uncertainty.

Mixed job data. ADP private sector hiring in May came in at just 37K its lowest level since March 2023. Jobless claims rose by 8K to 247K, the highest since October, with Kentucky accounting for most of the increase (5,5K claims). The four-week moving average ticked up to 235K from 227K, and Kentucky’s reliance on the distilling industry, which faces trade retaliation, may be contributing to reported layoffs in whiskey production. Two-month Non-Farm-Payroll revised lower by -95K, but May actual comes at 139K, higher than expected. Unemployment rate stays at 4.2%, participation rate still solid.

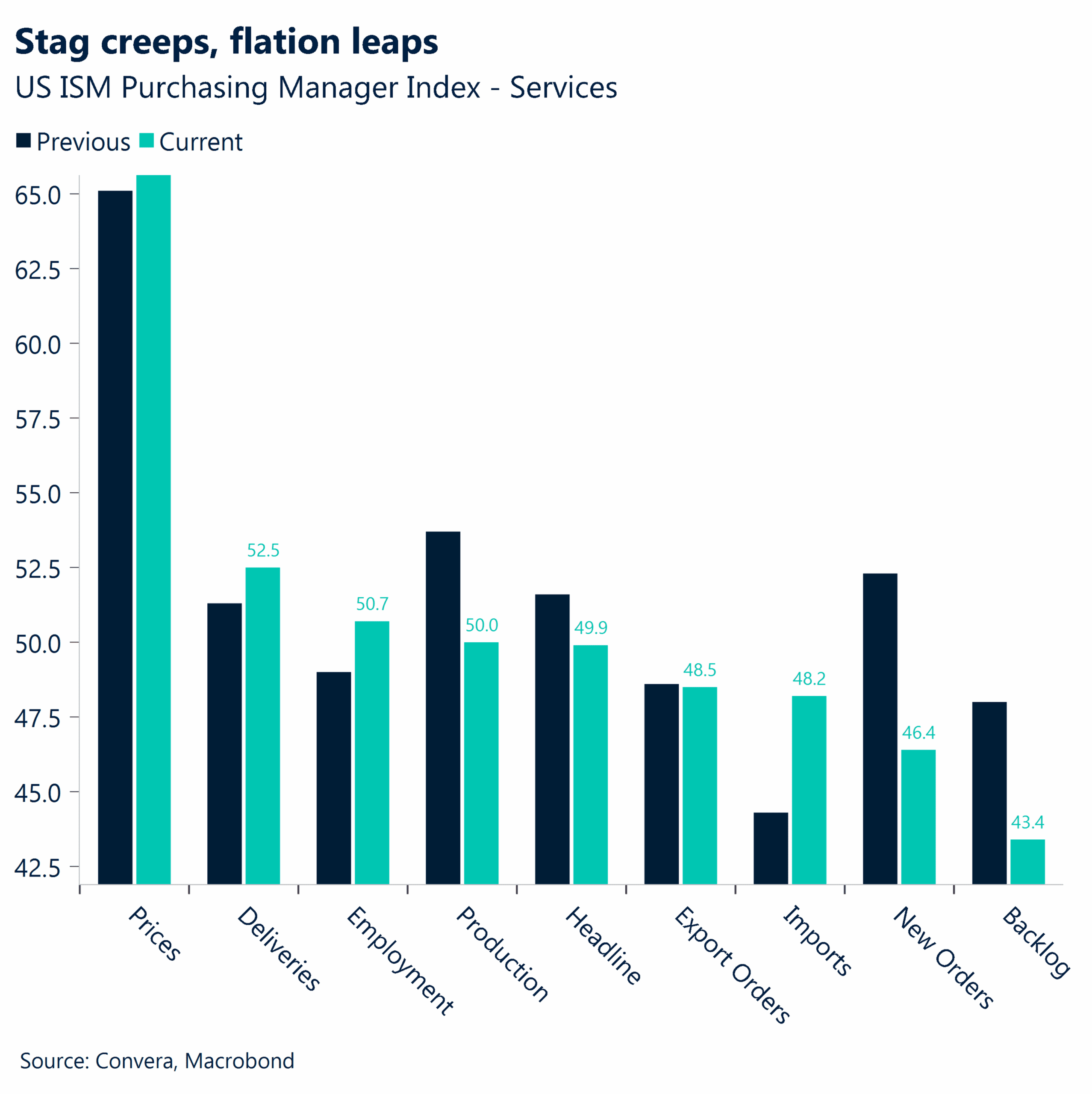

Stag creeps, flation leaps. ISM services PMI slipped to 49.9, falling short of the expected 52, with new orders plunging to 46.4 from 52.3 the previous month. On the cost front, inflationary pressures intensified as the prices paid index climbed to 68.7, reaching levels last seen during the final stretch of the post-pandemic supply chain disruptions.

Tariffs & trade. The hike in steel and aluminum tariffs from 25% to 50% took effect on June 4, yet markets have largely tuned out concerns about US policy throughout the week. Global trade is steady, but US West Coast freight volumes show decline. Key indicators have rebounded but remain below recent peaks. April’s sharp US import drop likely corrects pre-tariff inflation, while Chinese and Korean exports to the US also fell.

Week ahead

Diverging price pressures

- Germany CPI. If prints come in softer than consensus for Europe’s largest economy, it will reinforce the emerging deflationary narrative across the euro area.

- Eurozone trade balance will show whether external demand is rescuing the eurozone’s growth trajectory as domestic consumption cools. A wider surplus would bolster hopes that net exports can offset slowing internal demand, whereas a narrowing gap would heighten ECB officials’ concerns about the broader economic outlook given lingering trade‐war uncertainties (e.g., U.S. tariffs).

- US CPI figures for May will be scrutinized for signs of persistent price pressures. If core inflation stays stubborn, it may prompt markets to push back expectations of an easing cycle beyond the June 18 FOMC meeting.

- US PPI figures. Any upside surprise could signal that input costs are still being passed through, sustaining broader inflationary trends. In an environment where the Fed is nearing a decision on whether to pause or pivot, a hotter PPI print would likely reinforce a more cautious Fed stance, keeping US Treasury yields elevated and US equities under pressure.

- UK labour market report. Wage growth is expected to remain robust at around 5–6% year‑on‑year, continuing to outpace inflation and reinforcing the Bank of England’s reluctance to cut rates.

FX Views

Focus flips to fundamentals

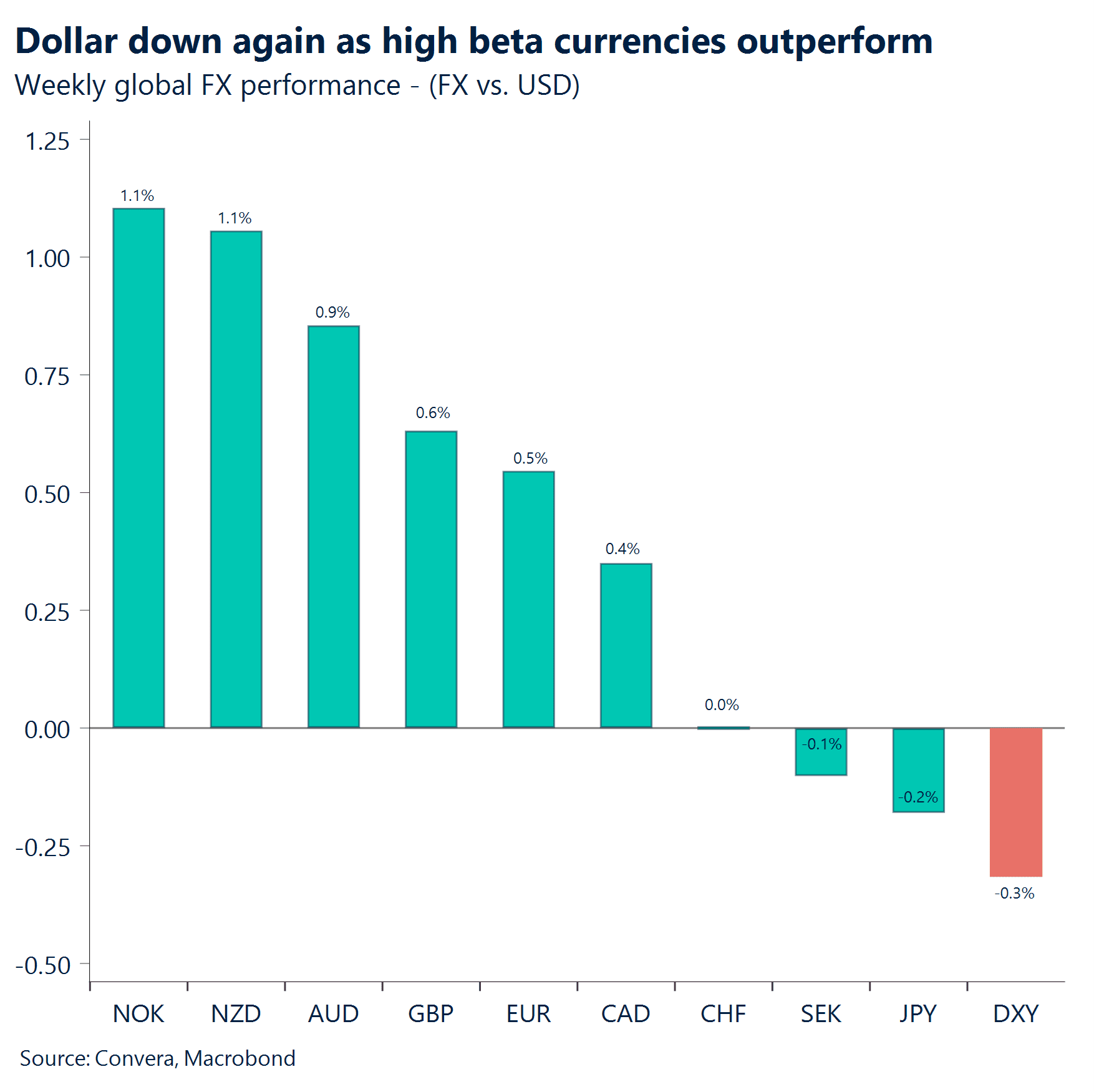

USD Dropping on data deluge. The US dollar remains under selling pressure with standout losses endured against high beta peers such as the NZD (-1.2%) and NOK (-1.1%) this week. The dollar’s recent weakness is beginning to look less like a temporary positioning adjustment and more like a clear signal of shifting macroeconomic sentiment. Market participants are reacting to mounting evidence that the US economy is losing momentum, reinforcing expectations that the Fed may need to cut rates sooner than officials have suggested, which could trigger another leg lower for the dollar. Moreover, the evolving US fiscal backdrop remains a key factor, amplifying doubts about the dollar’s stability as well as section 899 of Trump’s tax bill – a policy that reduces foreign investors’ returns on US holdings which would likely dampen capital inflows, further driving away foreign investors from US assets. That said, market positioning already reflects broad skepticism toward the dollar, so the scale of additional bearish shifts may be constrained.

EUR Hawkish surprise lifts the euro. The euro fluctuated around the $1.14 handle early in the week before gaining momentum, fueled by a hawkish Lagarde, who signaled that the rate-cutting cycle is nearing its end. With the ECB’s rate cut and soft Eurozone CPI largely priced by markets, any significant bearish impact on the euro was muted. Instead, disappointing US data, particularly forward-looking indicators like PMIs, added to uncertainty driven by trade tensions, supporting the euro’s gains, which remain highly sensitive to US trade developments. With key trade deadlines approaching, the euro’s trajectory will remain largely trade-driven—any positive trade news favoring the US could apply downward pressure on the common currency.

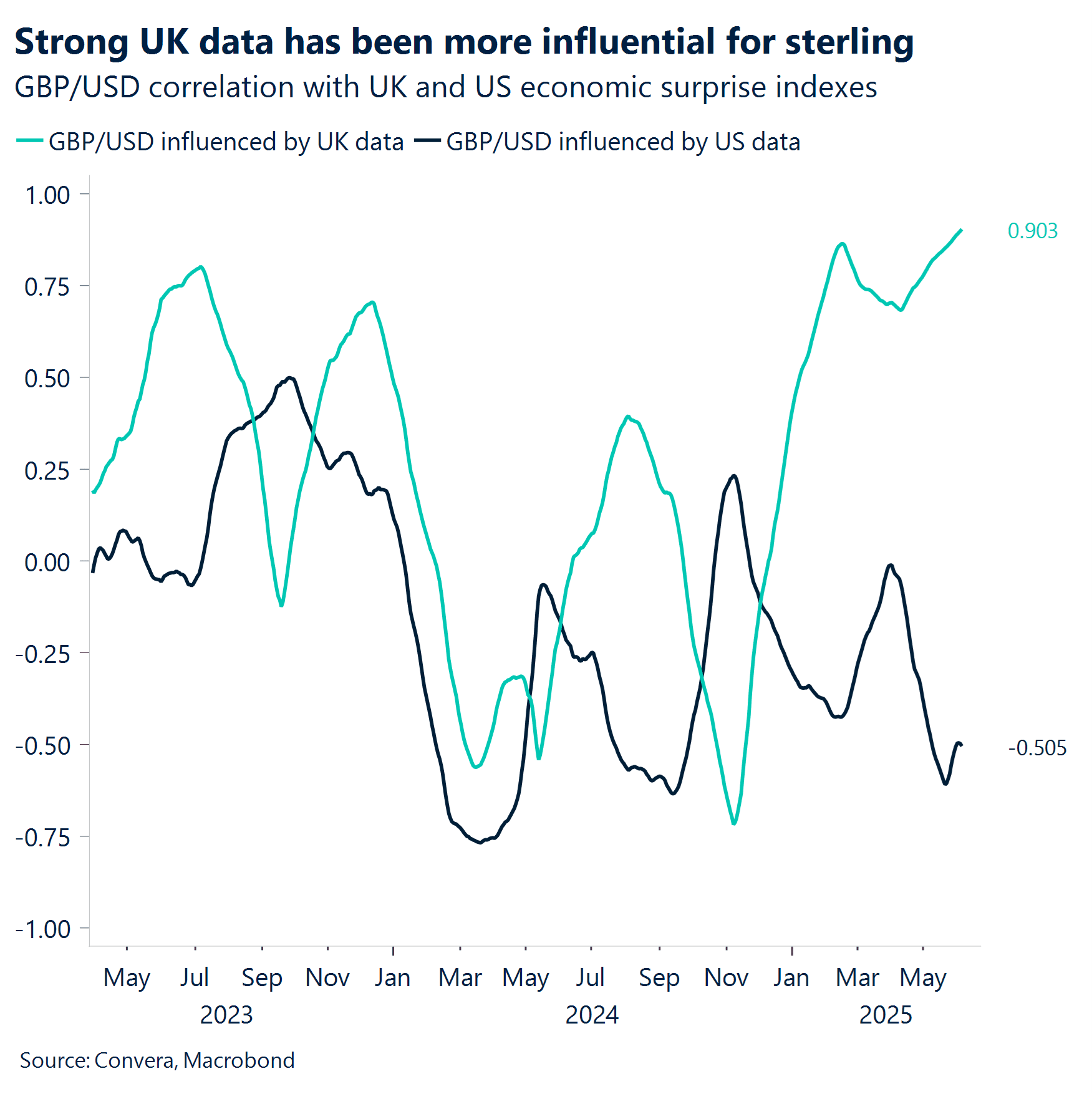

GBP Fleeting spike to 40-month high. The pound briefly spiked to its highest level since February 2022, finally breaking through the $1.36 resistance barrier – a level GBP/USD has only been above for 14% of the post-Brexit period. The move was triggered by a string of weak US data but recent UK data has consistently exceeded expectations too. This has helped GBP/USD’s over 8% rise year-to-date as the pair closely tracks the UK-US economic surprise differential. The six-month correlation coefficient is nearing its highest level in a decade and is more a reflection of strong UK data as opposed to weak US data. Thus, any deterioration in UK fundamentals, or a sharp rebound in US data, could temper upside potential for the pound, with $1.36 proving a tough threshold to hold above. Indeed, renewed risk aversion prompted the pair to reverse course sharply back towards $1.35. As sterling is approaching overbought conditions via the 14-day relative strength index, the upside potential in the short-term could be limited. Traders are also trimming their expectations on further gains in the British pound, according to options-market pricing. Key UK labour market figures will be closely watched on Tuesday for signs of easing wage pressures, which could influence rate expectations and thus the pound.

CHF Risk sentiment vs. monetary policy. After four monthly gains on the trot, the Swiss franc has started June still stronger versus the dollar, with USD/CHF dipping below 0.82 this week. Ongoing global economic uncertainty and de-dollarization trends have boosted traditional safe havens this year with the franc rising almost 10% vs. the dollar. Still, as we’ve flagged several times, a strong franc poses a problem for the Swiss National Bank (SNB), reducing the cost of imported goods and dragging headline back into negative territory. As such, markets are pricing a near 50% chance of a jumbo rate cut later this month with a return to negative interest rates by year-end increasingly likely. However, stronger-than-expected GDP growth complicates the picture, potentially reducing the urgency for aggressive SNB easing. If growth remains solid, the franc could stay supported, particularly as global uncertainty drives safe-haven demand. Indeed, if the de-dollarization theme persists and risk sentiment remains fragile, the franc’s safe-haven appeal could even counterbalance any SNB-driven downside risks.

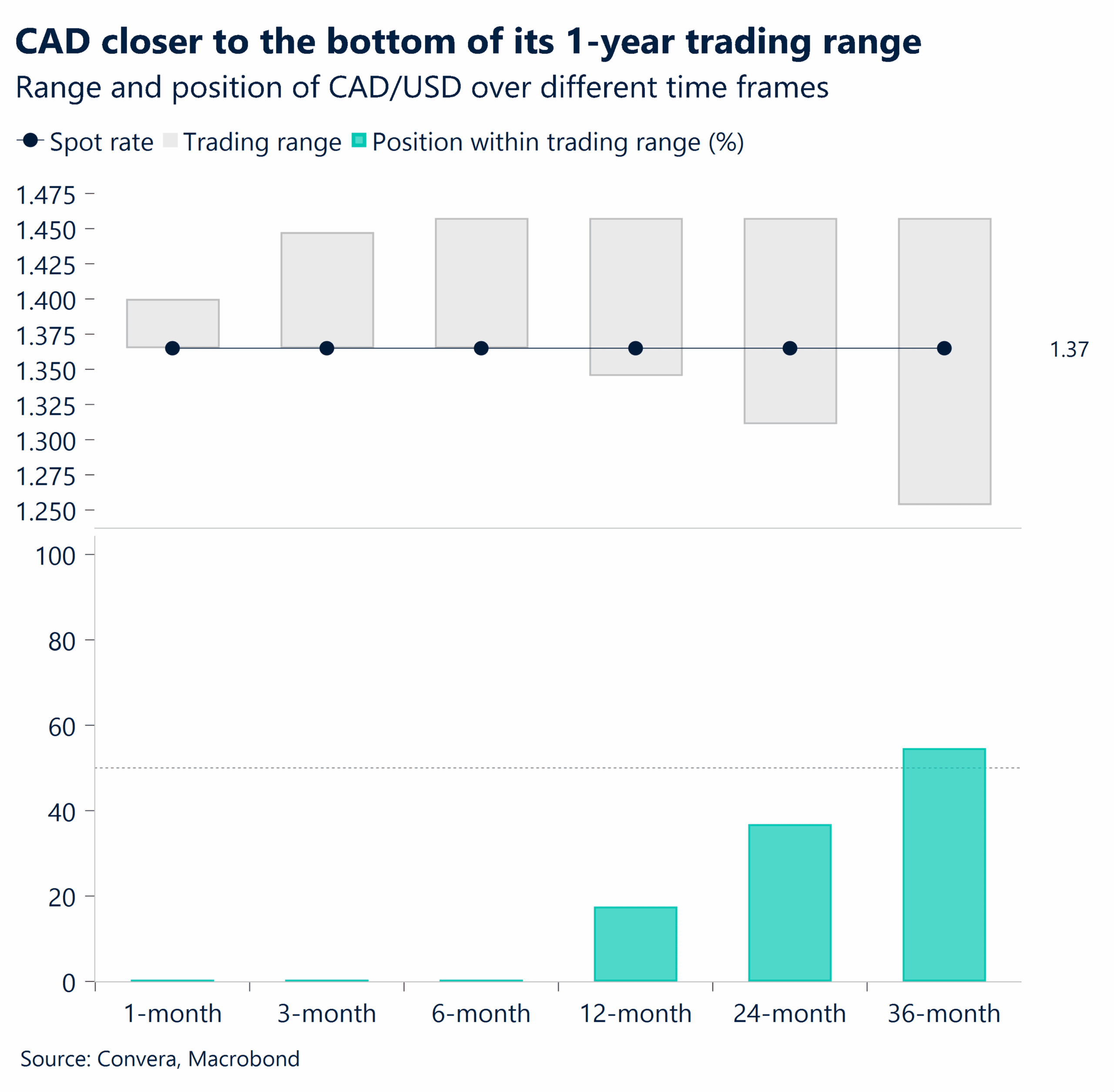

CAD Slow grind lower. The Bank of Canada (BoC) cut rates as expected, reiterating that uncertainty remains the theme, just as it was in the April meeting. The big question: when will the BoC provide clearer guidance on monetary policy moving forward? At this point, a rate cut in July is a coin toss. Macklem pointed out that they’ll be watching two upcoming inflation reports closely before the July meeting. Meanwhile, the Governing Council noted that while disinflationary forces are showing up on the goods side, rising costs are likely keeping inflation elevated, pushing core inflation measures higher than the BoC had expected, and wanted. The Canadian dollar has reached a fresh 2025 low of 1.3635 amid continued US dollar softness. Opening June with a high of 1.3746 and a low of 1.3635, the CAD has struggled to hold below 1.365 for long. The gradual and slow decline has pushed it beneath its 100-week SMA at 1.3763 over the past two weeks, signaling persistent downward pressure. On a daily scale, the CAD is edging toward oversold territory, as indicated by the Relative Strength Index (RSI), suggesting a potential rebound, especially if the US dollar strengthens. Meanwhile, the 20-, 40-, and now 60-day SMAs have all crossed below the 200-day SMA, establishing firm resistance at the 1.377 level. To the downside, 1.36 remains the next key support, marking a crucial threshold for further movement.

AUD Aussie growth misses expectations. Australia’s Q1 GDP growth disappointed, coming in at 0.2% q/q versus 0.4% expected, with annual growth steady at 1.3% y/y. Weak domestic demand and adverse weather impacting mining and exports were key contributors. The household savings ratio rose to 5.2%, reflecting cautious consumer behavior despite the Reserve Bank of Australia’s (RBA) 50bps rate cuts this year. From a technical perspective, AUD/USD has struggled to sustain rallies near the 0.6535-0.6550 Fibonacci resistance zone. The pair appears to be forming a topping pattern, with tactical support levels at 21-day EMA of 0.6498 and 200-day EMA of 0.6404 next. Looking ahead, traders will focus on the NAB Business Confidence data, which could provide insights into the domestic economic outlook and influence the RBA’s policy stance.

CNY China’s services PMI shows resilience. China’s Caixin services PMI edged higher to 51.1 in May, beating expectations of 51.0 and improving from 50.7 prior. This suggests modest growth in the services sector, with both supply and demand improving slightly. However, foreign demand weakened, as new export orders contracted for the first time this year, reflecting global trade challenges. The composite PMI slipped into contraction at 49.6, dragged down by manufacturing weakness. CNY is near six-month highs after Trump-Xi’s recent call. The next key resistance levels are at 21-day EMA of 7.2022, 50-day EMA of 7.2296 and 200-day EMA of 7.2428. Upcoming data, including CPI, trade balance, and export figures, will be critical in shaping market expectations for further policy support from Beijing and its impact on the yuan.

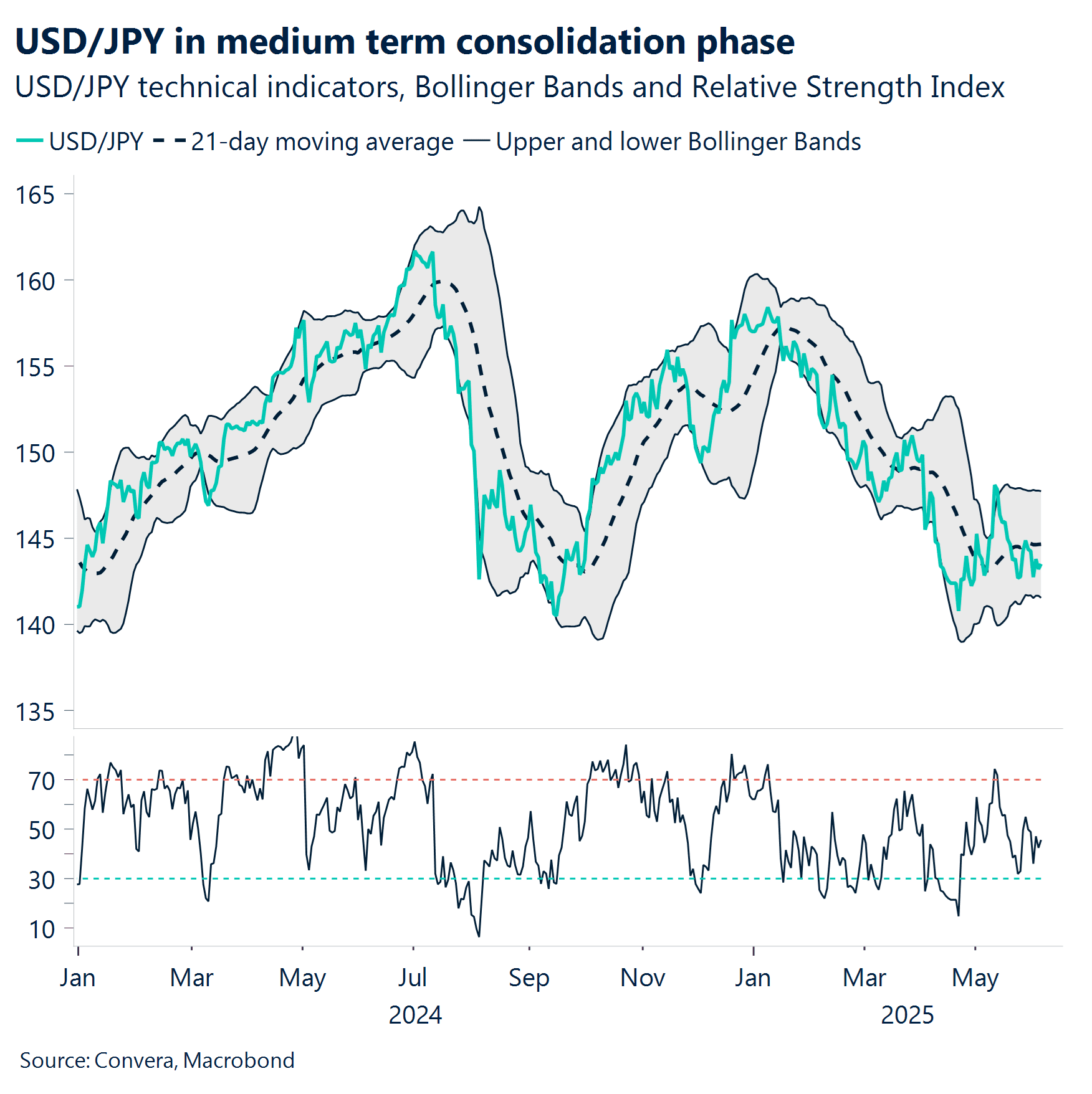

JPY Japan’s core-wage growth recovers. Japan’s core-wage growth accelerated to 2.5% y/y in April, up from 2.1% prior, though still below January’s 2.9%. Headline wage growth remained steady at 2.6%, but real wages continued to decline due to persistent inflation, falling 1.1% on a core basis. This highlights the challenge for the Bank of Japan (BoJ) in achieving sustainable wage-driven inflation. USD/JPY has retreated from the 148.39-148.70 resistance zone, testing tactical support at 141.97-142.36. The pair remains in a medium-term consolidation phase, with key support at 140. A break below this level could signal further downside, though near-term range trading is likely. USD/JPY is now inching towards key psychological resistance of 145 level. The next resistance level is at 50-day EMA of 145.15. Market participants will monitor Japan’s upcoming GDP, current account, and industrial production data for clues on economic momentum and potential shifts in BoJ policy.

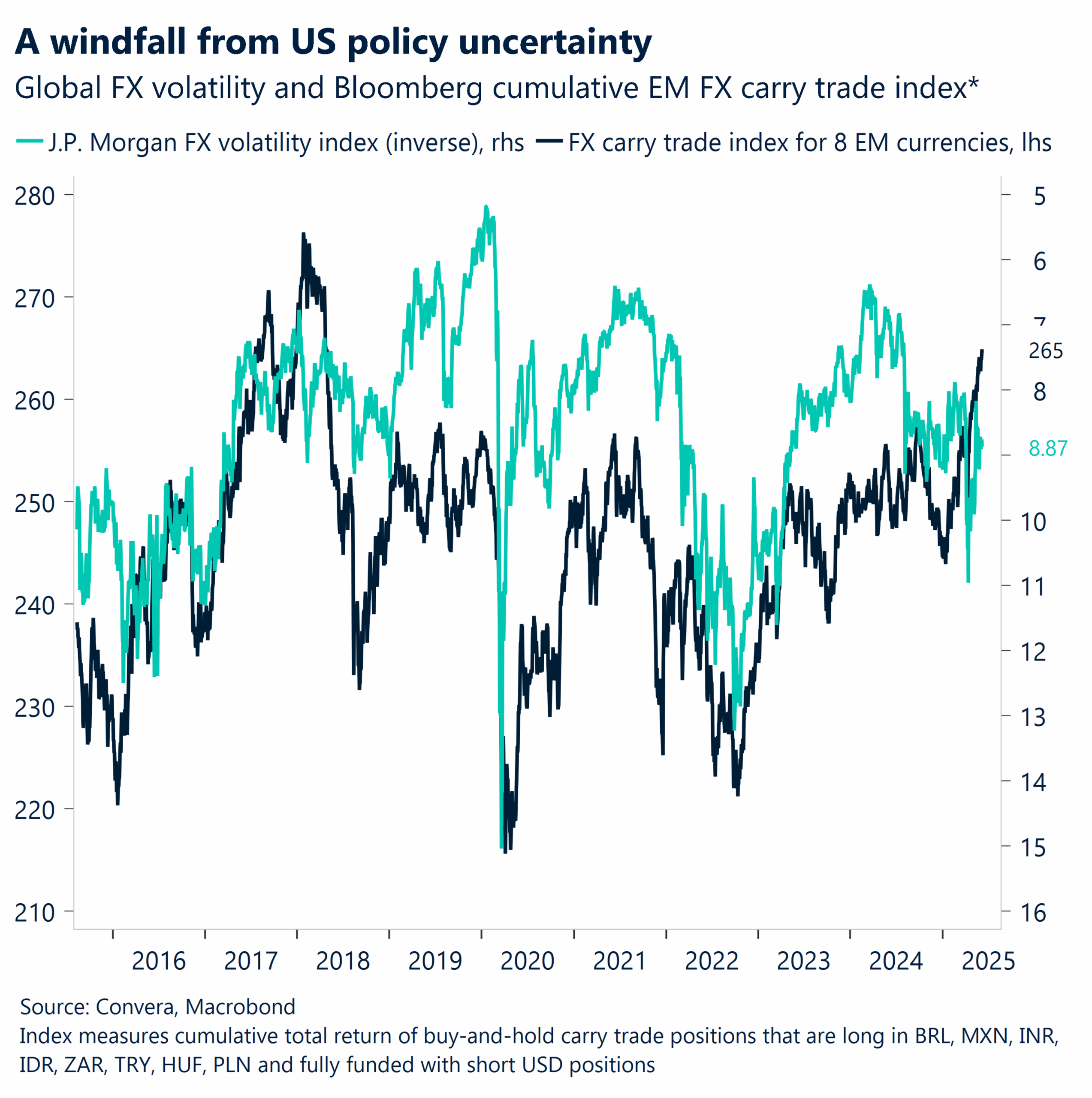

MXN Peso gains as EM carry trades surge. The Mexican peso has gained this week, riding the wave of low volatility and renewed enthusiasm for emerging market and Latin American carry trades. Investors are diving back into the strategy, fueled by easing trade tensions and momentum from TACO. With traders borrowing in low-yield currencies to invest in higher-yielding emerging markets, stability remains critical, any sudden shifts, especially from Trump, could disrupt the trend. A global currency volatility measure recently dropped to 8.9%, lifting Bloomberg’s EM carry trade index to a seven-year high. Meanwhile, moderating inflation is making EM bonds more appealing, with currencies like the Brazilian real and Turkish lira standing out. Asset managers have also ramped up bets on EM currencies, with positions in Mexico’s peso hitting an eight-month high. Despite market resilience, Mexico’s macro landscape continues to show signs of strain. The country’s manufacturing PMI edged up to 46.7 in May from 44.8 in April, according to S&P Global, but remains in contraction for the 11th consecutive month. Supply and demand pressures persist, with new orders declining for the 11th straight month—partly due to U.S. tariffs. Export activity has plunged to its lowest levels since early 2021, while purchasing activity has slowed at the fastest pace since late 2020, highlighting ongoing concerns over weak demand. Meanwhile, the peso has gained 0.8% this week against the U.S. dollar, bringing its year-to-date appreciation to 8.7%. It reached a high of 19.44 and a low of 19.14, its lowest level year-to-date and the weakest in eight months, as it gradually nears the 200-week SMA at 19.04. Since April, the 20-day SMA has remained a moving resistance level, presenting opportunities for USD sell-offs during upward rebounds.

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.