- The USD/JPY weekly forecast indicates rising economic uncertainty in Japan.

- Trump imposed a tariff on steel and aluminum imports.

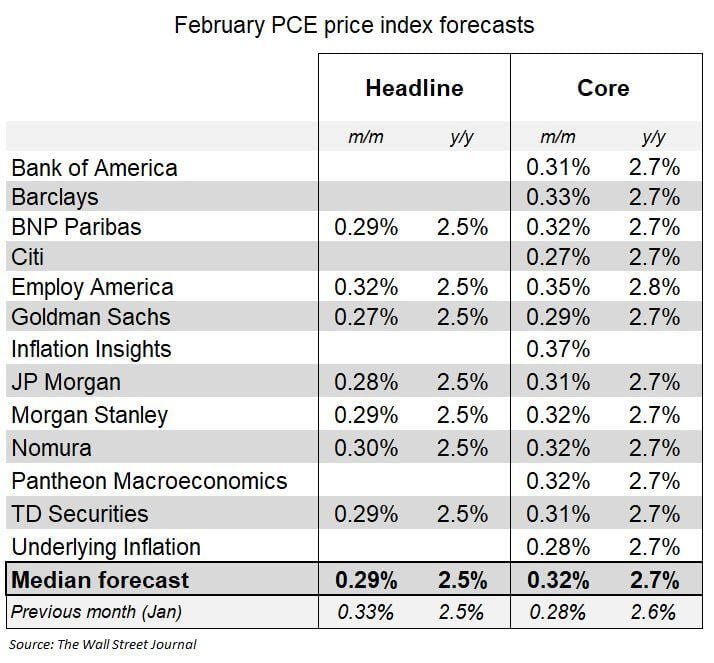

- Tariff fears overshadowed a downbeat US inflation report.

The USD/JPY weekly forecast turns positive as fears of the impact of Trump’s tariffs on Japan’s economy rise.

Ups and downs of USD/JPY

The USD/JPY price had a slightly bullish week as the dollar recovered with Treasury yields. Meanwhile, the yen gave up some gains as market participants worried about the impact of Trump’s tariffs on Japan.

-Are you interested in learning about the forex indicators? Click here for details-

Trump imposed a tariff on steel and aluminum imports, igniting trade wars with Canada and the Eurozone. This escalated fears of a global economic slowdown. As a result, traders sought safety in US Treasuries. Meanwhile, the tariff fears overshadowed a downbeat US inflation report.

On the other hand, the yen eased as market participants focused on the vulnerable export-reliant Japanese economy. Trump’s tariffs might hurt the economy.

Next week’s key events for USD/JPY

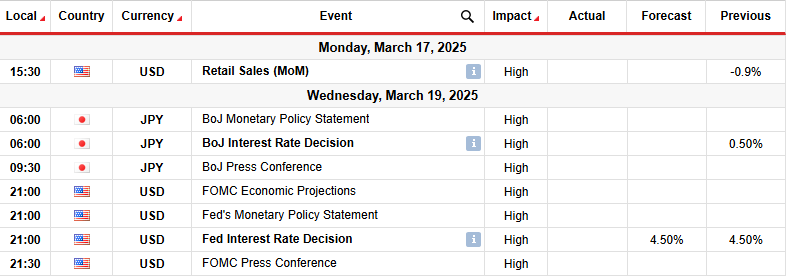

Next week, market participants will focus on monetary policy meetings by the Bank of Japan and the Fed. Moreover, the US will release its retail sales report, showing the state of consumer spending.

Economists believe both the Bank of Japan and the Fed will keep interest rates unchanged. However, BoJ policymakers might maintain a hawkish tone, signaling future hikes. Meanwhile, the Fed might remain cautious due to uncertainty regarding Trump’s tariffs.

USD/JPY weekly technical forecast: Eying 149.00 key level

On the technical side, the USD/JPY price is climbing after meeting the 0.618 Fib retracement. However, the price is still below the 22-SMA. At the same time, the RSI trades below 50, supporting strong bearish momentum. Since the price broke below the 22-SMA, it has maintained its position below this line, indicating a strong downtrend. Furthermore, the price has consistently made lower highs and lows.

-Are you interested in learning about the best AI trading forex brokers? Click here for details-

The downtrend recently made a milestone move by breaking below the 149.00 support level. After the break, the price has risen to retest this level as resistance. If it holds firm, bears might resume the downtrend. However, the price would have to break below the 0.618 Fib retracement. This would allow USD/JPY to target the 142.00 support level.

On the other hand, if bears fail to break below the 0.618 Fib, bulls might push the price back above 149.00. A break above the SMA would signal a likely reversal.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.