January 2024 has seen continued volatility in the forex markets. The US dollar was somewhat mixed, showing some weakness later in the month. The Federal Reserve kept rates on hold, and said it is not in a hurry to lower rates. After declining in the early part of the month, the euro clawed back its losses against the USD. The pound declined significantly in the first two weeks of January, but hs also managed to rise later in the month, not far off being flat.

Here’s what to watch in February:

- Trump: With tariff threats and calls for lower rates in the US, new US President Trump’s policies and comments could result in elevated volatility.

- GBP: The pound fell as low as 1.21 in the first two weeks of January. While it has pulled higher, the economic outlook in the country may see the pressure on the currency continue.

- Euro Area Economy: The European economy stalled in the fourth quarter, with GDP unchanged, coming in at 0%, below consensus expectations. If there is further negative data in the region, we could see some pressure on the euro.

US Dollar (USD)

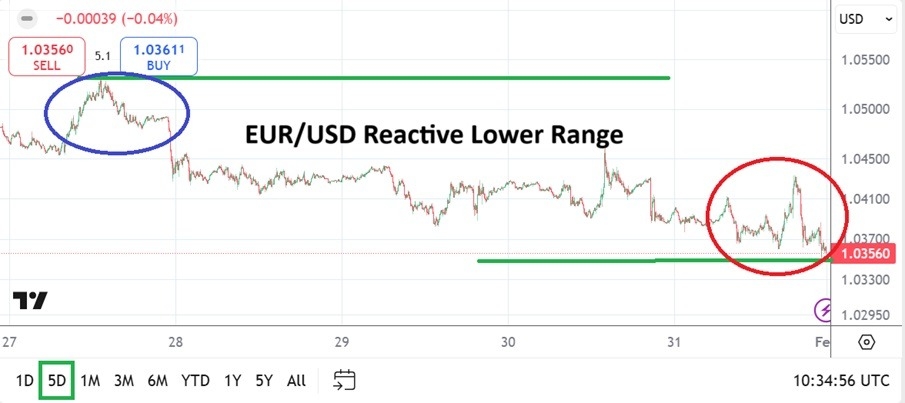

As mentioned earlier, January was a mixed bag for the USD. However, with the Federal Reserve keeping rates at the current level and the volatility expected with Trump now in charge, there is the possibility that the dollar could strengthen as investors look to safe haven assets. Assessing the EURUSD daily chart, we can see the downtrend remains intact, despite the recent pullback. However, we should also note that Bank of America said it sees short-term upside risks to the USD.

Key Levels:

- EURUSD: Higher – 1.0600, Lower – 1.0200

- GBPUSD: Higher – 1.2610, Lower – 1.2150

- USDJPY: Higher – 158.50, Lower – 150.80

Euro (EUR)

For the euro, the latest GDP data may provide some concerns heading into February. The President of the European Central Bank recently said that the direction of rates will depend on the incoming data. Nevertheless, one of the primary concerns for the economy will be the potential tariffs from the US. If implemented, the euro could come under pressure, resulting in the downtrend continuing.

Key Levels:

- EURUSD: Higher – 1.0600, Lower – 1.0200

- EURGBP: Higher – 0.8500, Lower – 0.8270

British Pound (GBP)

Despite the recent pullback against the USD, the GBP still faces headwinds, with the economy under pressure. The government’s budget announced in 2024 is still taking criticism and in recent weeks, some businesses have announced job cuts. Bloomberg recently stated: “UK businesses have run down a mountain of cash reserves built up during the pandemic, leaving them more likely to cut jobs when Labour’s tax hikes come into effect in April.”

The outlook for the economy means the GBP may be expected to weaken. After hitting a low of 1.21 in January, the price has pushed back above 1.24. However, we would not be surprised to see another push lower.

Key Levels:

- EURGBP: Higher – 0.8500, Lower – 0.8270

- GBPUSD: Higher – 1.2610, Lower – 1.2150

Japanese Yen (JPY)

The Japanese yen had a solid month against the USD, hitting a low of 153.70. The yen maintained its gains after comments from Bank of Japan Deputy Governor Ryozo Himino reiterated views that the central bank will keep increasing rates this year. Himino reportedly said that the central bank will increase rates if its outlook is realised. Looking at the chart on a daily timeframe, the USDJPY is still in an uptrend but threatening to break lower.

Key Levels:

- USDJPY: Higher – 158.50, Lower – 150.80

- EURJPY: Higher – 166.00, Lower – 155.90

People Also Read:

Trade EURUSD with our top brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

Your capital is at risk Your capital is at risk Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk Your capital is at risk Founded: 2006 Europe* CFDs ar… |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose Between 74-89% of CFD traders lose Founded: 2010 Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

51% of eToro CFD traders lose 51% of eToro CFD traders lose Founded: 2007 51% of eToro retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. |

|

ASIC, CySEC, FCA | eToro Platform | ||

Your capital is at risk Your capital is at risk Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk Your capital is at risk Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Your capital is at risk Your capital is at risk Founded: 2011 |

|

CySEC, FSCA, MISA | MT4, MT5, OctaTrader | ||