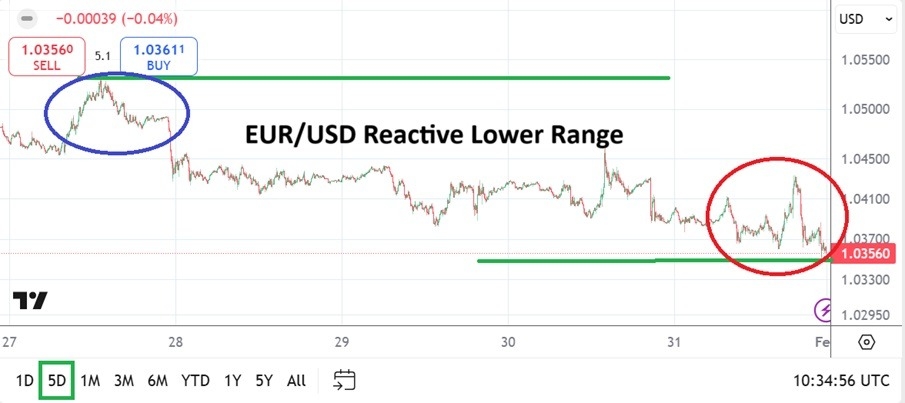

- As this week’s trading began, the turmoil caused by Trump’s trade policies has somewhat subsided, allowing the EUR/USD currency pair to rebound, reaching 1.0607 at the time of writing this analysis.

- Recovering from the sharp losses it suffered recently, reaching the 1.0496 level, the lowest level for the currency pair since a year ago, those losses.

- As we mentioned before, were enough to push technical indicators towards strong oversold levels.

Reason for the recent decline of the Euro

The recent decline in the euro price is due to the political and economic imbalance in Germany, as the country is now preparing to vote on a new government next February. At the same time, economic data issued by the euro zone was weak, which prompted markets to determine high possibilities for a 50-basis point interest rate cut by the European Central Bank (ECB) in December 2024.

What awaits the Euro in the coming days?

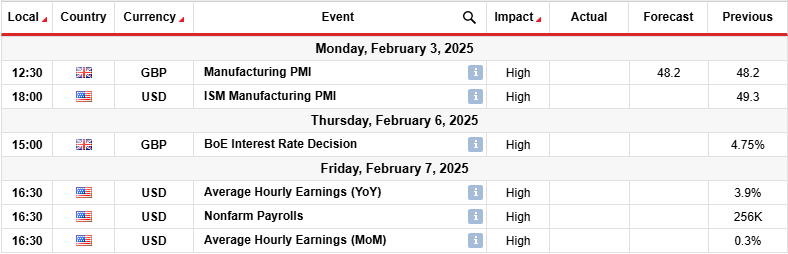

For the Eurozone, the most important and influential factor is the release of the Purchasing Managers’ Index for the manufacturing and services sectors of the largest economies in the bloc for the month of November, which will shed some light on recent events. A stronger-than-expected reading could help the EUR/USD currency pair gain momentum, but a decline in figures below expectations could cause the EUR/USD to form another weekly red candle as the market prepares for a potential 50 basis point interest rate cut by the European Central Bank next month.

Has the US Dollar ended its gains?

So far, it cannot be considered that the US dollar’s gains have ended. This is so far only according to investor sentiment regarding the announcement of Trump’s victory in the US presidential elections, and what happened could be just profit-taking operations. Trump’s plans for the coming year will determine the fate based on official decisions. So far, the indications confirm that he will continue to pursue tariffs and tax cuts and enhance US energy production. This, in turn, will increase inflation rates for a longer period and strengthen the US economic performance. Consequently, it halts the easing cycle of the US Federal Reserve, which would be positive for the US dollar in the end.

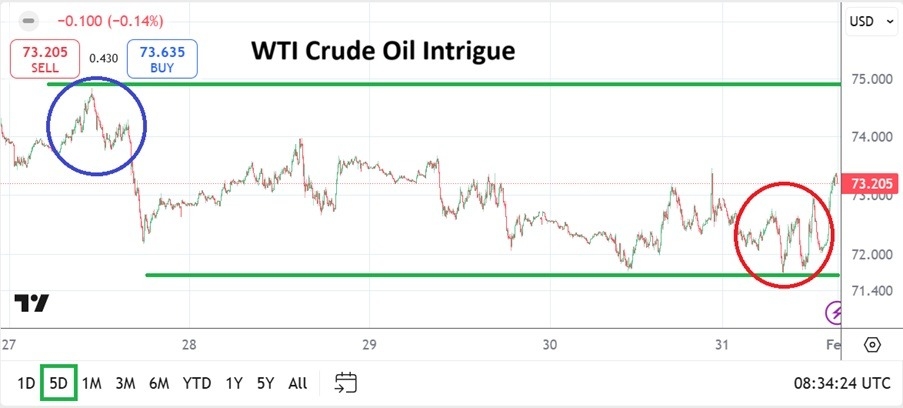

EUR/USD Technical analysis and forecast:

Technically, according to the performance on the daily chart, the losses of the EUR/USD currency pair to oversold levels. According to technical indicators, the Relative Strength Index (RSI) has turned upward after falling below 30 last week. As is well known, a reading of 30 is important because it indicates that the asset is oversold and a rebound or period of neutrality is expected. We expect to see the EUR/USD price rise as this oversold condition continues. Breaking the current downtrend requires a rebound towards resistance levels of 1.0665, 1.0730, and 1.0800, respectively. Conversely, the level of 1.0500 will remain the most important for the bears’ dominance and readiness for sharp upcoming losses.

Learn about trading signals for the EUR/USD and other exclusive free live trading recommendations on our website. As we always recommend, do not take risks and activate take-profit and stop-loss orders to ensure the safety of your trading account from any unexpected adverse fluctuations.

Ready to trade our daily EUR/USD Forex analysis? We’ve made this forex brokers list for you to check out.