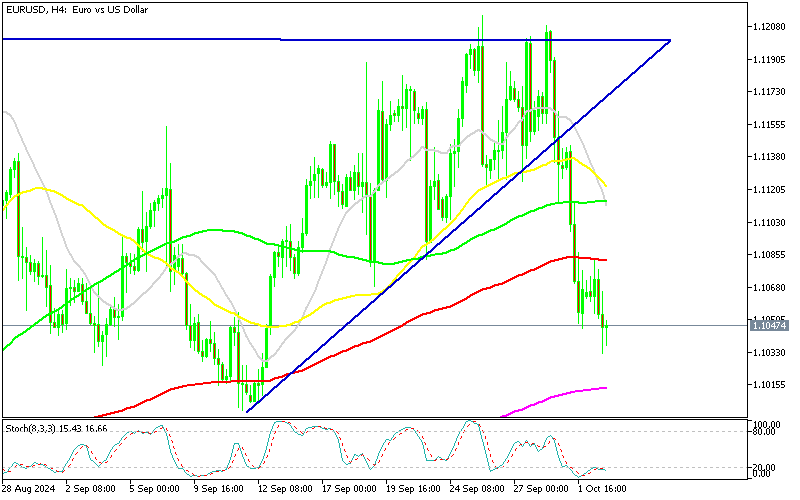

EURUSD retested the 1.12 level many times, but it is heading for 1.10 now after buyers failed to make a clear break of that resistance zone. Now the fundamentals have turned bearish for the Euro, as the Eurozone economy continues to remain pretty weak, while market expectations for another 50 bps FED rate cut in November have declined considerably.

EUR/USD showed notable strength throughout June and July, climbing from below 1.07 to 1.12. After a pullback in August, the pair retested the upside and held near 1.12 until recently. However, buyers were unable to sustain the momentum above this level, and the tide has now shifted in favor of the USD, with fundamentals increasingly supporting the dollar and weighing against the euro. The technical outlook also suggests a bearish reversal, indicating that EUR/USD is likely to dip below 1.10 soon. This week, the pair broke below a key triangle pattern, and the 100 SMA (red) has now turned into resistance, which is often a bearish signal.

EUR/USD Chart H4 – MAs Are Turning Into Resistance

On the eurozone side, the latest CPI data showed a further decline in inflation, and the services sector has weakened considerably, while manufacturing remains in deep recession. This has led the European Central Bank (ECB) to adopt a more dovish stance, as reflected in ECB President Christine Lagarde’s recent remarks. In contrast, better-than-expected ADP employment figures and stronger US JOLTS job data have reinforced the resilience of the US labor market, easing concerns about a potential recession. As a result, markets are now pricing in a 25 basis point rate cut by the ECB in October.

Eurozone Final Services Report for September

- Eurozone Services PMI: 51.4 points vs 50.5 expected (previous: 52.9)

- Eurozone Composite PMI: 49.6 points vs 48.9 expected (previous: 51.0)

Spain:

- Services PMI: 57.0 points vs 54.0 expected (previous: 54.6)

- Composite PMI: 56.3 points vs 53.5 prior

Italy:

- Services PMI: 50.5 points vs 51.0 expected

- Composite PMI: 49.7 points vs 50.8 prior

Germany:

- Services PMI: 50.6 points (Aug: 51.2), hitting a 6-month low

- Composite PMI: 47.5 points (Aug: 48.4), marking a 7-month low

- Growth expectations have slumped to their lowest in a year

France:

- Services PMI: 49.6 points vs 48.3 expected (previous: 55.0)

- Composite PMI: 48.6 points vs 47.4 expected (previous: 53.1)

Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, voiced concern over the latest PMI data, noting that the services sector is steadily losing its position as an economic stabilizer. Growth has slowed for four straight months, nearly stalling in September, with a sharp decline in new orders—already weakening for the previous three months. If this trend continues, the sector could deteriorate further before improving.

While rising costs still pressure service providers, this burden has eased significantly to its lowest point since early 2021, largely due to falling oil and gas prices and lower financing costs rather than slower wage growth. The challenges in the industrial sector are increasingly affecting services.

EUR/USD Live Chart

EUR/USD