Given the importance of the AI buildout, Broadcom’s semiconductor chips make the stock a top pick under any economic conditions.

Stock market crashes rattle most investors, as they are the ultimate tests of patience and willpower. Some people abandon high-quality companies if they drop by 10%, only to regret that decision when those same corporations reclaim all-time highs.

This powerhouse growth stock has outperformed the S&P 500 for several years, and recent tailwinds suggest it should continue to thrive. Broadcom (AVGO 1.87%) is an attractive buy on any dip, especially during a market crash, since AI chips aren’t going anywhere.

Broadcom’s role in the AI boom

Broadcom is one of the AI chipmakers that tech giants have turned to for their AI plans. Autonomous vehicles, humanoid robots, and AI models like ChatGPT are some of the products and services that rely on semiconductors.

Image source: Getty Images.

While Nvidia (NVDA 2.21%) has the largest market share, Broadcom specializes in ASIC chips, which are customized for each customer. This customization sets Broadcom apart from Nvidia and other graphics processing unit (GPU) chipmakers. Although Nvidia offers some ASIC chips, those chips are Broadcom’s entire business, making it the go-to choice for customized chips.

Nvidia and Broadcom compete, but they sell similar products instead of identical ones. On the other hand, Advanced Micro Devices (AMD +0.67%) competes directly with Nvidia, since it mostly makes GPUs. Broadcom doesn’t face as much competition in ASIC chips, which explains why the company feels so optimistic about future results.

Today’s Change

(-1.87%) $-6.18

Current Price

$324.99

Key Data Points

Market Cap

$1.5T

Day’s Range

$324.69 – $334.15

52wk Range

$138.10 – $414.61

Volume

781K

Avg Vol

31M

Gross Margin

64.71%

Dividend Yield

0.74%

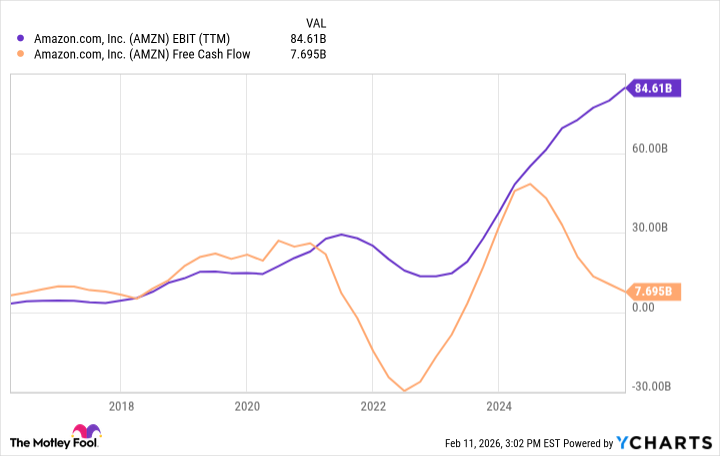

Broadcom CEO Tan Hock told investors that AI semiconductor revenue should double year over year in the first quarter to $8.2 billion. That’s more than 40% of the company’s projected Q1 2026 revenue.

Tech giants continue to ramp up their spending

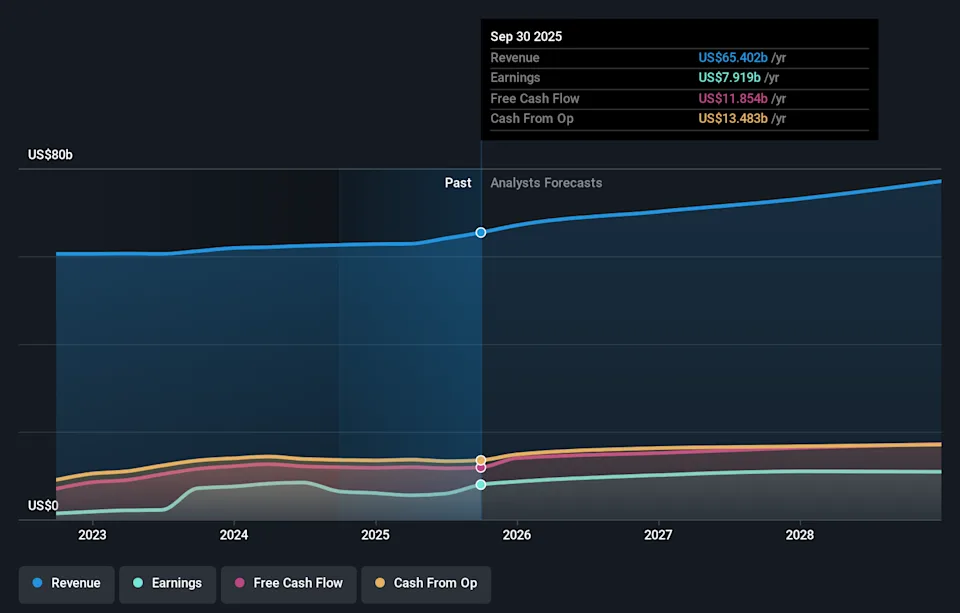

A central thesis of the AI boom is that technology companies will continue to increase their AI expenditures each year. This technology has helped companies deliver higher revenue and profits, so there is a return on investment. Big tech has committed roughly $650 billion toward AI investments in 2026, and every tech company has increased its annual spending.

Many tech CEOs see this technology as revolutionary and aren’t afraid to commit significant capital to it. These same leaders have seen the benefits of being a first mover. Google became the world’s leading search engine in large part due to its early entry into the industry. Facebook became the top social network because it was one of the first options. Amazon (AMZN 0.39%) gobbled up e-commerce market share by being the first of its kind.

Those types of opportunities exist in AI, and the tech giants know it. They aren’t afraid to invest significant capital in the industry. As revenue and profits continue to grow, it will further support each tech leader’s ability to invest more in AI infrastructure, such as Broadcom’s ASIC chips.

Marc Guberti has positions in Broadcom. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.